What Is a Gold-Backed Token? Tether Gold vs PAX Gold Explained

In the second half of 2025, gold briefly pushed past $4,500 per ounce, as a weaker U.S. dollar and shifting rate-cut expectations drove capital back into assets not tied to government credit. Inside the crypto market, one answer keeps surfacing: gold-backed tokens. Unlike physical bullion, ETFs, or paper gold, on-chain gold trades 24/7, settles instantly, and moves globally without banks, clearing houses, or geographic friction, turning gold into a liquid, crypto-native instrument.

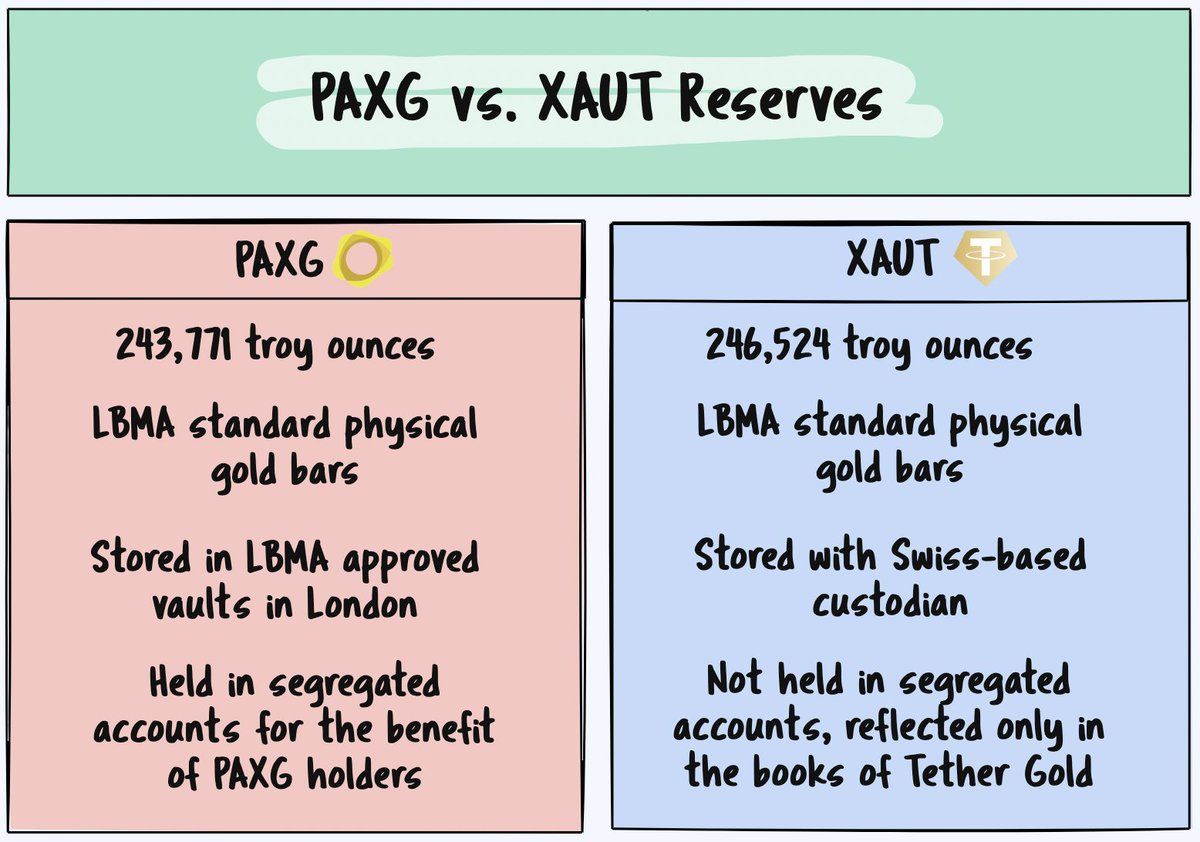

By 2025, this trend has narrowed the spotlight to two names:PAX Gold (PAXG) and Tether Gold (XAUT). Searches around PAXG crypto, is PAX Gold safe, is PAX Gold a good investment, and Tether Gold vs PAX Gold have become some of the most frequent gold-related queries across both crypto traders and institutional desks. With gold prices surging and macro uncertainty lingering, choosing between these two gold-backed tokens is no longer theoretical — it is a practical portfolio decision.

What Is a Gold-Backed Token?

A gold-backed token is built around a simple promise: one token equals real, physical gold held in custody. Tokens are minted only when gold already exists in a professional vault, and their market price closely follows spot gold. The structure resembles a digital warehouse receipt. Instead of holding a certificate or relying on ETF mechanics, the investor holds a blockchain asset that represents ownership of bullion stored off-chain.

This design matters because it removes friction. Gold-backed tokens trade continuously, clear instantly, and can be transferred globally within minutes. In practice, gold starts behaving more like a liquid crypto asset — without losing its connection to real-world value. That efficiency explains why gold-backed tokens have moved from a niche product into a serious portfolio tool.

What Makes a Gold-Backed Token Work

At its core, a gold-backed token is a digital claim on physical gold. Tokens are issued only when real gold bars already exist in custody, and prices closely track the spot gold market. Instead of holding paper certificates or navigating ETF mechanics, traders hold a blockchain asset that represents bullion stored in professional vaults.

This structure changes how gold behaves. Settlement is instant. Trading is continuous. Transfers are global and bank-free. For traders used to crypto market speed, gold-backed tokens remove many of the frictions that have traditionally made gold awkward to use tactically.

PAX Gold (PAXG): How PAXG Crypto Is Structured

PAX Gold is widely treated as the reference standard for gold-backed tokens. Each PAXG token represents one fine troy ounce of gold, fully backed and stored in LBMA-accredited Brink’s vaults in London. The underlying bars are 400-ounce “Good Delivery” bars, the same format used by central banks and major bullion desks.

What separates PAXG crypto from many alternatives is direct allocation. Each token corresponds to specific gold bars with identifiable serial numbers. Holders are not exposed to pooled or unallocated gold; they have a clear claim on physical bullion. That structure directly addresses one of the most common questions in this market: is PAX Gold safe.

Issuance is handled by Paxos Trust Company, a New York State-chartered trust regulated by the NYDFS. In 2025, when U.S. authorities intensified scrutiny on stablecoins and asset-backed tokens, Paxos continued to be cited as a compliance benchmark. Full reserves, legal segregation of assets, and transparent audits kept PAX Gold on the right side of regulatory conversations. Monthly attestations by Withum confirm that the circulating PAXG supply is fully backed at all times.

Tether Gold vs PAX Gold: The Difference That Actually Matters

At a glance, Tether Gold and PAX Gold look nearly identical. Both represent one ounce of gold per token. Both aim to track spot prices closely. Both trade across major crypto platforms. The real decision rarely comes down to price mechanics.

The difference shows up in regulation and disclosure. PAX Gold operates inside a clearly defined U.S. regulatory framework, with frequent third-party attestations and segregated custody. Tether Gold, while backed by physical gold stored in Swiss vaults, offers less formal regulatory transparency. That gap may not matter to every user, but it becomes significant for institutions, funds, and compliance-driven traders.

Market behavior reflects this split. PAXG crypto appears more often in institutional research, regulated trading environments, and DeFi protocols that prioritize compliance. Tether Gold is more commonly favored by users already embedded in the broader Tether ecosystem, where familiarity and liquidity take precedence over regulatory clarity.

Is PAX Gold a Good Investment for Traders?

When people ask is PAX Gold a good investment, they are usually not looking for explosive upside. Gold has never been a growth asset, and PAXG doesn’t pretend to be one. Its value lies elsewhere.

PAX Gold tracks spot gold closely, with minimal long-term deviation. Short-term premiums or discounts can appear during periods of volatility or regional demand spikes, but arbitrage tends to close those gaps quickly. From a trader’s perspective, PAXG behaves exactly as digital gold should.

That makes PAXG crypto a risk-management instrument. During equity drawdowns, geopolitical stress, or currency weakness, rotating capital into PAX Gold provides gold exposure without exiting the crypto ecosystem. It also serves as a parking asset when holding fiat-backed stablecoins feels less attractive under inflation or policy uncertainty.

Seen through this lens, PAX Gold is not a speculative bet. It functions as infrastructure — a way to hold gold with the speed, liquidity, and accessibility crypto traders expect.

Is PAXG Safe Compared With Other Gold-Backed Tokens?

Safety in a gold-backed token comes down to three factors: custody, audits, and legal structure. PAXG scores strongly across all of them. The gold is stored in recognized vaults, ownership claims are legally enforceable, and supply is independently verified on a monthly basis. In insolvency scenarios, customer assets remain segregated from the issuer’s balance sheet.

That combination explains why “is PAXG safe” remains one of the most searched questions in this category, and why PAX Gold often serves as the benchmark in gold-backed token comparisons.

Trading PAX Gold on WEEX

For traders who actively trade gold-backed tokens rather than passively hold them, execution quality matters. WEEX provides an environment built for assets like PAXG, where liquidity depth, price accuracy, and risk control directly affect outcomes. With institutional-grade liquidity providers and advanced risk management systems, WEEX allows traders to access PAX Gold without the friction typically associated with physical gold or traditional commodity markets.

In fast-moving macro conditions, where gold reacts sharply to rate expectations or geopolitical headlines, the ability to trade PAXG with low latency becomes a functional advantage, not a marketing slogan.

Final Thoughts: Gold-Backed Tokens and the Role of PAX Gold

Gold-backed tokens represent a quiet shift in how traders interact with real-world assets. Instead of choosing between crypto volatility and traditional finance rigidity, assets like PAXG crypto sit in the middle.

Between Tether Gold vs PAX Gold, the choice usually reflects priorities. Traders who value regulatory clarity, audit transparency, and institutional credibility tend to favor PAX Gold. Those focused on ecosystem familiarity may choose differently.

For anyone asking is PAX Gold a good investment, the answer depends on intent. It is not designed to outperform growth assets. But as a hedge, a store of value, and a bridge between gold and crypto liquidity, PAX Gold has established itself as one of the most credible gold-backed tokens available in 2025.

You may also like

Silver (XAG) Coin Price Prediction & Forecasts for January 2026: Navigating the Recent Dip Amid Silver Market Volatility

Silver (XAG) Coin, a digitized derivative tracking international spot silver prices, has seen some turbulence lately with a…

PAX Gold Price in INR: Current Trends, Predictions for 2026, and Smart Buying Strategies

Ever wondered how you could tap into the timeless appeal of gold without dealing with heavy bars or…

PAX Gold Price History: A Deep Dive into the Evolution of Digital Gold from Launch to 2026

Gold has long served as a reliable hedge against economic uncertainty, but what if you could own it…

PAX Gold Price Prediction Tomorrow: Expert Insights for 2026 Traders

As a crypto investor who’s navigated the ups and downs of the market since the early days of…

PAX Gold Price Prediction 2025: What Investors Need to Know About PAXG Crypto’s Future

As someone who’s been trading crypto since the early days of Bitcoin, I’ve seen how assets like gold-backed…

PAX Gold Price on TradingView: Charts, Trends, and 2026 Predictions

As a crypto trader who’s been navigating the markets since the early days of Ethereum, I’ve seen how…

Pax Gold (PAXG): Your Guide to the Gold-Backed Crypto Stablecoin in 2026

As someone who’s traded crypto for over a decade, I’ve watched assets like gold find new life in…

PAX Gold Price Graph: Tracking Historical Trends and Forecasting Future Movements in 2026

As a crypto investor who’s watched gold-backed assets evolve since the early days of blockchain, I’ve seen how…

Where to Buy Pax Gold (PAXG): Your Complete Guide to Getting Started with This Gold-Backed Crypto

Have you ever thought about owning gold without dealing with the hassle of storing heavy bars in a…

Paxful Razer Gold: How to Trade Gaming Credits for Crypto and Exploring PAX Gold as a Digital Alternative

Ever wondered how gamers in places like Indonesia and Nigeria turn their Razer Gold credits into real cryptocurrency?…

Paxful Gold Explained: Trading Razer Gold on Paxful and Why PAXG Crypto Stands Out as True Digital Gold

Ever stumbled upon the term “paxful gold” while hunting for ways to trade digital assets or gaming credits,…

How to Buy PAXG: Your Step-by-Step Guide to Getting Started with Pax Gold Crypto

Ever wondered how you could own a piece of gold without dealing with the hassle of storing heavy…

Is PAXG a Stablecoin? Exploring the Gold-Backed Token in Today’s Crypto Landscape

You’ve probably heard about stablecoins as the steady anchors in the volatile world of crypto, but what if…

Is PAXG Legit? Unpacking the Reliability of Paxos Gold Token in 2026

As someone who’s spent years trading crypto and watching markets shift like tides, I remember the first time…

Is PAXG a Good Investment in 2026? Weighing the Pros, Cons, and Gold-Backed Potential

As someone who’s been trading crypto since the early days of Ethereum, I’ve seen plenty of tokens come…

PAXG Stock: Exploring PAX Gold as a Digital Gold Investment in 2026

Ever wondered if you could own gold without dealing with heavy bars or pricey vaults? As someone who’s…

PAXG Price Prediction 2026: Expert Insights on Pax Gold’s Future Amid Gold’s Bull Run

As a crypto investor who’s ridden the waves of market highs and lows since the early days of…

PAXG Crypto: Your Guide to Paxos Gold Token and Its Role in the 2026 Crypto Market

Ever wondered how you could own gold without dealing with heavy bars or secure vaults? That’s where PAXG…

Silver (XAG) Coin Price Prediction & Forecasts for January 2026: Navigating the Recent Dip Amid Silver Market Volatility

Silver (XAG) Coin, a digitized derivative tracking international spot silver prices, has seen some turbulence lately with a…

PAX Gold Price in INR: Current Trends, Predictions for 2026, and Smart Buying Strategies

Ever wondered how you could tap into the timeless appeal of gold without dealing with heavy bars or…

PAX Gold Price History: A Deep Dive into the Evolution of Digital Gold from Launch to 2026

Gold has long served as a reliable hedge against economic uncertainty, but what if you could own it…

PAX Gold Price Prediction Tomorrow: Expert Insights for 2026 Traders

As a crypto investor who’s navigated the ups and downs of the market since the early days of…

PAX Gold Price Prediction 2025: What Investors Need to Know About PAXG Crypto’s Future

As someone who’s been trading crypto since the early days of Bitcoin, I’ve seen how assets like gold-backed…

PAX Gold Price on TradingView: Charts, Trends, and 2026 Predictions

As a crypto trader who’s been navigating the markets since the early days of Ethereum, I’ve seen how…