What Is Interlink (ITLG) and How Does It Work?

As Web3 transitions from speculation to utility, verifying real human identity has become crucial. Rampant bot activity and Sybil attacks undermine governance and airdrops, hindering mainstream adoption.

Interlink (ITLG) addresses this through Proof of Personhood - a protocol placing verified human identity at Web3's core. By replacing bots with authenticated users, it creates secure foundations for dApps, DAOs, and community participation.

This human-centric approach enables trustless verification while maintaining privacy. For developers building dApps or communities seeking authentic engagement, Interlink establishes the critical identity layer missing from current blockchain infrastructure.

What Is Interlink (ITLG)?

Interlink represents a paradigm shift in blockchain architecture by placing verified human identity at the center of its ecosystem. The protocol functions as a Web3 infrastructure layer that exclusively authenticates and serves real human participants, effectively eliminating bots, artificial intelligence agents, and fraudulent accounts from its network. Moving beyond traditional consensus mechanisms like Proof of Work or Proof of Stake, Interlink introduces Proof of Personhood - a revolutionary approach where network validation and participation rights derive from verified human identity rather than computational power or financial stake.

The system employs advanced biometric verification including facial recognition and liveness detection to establish unique human identities, which are then cryptographically secured as encrypted hashes on-chain. This ensures the fundamental principle of one verified person equaling one network node, substantially reducing vulnerabilities to Sybil attacks and identity exploitation. The Interlink Genesis Token (ITLG) serves as the economic engine within this identity-centric ecosystem, functioning as both utility and governance instrument for verified participants. Beyond technical infrastructure, Interlink envisions creating a global digital citizenship framework where smartphone access enables secure, equitable Web3 participation without financial barriers.

How Interlink (ITLG) Works?

Interlink's operational framework builds upon a foundational premise: every digital identity should correspond to a verified human entity. The protocol achieves this through a sophisticated biometric verification process that replaces traditional mining equipment and staking requirements. Users initiate participation by downloading the Interlink application and completing a streamlined verification procedure incorporating facial recognition and liveness assessment. Successful verification generates an encrypted identity hash stored on-chain, representing a confirmed human participant without duplications or artificial entities.

These verified users, designated as "Human Nodes," gain full network participation rights without demanding substantial hardware investments or capital commitments. The implementation unfolds through several key mechanisms:

- Unique human validation: Each participant undergoes biometric verification ensuring singular, authentic human representation

- Automated system resistance: Exclusive verification requirements prevent bot infiltration in block production, transaction validation, and governance processes

- Privacy preservation: Zero-knowledge proof technology enables identity confirmation without exposing sensitive biometric information

- Cross-platform compatibility: Verified Interlink identities facilitate access across multiple blockchain networks including Ethereum, BNB Chain, and Solana

- Practical utility integration: Authenticated users can earn ITLG tokens, utilize them within decentralized applications, engage in governance, and access ecosystem tools

Interlink (ITLG) Tokenomics

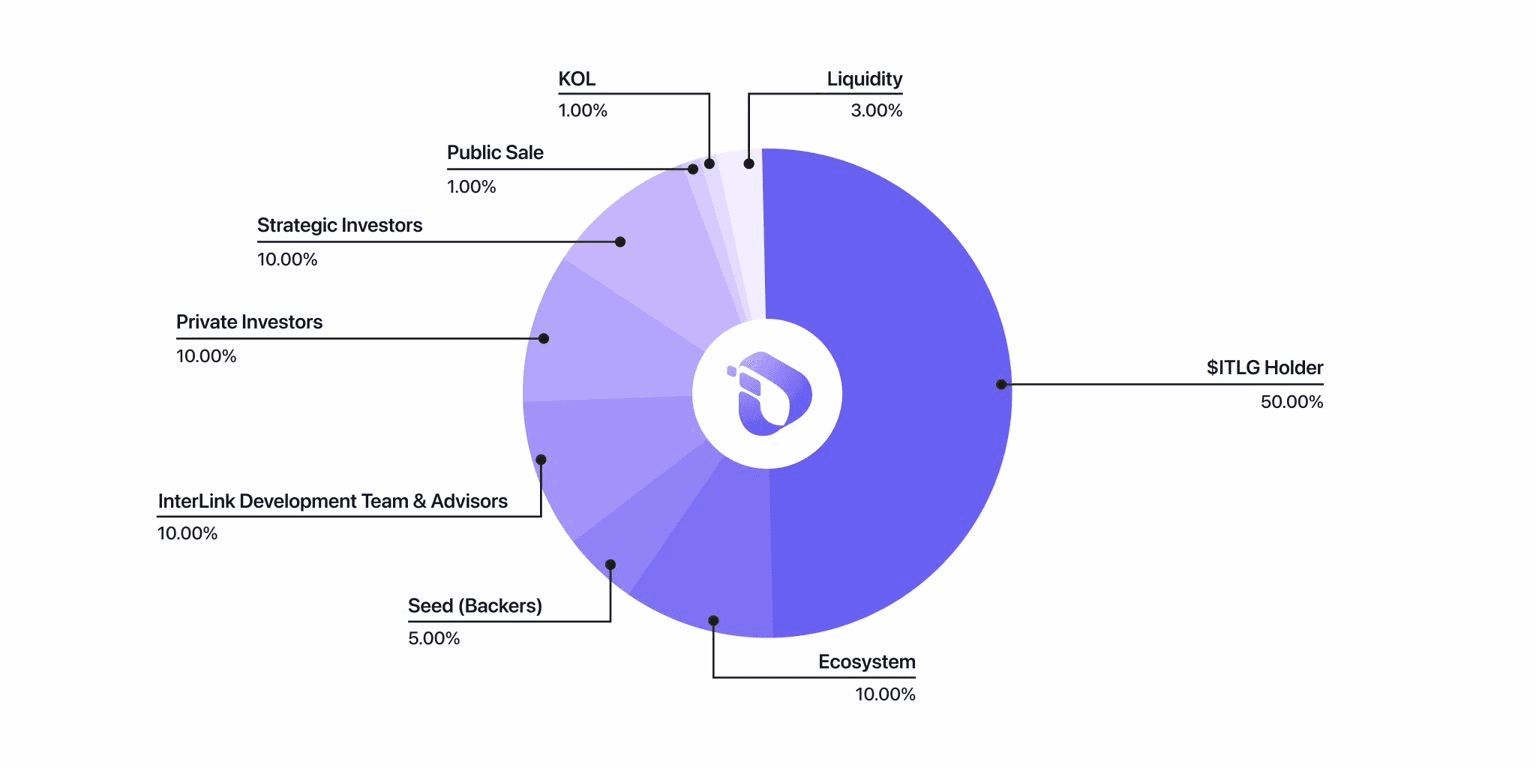

Interlink employs a sophisticated dual-token economic model that strategically separates internal ecosystem functions from external market dynamics. The primary token, ITLG (Interlink Genesis Token), distributes exclusively to verified users as reward for identity validation, network referrals, and active participation. This token serves dual purposes as both utility instrument within the ecosystem and governance mechanism for protocol decisions.

Complementing ITLG, the secondary ITL token facilitates external transactions, institutional engagement, and exchange liquidity. This structural separation enables Interlink to maintain focus on human verification incentives while ensuring seamless interoperability with broader cryptocurrency markets. The token distribution model emphasizes sustainable growth through carefully calibrated allocation mechanisms that prioritize network participation over speculative accumulation.

Key Features of Interlink ($ITLG)

The defining characteristics of Interlink ($ITLG) encompass:

- Biometric Verification Mining

Participants generate tokens through periodic identity confirmation, replacing computational mining equipment with accessible human verification processes.

- Dual-Currency Architecture

$$ITLG operates as the primary utility token while$$ITL functions as the institutional-grade asset for accessing verified human network layers.

- Multi-Level Referral Framework

Structured referral mechanism enhances network integrity through tiered compensation, rewarding both direct and secondary network expansion contributions.

- Identity-Based Governance

Verified token holders exercise voting authority over protocol evolution, resource distribution, and strategic direction through authenticated participation.

- Integrated Application Ecosystem

$ITLG facilitates transactions across gaming platforms, revenue-generating applications, commercial services, and decentralized finance tools within the InterLink environment.

- Multi-Protocol Interoperability

Native compatibility with major blockchain networks including Ethereum, Solana, BNB Chain, Polygon, and Tron through unified wallet infrastructure.

Interlink (ITLG) Price Prediction 2025–2030

Interlink has scheduled its token listing for late 2025 or early 2026, with final determination subject to decentralized governance procedures through the InterLink DAO. The Token Generation Event will implement linear vesting schedules correlated with token ownership, featuring extended lock-up periods designed to minimize market volatility and encourage long-term stakeholder alignment. This structural approach, combined with the protocol's inherent resistance to automated manipulation, aims to cultivate genuine value appreciation rather than transient speculative interest.

The protocol incorporates deflationary measures including multiple halving events and token burning mechanisms triggered by on-chain activity. While specific pricing parameters remain undetermined, token valuation will directly correlate with verified user adoption metrics at launch - creating intrinsic alignment between network growth and economic value. The dual-token architecture maintains clear separation between community governance functions (ITLG) and institutional utility applications (ITL), enabling scalable expansion across both individual and enterprise use cases without compromising economic integrity.

Conclusion

Interlink represents a fundamental advancement in blockchain architecture by addressing the critical challenge of authentic human verification in digital environments. The protocol's identity-centric approach provides comprehensive solutions to persistent issues including Sybil attacks, governance manipulation, and reward distribution inefficiencies. Through its innovative Proof of Personhood consensus, privacy-preserving verification methods, and economically sustainable token model, Interlink establishes a robust foundation for trustworthy digital interactions.

The protocol's future trajectory will depend on execution capability, adoption rates, and scalability across diverse user segments. However, with its governance framework, deflationary economic model, and strategically segmented token system, Interlink positions itself as essential infrastructure for the next evolution of Web3 - where human identity becomes the cornerstone of decentralized ecosystems.

Further Reading

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

You may also like

What is AAPL stock? AAPL/USDT Perpetual Futures Explained

If you're asking "what is AAPL stock" - you're not alone. As one of the most searched and traded securities globally, Apple Inc.'s stock represents far more than just a ticker symbol. AAPL stock (NASDAQ: AAPL) has become a cornerstone of modern portfolios, blending technological innovation with financial stability in a way few companies have achieved. Whether you're a beginner investor or an experienced trader, understanding AAPL stock is essential in today's market landscape.

Understanding the Basics: What is AAPL stock?AAPL stock refers to the publicly traded common shares of Apple Inc., the Cupertino-based technology giant that revolutionized personal computing, mobile communication, and digital services. With a market capitalization consistently hovering around $4 trillion, Apple isn't just a company - it's an economic force that influences global markets.

When people search for "what is AAPL stock", they're typically seeking to understand:

How Apple's business model translates to shareholder valueWhy institutional investors consider AAPL a "must-own" positionThe trading mechanics behind this highly liquid securityHow to access Apple's growth through various investment vehiclesWhat Makes Apple's Business Model So Powerful?Apple's success story is built on three pillars that directly impact AAPL stock performance:

Hardware DominanceThe iPhone, representing over 50% of Apple's revenue, continues to drive the company's financial engine. Each product cycle generates massive revenue spikes that analysts closely monitor when evaluating AAPL stock prospects.

Services TransformationApple's Services segment - including App Store, Apple Music, iCloud, and Apple Pay - has become the company's growth engine, boasting higher margins and recurring revenue streams that provide stability to AAPL stock valuation.

Financial EngineeringApple's aggressive share buyback program, returning over $650 billion to shareholders since 2012, has been a significant driver of AAPL stock appreciation by increasing earnings per share and demonstrating management's confidence.

AAPL Stock: From Traditional Markets to Crypto DerivativesTraditional Market AccessAAPL stock trades on NASDAQ during regular U.S. market hours (9:30 AM to 4:00 PM EST) with exceptional liquidity - typically tens of millions of shares changing hands daily. This makes AAPL stock accessible through virtually any brokerage account, with options for fractional shares allowing investors to participate regardless of budget size.

The Crypto Connection: AAPL/USDT Perpetual FuturesFor traders seeking innovative ways to engage with Apple's market performance, AAPL/USDT perpetual futures offer a groundbreaking opportunity. These derivative contracts allow you to speculate on Apple's price movements using cryptocurrency pairs, providing:

24/7 Trading Accessibility: Unlike traditional markets, AAPL/USDT perpetual futures trade around the clock, allowing you to react to global news and earnings reports instantlyLeverage Flexibility: Many platforms offer adjustable leverage options, enabling sophisticated position sizing strategiesCross-Asset Integration: Trade Apple exposure while maintaining a crypto-native portfolio structureGlobal Accessibility: Available to traders worldwide without traditional brokerage restrictionsWhy Institutional Investors Love AAPL Stock?The Swiss National Bank's approach to Apple mirrors broader institutional sentiment. As with their strategic MSTR stock positions for Bitcoin exposure, institutions view AAPL stock as:

A reliable store of value in volatile marketsA liquidity anchor for large portfoliosA growth-and-income hybrid (through dividends and appreciation)A benchmark-relative performer that rarely disappointsKey Metrics Every AAPL Stock Investor Should MonitorWhen evaluating AAPL stock, focus on these critical indicators:

Financial Health MetricsPrice-to-Earnings Ratio: Currently in the low-to-mid 30s range, reflecting growth expectationsFree Cash Flow: Consistently above $100 billion annually, funding buybacks and dividendsGross Margins: Services segment margins approaching 70%, enhancing overall profitabilityMarket Structure FactorsInstitutional Ownership: Over 60% held by institutions, providing price stabilityTrading Volume: Exceptional liquidity ensures efficient price discoveryOptions Activity: Heavy trading in AAPL options indicates sophisticated investor interestHow to Trade AAPL Stock?For traders seeking sophisticated exposure, WEEX Exchange offers comprehensive AAPL/USDT perpetual futures trading with:

Low trading fees: Lower costs than many traditional brokersHigh Security: Institutional-grade protection for your assetsIntuitive Interface: Designed for both beginners and professional tradersCross-Platform Support: Seamless experience across web and mobileRisk Considerations on AAPL StockWhile AAPL stock represents a blue-chip investment, consider:

Valuation Sensitivity: High expectations are priced into current levelsRegulatory Scrutiny: Ongoing antitrust investigations in multiple jurisdictionsMarket Concentration: Heavy reliance on iPhone sales remains a focal pointGlobal Economic Factors: Consumer spending patterns impact device refresh cyclesConclusion: Why AAPL Stock Belongs in Modern PortfoliosUnderstanding "what is AAPL stock" means recognizing how Apple combines innovation, financial strength, and market leadership into one investable asset. Whether through traditional shares or modern instruments like AAPL/USDT perpetual futures, Apple offers a direct path to the digital economy.

For traders seeking advanced exposure, WEEX Exchange provides a secure and accessible platform for trading AAPL-linked derivatives. With competitive fees, strong security, and 24/7 trading, WEEX supports both new and experienced traders in capturing Apple’s growth with flexibility.

Ready to trade AAPL/USDT perpetual futures? Sign up and start now on WEEX!

FAQQ1: What are Perpetual Futures?A: Perpetual futures are derivative contracts that allow traders to speculate on the price of assets such as Bitcoin, Ethereum, or other cryptocurrencies.

Q2: Where can i trade AAPl/USDT perpetual futures?A: You can trade AAPL/USDT perpetual futures on WEEX Exchange with low trading fees.

Q3: How long can you hold a perpetual futures contract?

A: Perpetual futures allow traders to speculate on an asset's price indefinitely, with no expiration date—unlike traditional futures contracts.

What Is 小股东 (XiaoGuDong)? Solana Meme Coin Overview

If you've been exploring the dynamic world of Solana meme coins, you may have come across 小股东 (XiaoGuDong) – a token that's more than just a cryptocurrency; it's a cultural symbol for retail investors everywhere. Translating to "Little Shareholder," Xiao Gu Dong captures the spirit of everyday traders navigating the volatile crypto markets. Built on the high-speed Solana blockchain, this community-driven token has quickly gained traction among those who identify with the underdog narrative in investing.

In this guide, we’ll explore what Xiao Gu Dong is, why it's resonating with traders, how to buy and trade it safely, and what you need to know before getting involved.

What is 小股东 (XiaoGuDong)?小股东 (Xiao Gu Dong) is a Solana-based meme token inspired by Chinese internet culture and the retail trading experience. The name refers to the "little shareholder" – a term often used to describe individual investors who take on the markets with limited capital but big dreams. Unlike traditional cryptocurrencies, Xiao Gu Dong isn't focused on utility or technology; it’s driven by community, culture, and shared identity.

With a total supply of 1 billion tokens, Xiao Gu Dong is designed to be accessible and liquid, making it easy for small-scale traders to participate. It’s part of a growing wave of cultural meme tokens – like 牛马 (NIUMA) – that use social narratives to build engagement and value.

Why is 小股东 (XiaoGuDong) Trending?Cultural ConnectionThe term "小股东" resonates deeply within Chinese-speaking trading communities, symbolizing the collective experience of retail investors. By turning this identity into a token, Xiao Gu Dong has built an instant community of supporters who see themselves reflected in the project.

Solana's Speed and AffordabilityBuilt on Solana, Xiao Gu Dong benefits from fast transaction times and low fees – making it ideal for meme coin trading, which often involves rapid buying and selling.

Pure Community PowerWith no formal team, roadmap, or venture backing, Xiao Gu Dong is a true grassroots movement. Its value is driven entirely by social buzz, community engagement, and viral potential on platforms like X (Twitter), Telegram, and Chinese social media.

Key Risks to Consider Before Investing in 小股东 (XiaoGu Dong)High Volatility: 小股东 (Xiao Gu Dong) is a microcap meme coin with extreme price swings.No Formal Development: The project is community-run with no roadmap or long-term plan.Low Liquidity: This can lead to slippage and difficulty exiting positions.Speculative Nature: Value is based purely on social sentiment, not fundamentals.What Makes 小股东 (XiaoGuDong) Special?Xiao Gu Dong represents a new kind of crypto asset – one where culture and community drive value. Alongside tokens like 牛马 (NIUMA), it highlights how blockchain can turn shared identities and experiences into tradable digital assets.

For traders, 小股东 (XiaoGuDong) offers a way to participate in a social movement while speculating on viral trends. However, it should be approached as a high-risk, high-reward experiment – not a long-term investment.

Read More: What Is 牛马(NIUMA) Token ? BSC Meme Coin Explained

Where to Trade 小股东 (XiaoGuDong)?If you're looking to explore 小股东 (Xiao Gu Dong) and other emerging social tokens, consider trading on a secure and reliable platform like WEEX Exchange.

At WEEX, you can enjoy:

Low trading fees and deep liquidityHigh security24/7 multilingual customer serviceIntuitive interface for beginners and pros alikeWhether you're trading 小股东 (Xiao Gu Dong), Bitcoin (BTC), or AAPL/USDT perpetual futures, WEEX provides a reliable environment to engage with both crypto and crypto-linked markets.

Sign up and start your trading now!

Further ReadingWhat Is 我踏马来了? A New Horse Themed Meme CoinWEEX Step-by-Step Trading Guide for BeginnersHow to Invest in Crypto 2026? Everything You Need to KnowDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What Is 牛马(NIUMA) Token ? BSC Meme Coin Explained

If you're active in crypto communities or follow Chinese social media trends, you may have come across 牛马 (NIUMA) coin—a meme token that’s capturing the voice of a generation. Unlike typical cryptocurrency projects, NIUMA isn’t just about technology or financial utility—it’s a cultural symbol. Representing the “Ox Horse Worker”—a slang term for overworked and underappreciated employees—this token resonates deeply with retail traders and young workers across Asia.

In this guide, we’ll break down what NIUMA coin is, why it’s trending, how to trade it safely, and what you should know before getting involved.

What is 牛马 (NIUMA) Token?牛马 (NIUMA) is a community-driven meme token launched on the BNB Smart Chain (BSC). The name directly translates to “Ox Horse,” referring to those who work tirelessly like livestock in corporate or gig economy jobs. This token embodies collective frustration and the desire for financial liberation through crypto—especially among retail traders in Chinese-speaking regions.

Launched in early 2026, NIUMA coin has no formal roadmap, no venture backing, and no utility beyond its social narrative. It’s a pure speculative asset driven by viral sentiment on platforms like Bilibili, Weibo, and Telegram.

Read Also: What Are Meme Coins?

Why is 牛马 (NIUMA) Token Gaining Attention?Cultural RelevanceThe term “牛马” has become a viral expression among young workers in China, describing the relentless daily grind. By turning this sentiment into a token, NIUMA has tapped into a ready-made community that identifies with its message.

Accessibility and SpeculationWith a total supply of 1 billion tokens, NIUMA is designed to be liquid and accessible. It’s traded mainly on decentralized exchanges like PancakeSwap, often paired with BNB or USDT. For many, it represents a low-barrier entry into the high-risk, high-reward world of meme coins.

Timing and Trends牛马 (NIUMA) Token emerged alongside the Fermi upgrade on BNB Chain, which boosted network activity and attracted more experimental token launches. Its growth is fueled almost entirely by social buzz—making it a classic example of a community-pumped asset.

How to Trade 牛马 (NIUMA)?Given its speculative and unverified nature, trading NIUMA requires caution. Here’s a step-by-step approach:

Use Trusted Platforms You can trade NIUMA coin on decentralized exchanges like PancakeSwap. Always verify the contract address through community channels to avoid scams.Check Liquidity and Security Tools like RugCheck and GMGN help monitor liquidity pools and developer activity. Low liquidity can mean high slippage and volatility.Start Small Treat NIUMA as a high-risk experiment. Never invest more than you’re willing to lose, and avoid FOMO-driven decisions.Stay Updated Follow NIUMA-related Telegram groups and forums for real-time sentiment and news—but always cross-check information.Risks Before Investing in 牛马 (NIUMA) TokenNo Formal Team or Roadmap: The project is fully community-run.High Volatility: Common with microcap meme coins.Low Liquidity: Can lead to sharp price swings.Cultural Dependency: Value is tied to ongoing social relevance.Why 牛马 (NIUMA) Matters in Crypto Culture?牛马 (NIUMA) is more than just a token—it’s a social commentary packaged as a crypto asset. It highlights how blockchain can give voice to grassroots movements and turn shared frustration into collective action (and speculation).

For traders interested in social-driven assets, NIUMA coin offers a case study in how culture, community, and crypto can intersect. It also reminds us of the power—and risks—of decentralized, sentiment-based investing.

Ready to Explore Meme Tokens Like NIUMA?If you're curious about 牛马 (NIUMA) token or other emerging social tokens, consider trading on a secure and user-friendly platform like WEEX Exchange.

At WEEX, you get:

Low trading fees and deep liquidityHigh security24/7 customer serviceIntuitive interface for beginners and pros alikeWhether you're trading 牛马 (NIUMA), Bitcoin (BTC), or AAPL/USDT perpetual futures, WEEX provides a reliable environment to engage with both crypto and crypto-linked markets.

Sign up and start your trading now!

Further ReadingWhat Is 我踏马来了? A New Horse Themed Meme CoinWhy POPCAT Crashes? A Complete ExplanationWhat Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Where to Buy Bitcoin: Top Trusted Crypto Exchanges for BTC in 2026

When Bitcoin surges or dips sharply, every second counts. Whether you are positioning for a breakout or seeking to take advantage of a temporary price pullback, the ability to buy BTC instantly has become a fundamental requirement rather than a luxury. In 2026, as Bitcoin becomes further integrated into both institutional strategies and personal portfolios, platforms are expected to offer not only fast execution but also reliability and security.

Not all exchanges, however, meet those expectations equally. While many advertise instant access to Bitcoin, some hide high fees, limit funding options, or fall short on transparency and user protection. In a post-FTX landscape, users are rightfully more cautious and better informed. This guide reviews the most trusted crypto exchanges for buying Bitcoin instantly, evaluating their security practices, purchase speed, fee structure, and overall user experience to help you make an informed choice.

Read More: If You Invested $1,000 in Ethereum 5 Years Ago, Here Is How Much You’d Have Today

How Can You Buy Bitcoin?The process of acquiring Bitcoin has diversified significantly, offering multiple pathways to suit different user needs and regional availabilities.

Credit and Debit CardsA widely supported method for immediate purchases, often completing in under a minute. While convenient, it typically incurs higher processing fees compared to other options.

Apple Pay and Google PayThese mobile payment solutions are increasingly integrated by exchanges, offering a seamless, contactless purchase experience directly from apps.

Bank TransfersIdeal for larger transactions, with fees generally lower than cards. Settlement times vary, though many platforms now support instant local payment networks.

Peer-to-Peer (P2P) TradingThis method facilitates direct transactions between individuals, often supporting a vast array of local payment methods. Reputable platforms provide escrow services to mitigate counterparty risk.

Now WEEX P2P Trading is already available, try now!

Stablecoin ConversionFor users already within the crypto ecosystem, converting stablecoins like USDT or USDC to Bitcoin on spot markets is often the fastest and most cost-efficient method.

Bitcoin ATMsProvide a cash-based on-ramp but are generally characterized by higher fees and less favorable exchange rates, with availability limited to specific urban areas.

Top-tier platforms typically integrate several of these options, providing users with flexibility and choice.

What Are the Costs of Buying Bitcoin?The advertised price of Bitcoin is rarely the final price paid. Total costs are comprised of several, sometimes opaque, components:

Trading Fees: On reputable spot markets, these typically range from 0.1% to 0.3%.Payment Processing Fees: Instant buy options using cards or digital wallets can add premiums of 1.5% to 4% or more. These are often charged by third-party processors, not the exchange itself.The Spread: This is the difference between the market's mid-price and the price quoted to you. Some "zero-fee" services compensate by widening this spread.Deposit/Withdrawal Fees: Fiat deposit or withdrawal may incur charges depending on the method and currency.Transparency is key. Trusted exchanges clearly disclose all potential costs before a transaction is finalized.

Comparative Review of Leading Crypto ExchangesWhen selecting a platform, balancing cost, security, and convenience is paramount.

WEEXWEEX Exchange stands out in the competitive cryptocurrency landscape by prioritizing a seamless and secure trading experience, built upon the core advantages of zero lock-up Auto Earn, deep liquidity, and robust user protection. Its flagship Auto Earn feature uniquely allows users to generate hourly yield on assets like USDT directly within their trading accounts, without sacrificing liquidity for use as margin or collateral. This is powered by matching with institutional-grade liquidity pools, ensuring stable execution even during high volatility. Furthermore, WEEX reinforces trust through a transparent 1,000 BTC User Protection Fund and a commitment to security, offering traders a reliable platform that effectively balances opportunity, flexibility, and safety.

BinanceOffers deep liquidity, a vast array of payment options including a robust P2P marketplace, and competitive trading fees starting at 0.1%. Its comprehensive suite of tools caters to a global audience, though regulatory restrictions apply in some jurisdictions.

CoinbasePrioritizes regulatory compliance and user-friendliness, making it a premier choice for beginners in supported regions. Its instant purchase service is straightforward, though fees are generally higher. Advanced users can access lower fees on Coinbase Advanced Trade.

KrakenHas built a long-standing reputation on security and operational reliability. It supports multiple fiat currencies with a strong focus on transparency, including regular proof-of-reserves audits. Trading fees on its professional interface are competitive.

How to Choose Your Best Crypto Exchange?Selecting the right exchange is a personal decision based on your priorities. Use the following framework to guide your choice:

Define Your Priority: Is it lowest cost, simplest user experience, strongest regulatory standing, or access to specific payment methods?Verify Security Practices: Prefer platforms that offer two-factor authentication (2FA), cold storage for assets, and publicly available proof-of-reserves reports.Analyze the Total Cost: For your intended purchase amount and method, calculate the all-in cost including any spread, trading fee, and processing charge.Check Local Availability: Confirm that the exchange operates in your region and supports your preferred local currency and payment rails.Start Small: Consider making a initial, small test transaction to evaluate the platform's speed, customer support, and withdrawal process before committing larger sums.Step-by-Step Guide: How to Buy Bitcoin on WEEX Exchange?Now, let’s dive into the step-by-step process for buying and selling cryptocurrencies on WEEX.

Step 1: Set Up a WEEX AccountTo trade cryptocurrencies on WEEX, you’ll need an account. Here’s how to get started:

Access the WEEX Website: Visit WEEX.

Register: Click the “Sign Up” button at the top and enter your email or phone number to create an account.

Verify Your Account: Input the verification code sent to your email or phone to complete registration.

Activate 2FA: For added security, set up two-factor authentication (2FA) using apps like Google Authenticator or Authy.

With your account created and secured, you’re ready to trade.

Step 2: Fund Your WEEX AccountTo start trading, you must deposit funds into your WEEX account, either in fiat currency (USD, EUR, etc.) or cryptocurrency.

Sign In: Log into your WEEX account using your credentials.

Go to Deposits: Find the “Deposit” tab on the dashboard.

Choose a Deposit Option: Select from:

Bank transfer (for fiat)Credit/debit card (for fiat)Cryptocurrency deposit (for assets like BTC, ETH)Complete the Deposit: Follow the prompts to provide payment details and finalize the deposit.

Wait for Funds: Depending on the method, funds will appear in your account soon after processing.

Step 3: Buying Bitcoin on WEEXWith funds in your account, you’re set to purchase cryptocurrencies. Here’s how:

Visit the Markets Section: From the dashboard, go to the “Markets” tab to see available crypto pairs.

Pick a Trading Pair: Choose BTC/USD.

Select “Buy”: Click the “Buy” button for your chosen pair.

Specify the Amount: Enter how much crypto you want to buy, either in cryptocurrency or fiat terms.

Check the Order: Review the price, amount of crypto, and total cost.

Finalize the Purchase: Click “Confirm” to complete the trade.

Your purchased crypto will appear in your WEEX wallet once processed.

ConclusionThe market for buying Bitcoin instantly in 2026 is defined by mature options that cater to differing needs. The optimal platform for a first-time buyer valuing simplicity differs from that of an active trader seeking the lowest fees. The landscape rewards informed users who look beyond marketing claims to assess security protocols, total cost structures, and the long-term reliability of the exchange. By applying a disciplined selection criteria, you can ensure that your entry into the Bitcoin market is not only fast but also secure and cost-effective.

Ready to trade Bitcoin(BTC)?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

Further ReadingIf You Invested $1,000 in Bitcoin 10 years ago, Here’s How Much You’d Have NowHow to Trade Bitcoin Futures on WEEX?What Is Bitcoin and How Does It Work?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

WEEX Labs: Is the Chinese Meme Coin Craze Really Now?

Since the start of 2026, even though the overall crypto market's still in the dumps, on-chain buzz has quietly bounced back. A bunch of Chinese-language meme coins aren't just sparking rallies in some veteran memes—they're shaking things up with celebrity shoutouts and homegrown cultural twists, flipping the script on the usual English-dominated narratives.

In this quick read, we'll break down these hot Chinese meme coins and share our two cents.

币安人生

"币安人生" dropped on October 4, 2025, inspired by CZ's memoir vibes and folks' hilarious rants about "life's ups and downs" during app crashes.

As the first Chinese meme coin to smash past a $100M market cap, it kicked off a mini-boom for others like "客服小何", "哈基米" and "马到成功".

With more Chinese memes launching and heating up this year, this one's rebounded from its dip, holding steady at a $260M market cap now.

Trade "币安人生" now.

哈基米 @hajimi_CTO_BNB

"哈基米" is pure Chinese internet slang turned meme coin.

It stems from a honey drink, but blew up thanks to the anime *Uma Musume: Pretty Derby*, where the character Tokai Teio obsesses over honey water, repeating "hachimitsu" (hajimi). That evolved into a cat-personified theme, and by a funny phonetic twist, it links to Google's AI model Gemini—turning it into a nationwide cute pet code and a crossover cultural icon.

Right now, its FDV sits at $43M, right behind "币安人生".

Trade "哈基米" now.

我踏马来了

This token comes from He Yi's New Year's Day 2026 tweet: "2026, 我踏马来了."

Thanks to its viral spread and that uniquely Chinese punny flair (playing on words like a horse charging in), "我踏马来了" skyrocketed to a peak FDV of $52M after listing on WEEX, leading the pack in recent Chinese memes.

Trade "我踏马来了" now.

雪球

Late last year, a meme coin called snowball gained traction with its 100% auto-buyback tax mechanism. Then the Chinese version popped up, embodying how niche projects can "雪球" into something big in meme culture. It uses a 3% buy/sell tax for auto-buybacks and token burns.

This flywheel-powered meme hit a high FDV of $31.5M.

Trade "雪球" now.

人生K线

"人生K线" is a techy, mystic-wrapped, team-run meme coin that's all about emotional highs and lows.

It comes from @0xsakura666, whose main gig is lifekline.cn—an AI-powered tool that charts your life's fortune trends as a K-line graph, like a visual roadmap of your destiny's twists and turns.

This coin taps into the randomness of fate and philosophical investing vibes, drawing folks in naturally. It got a big FOMO boost from mentions in Guangming Daily on January 2 and CCTV's WeChat article on January 3.

Peak FDV hit $41M, now cooled to $7.8M.

Trade "人生K线" now.

老子

"老子" taps into the folksy charm of Sichuan dialect mixed with the ancient philosopher's cultural clout, launching recently amid hype.

Like others, it got a boost when the BNB Chain Foundation scooped up 50,000 tokens, spiking the price over 20% short-term.

It's still on the upswing, with an FDV of $7.5M.

Trade "老子" now.

Conclusion

As we chatted about in our earlier post "Memecoin Next Act: The Flash Era," more new memecoins are riding the "social media buzz + data-driven" wave into fast-paced, small-cap territory. Especially in this sluggish market with thin liquidity, these Chinese memes—with their built-in chatter and wealth-creation stories—are giving the Chinese community a sense of belonging in crypto, sparking a fresh meme trading frenzy.

It's worth mentioning that the WEEX spot team has identified and listed these new coins relatively early, providing investors with an early opportunity to get involved. We'll keep digging for more promising tokens down the line, but remember the old saying: "Don't count your chickens before they hatch." Investors, always DYOR—do your own research—and amid the speculative fun, make smart calls and trade wisely.

Top 4 Four.meme Ecosystem (BNB Memes) Coins Defining Current Market Cycles in January 2026

As the crypto market transitioned from 2025 into 2026, memecoins reclaimed center stage. This resurgence was distinct; they emerged not merely as speculative assets but as a reflection of on-chain cultural sentiment. While previous cycles were dominated by Ethereum and Solana-based memecoins, the narrative subtly shifted as the Binance Smart Chain (BSC) experienced a renewed wave of activity, significantly propelled by platforms like the Four.meme ecosystem.

This January 2026 memecoin cycle differed from the pure hype-driven frenzies of 2025. It exhibited more mature characteristics, including better liquidity retention, stronger community branding, and a clearer distinction between transient pump tokens and sustained memecoins. This article explores the top 5 Four.meme coins for January 2026, ranked by their market relevance, visibility, and trading activity, offering a structured overview for informed participation in this emerging narrative.

What is Four.meme Ecosystem in 2025–2026?The Four.meme ecosystem is best described as a native memecoin launch and discovery platform on the Binance blockchain (BNB Chain). It gained prominence by lowering the barriers for meme token creation and distribution while providing visibility through community curation, data aggregation, and categorization.

What’s New for Four.meme?From 2025 into early 2026, the ecosystem underwent critical transitions:

Improved Market Transparency: Consistent tracking via data aggregators increased the credibility and discoverability of listed memecoins.Narrative Maturation: Projects began focusing more on cultural satire, identity-based branding, and thematic depth, moving beyond simple animal memes.BNB Chain Tailwinds: Increased retail participation was fueled by network upgrades, renewed ecosystem incentives, and low transaction costs on the BNB Chain.Four.meme distinguishes itself not by competing with the high-frequency trading environment of Solana, but by emphasizing narrative continuity and community stickiness.

Top 4 Four.meme Ecosystem (BNB Memes) Coins for January 2026Here are the five tokens driving the January 2026 memecoin cycle on Four.meme.

币安人生 (BinanceLife)Key Metric: Market Cap ~$124.6MOverview: The flagship token of the ecosystem, 1. 币安人生 (BinanceLife) draws branding directly from the daily experiences, humor, and psychology of users within the Binance community. Its relatable theme has cemented its position as a blue-chip memecoin on BSC.2026 Outlook: It remains the benchmark asset for the Four.meme ecosystem, often setting sentiment for smaller tokens. It offers relatively lower volatility for traders seeking core exposure to the BNB meme narrative.Siren (SIREN)Key Metric: Market Cap ~$63.8MOverview: A purely momentum-driven memecoin designed for fast-paced speculative cycles. Siren (SIREN) thrives during short-term trading waves and liquidity rotations within the BNB ecosystem.2026 Outlook: Attractive to active, experienced traders seeking high volatility and tactical opportunities during meme rallies, though it carries a correspondingly high-risk profile.哈基米 (HAJIMI)Key Metric: Market Cap ~$37.4MOverview: 哈基米 (HAJIMI) represents regionally rooted meme culture, inspired by an adorable, viral cat character from Chinese internet culture. It demonstrates how localized humor can gain global accessibility via blockchain.2026 Outlook: Positioned as a case study in cultural specificity, it appeals to traders interested in authentic, grassroots community memecoins with expansion potential beyond their initial niche.CZ’s Dog (BROCCOLI)Key Metric: Market Cap ~$27.1MOverview: Leveraging narratives around Binance leadership and crypto personality culture, CZ’s Dog (BROCCOLI) is highly reactive to broader discussions and sentiment within the BNB ecosystem.2026 Outlook: Primarily offers short-term speculative opportunities driven by hype cycles, catering to traders who closely monitor meme market sentiments.Four.meme Ecosystem Outlook for 2026The 2025-2026 cycle has matured Four.meme from a hype-driven venue to a more selective environment focused on sustainable narratives. Success now favors tokens with active communities, recognizable branding, and resilience across market rotations.

The ecosystem will continue to serve as the primary cultural testing ground for memes on BNB Chain, benefiting from strong alignment with the chain's retail user base. While it may lack the blistering speed of Solana platforms, it compensates with consistent liquidity cycles tied to BNB Chain activity. The 2026 outlook prioritizes steady relevance and resilience over rapid, unsustainable expansion.

ConclusionThe Four.meme ecosystem vividly illustrates the evolution of memecoins from short-term speculative vehicles into recurring fixtures of crypto culture. The current cycle rewards consistency in narrative, brand recognition, and community endurance over fleeting monetary hype.

As a hub for accessible and familiar memes on BNB Chain, Four.meme is cementing its role as a permanent layer of the crypto landscape. However, it remains crucial for traders to remember that these are still high-risk, sentiment-based assets. Success requires cultural awareness, precise timing, and disciplined risk management. This evolution presents both informed opportunity and inherent risk, defining the next chapter for memecoin investors.

If you're still unsure where to purchase these trending memecoins, your answer is WEEX. Register now to start seamless trading on a platform designed for speed and accessibility.

Further ReadingWhere to Buy Bitcoin: Top Trusted Crypto Exchanges for BTC in 2026Futures Trading in Crypto: A Beginner’s Guide in 2026Is Cryptocurrency Safe in 2026?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

How to Invest in Crypto 2026? Everything You Need to Know

The cryptocurrency market offers far more than just Bitcoin and Ethereum. Today's investors have thousands of digital assets to choose from for portfolio diversification. Making sound investment decisions starts with a clear understanding of the main cryptocurrency categories, their distinct roles, and associated risk profiles.

Mainstream Coins: The Foundational “Core Assets”Mainstream coins are the established giants of the crypto market, typically ranking within the top 20 by market capitalization. They are characterized by massive user bases, deep liquidity, high trading volumes, and a proven track record of surviving multiple market cycles. Their broad community consensus, real-world utility, and resilience make them the essential cornerstone for any crypto portfolio.

Examples:

Bitcoin (BTC) is the original and preeminent decentralized digital currency.Ethereum (ETH) is the leading smart contract platform, foundational to DeFi, NFTs, and dApps.Solana (SOL) is a high-performance blockchain known for speed and a rapidly growing ecosystem.For beginners, allocating a significant portion of a portfolio to these blue-chip cryptocurrencies is a prudent strategy. They provide exposure to the crypto market's growth with relatively lower volatility and higher stability compared to newer, unproven projects.

Stablecoins: The Essential “Safety Pad”Stablecoins are cryptocurrencies pegged to the value of a stable asset, most commonly the US Dollar. They are designed to maintain a stable price, making them a crucial tool for preserving value, facilitating trades, and acting as a safe haven during market volatility. They serve as the primary bridge between traditional finance and the crypto economy.

Examples:

USDT (Tether) and USDC (USD Coin) are the most widely adopted fiat-backed stablecoins.In any investment strategy, stablecoins function as a parking spot for capital, a medium for transfers, and a key component for risk management, allowing investors to exit volatile positions without leaving the blockchain ecosystem.

High-Risk Altcoins: The “Potential High-Return” SegmentHigh-risk altcoins encompass all cryptocurrencies beyond Bitcoin and Ethereum. This category includes projects with smaller market capitalizations that often focus on niche innovations like privacy, oracle networks, or scalable smart contracts. While they can introduce groundbreaking technology, many lack widespread adoption and are subject to extreme price volatility and lower liquidity.

Examples:

Chainlink (LINK) is a decentralized oracle network.Cardano (ADA) is a research-focused smart contract platform.These assets can offer significant growth potential but come with substantially higher risk. Investing in them requires thorough fundamental analysis of the project's technology, team, and use case, and should only be done with capital one is prepared to lose.

Meme Coins: The Speculative “Emotional Assets”Meme coins are cryptocurrencies born from internet culture and social media trends, not technological fundamentals. Their value is almost entirely driven by community sentiment, viral hype, and speculative trading, leading to wild, unpredictable price swings. They represent the highest-risk, highest-volatility corner of the crypto market.

Examples:

Dogecoin (DOGE) is the original meme coin.Shiba Inu (SHIB) is a popular Ethereum-based successor.Investing in meme coins is akin to speculative gambling. Beginners should avoid them entirely or allocate only a tiny fraction of "entertainment money" they are fully prepared to lose, understanding that gains and losses can be equally dramatic.

Read More: Is Dogecoin(DOGE) a Good Investment in 2026? Everything You Should Know

How to Invest in Crypto?A prudent asset allocation strategy for new investors prioritizes capital preservation while allowing for measured growth. A balanced, risk-controlled framework is essential:

Foundation (80-90% of Portfolio): Allocate the majority to stablecoins and mainstream coins like BTC and ETH. This provides stability, liquidity, and core exposure to the market.Growth & Risk (Up to 10-15% of Portfolio): Dedicate a small portion to researched high-risk altcoins with strong fundamentals. This allows participation in innovative projects with higher return potential.Speculation (≤5% of Portfolio, Optional): If desired, use a minimal amount for meme coin speculation. Treat this as a learning experience with money you can afford to lose completely.This structured approach helps beginners manage downside risk systematically while progressively exploring different segments of the crypto ecosystem.

ConclusionNavigating the digital asset landscape requires recognizing that different cryptocurrency categories serve different purposes and carry vastly different risk-reward profiles. A successful investment strategy is not about chasing the highest returns but about constructing a balanced crypto portfolio aligned with your financial goals and risk tolerance.

By building a foundation with mainstream coins, using stablecoins for safety and flexibility, and cautiously exploring altcoins and meme coins, investors can participate in the dynamic crypto market with clarity and discipline.

Now that you understand how to invest in crypto, it's time to take action. If you're looking for a trusted platform to execute your strategy, choose WEEX. Register now to start seamless trading with 0 fees, a user-friendly interface, and a high-security environment.

Further ReadingWhere to Buy Bitcoin: Top Trusted Crypto Exchanges for BTC in 2026Futures Trading in Crypto: A Beginner’s Guide in 2026Is Cryptocurrency Safe in 2026?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Which 4 Chinese Meme Coins Are Tredning in January 2026?

Unlike previous cycles driven by Western internet culture, this surge is deeply rooted in Chinese slang, social satire, and high-context humor. Fueled by the low-fee BNB Chain ecosystem, viral narratives, and rapid speculative capital, several projects saw exponential growth in a remarkably short time.

What defined the top Chinese meme coin trend in January 2026 was not just price action, but the unprecedented speed at which these tokens achieved multi-million dollar market capitalizations without any traditional fundamentals. This article analyzes the four names that dominated the narrative: 我踏马来了, 人生K线 , 币安人生, and 哈基米.

Key TakeawaysThe Chinese meme coin market in January 2026 was dominated by tokens leveraging culturally familiar phrases and high-velocity trading on BNB Chain, rather than utility.Narrative strength and cultural resonance proved more critical for short-term momentum than technological innovation or roadmap promises.While generating exponential returns, these assets exhibited extreme volatility. Success required strict risk management due to their reliance on concentrated liquidity and shifting trader sentiment.Chinese Meme Coin Growth in Early 2026The explosive growth in January followed a distinct, observable pattern:

Narrative-First Adoption: Success was built on pre-existing, viral Chinese internet slang, which created instant community recognition and lowered adoption barriers.BNB Chain Efficiency: The low transaction fees and fast confirmations of BNB Chain made it the preferred launchpad, attracting a dense network of active meme coin traders.Speculative Capital Rotation: After periods of consolidation in major assets, speculative capital aggressively rotated into these high-beta, culturally-themed tokens trending on Chinese crypto social media.Sentiment-Driven Valuation: Prices were almost entirely dictated by social media momentum and chart patterns, with traditional fundamentals like whitepapers or utility playing a negligible role.This environment enabled multiple projects to rocket from obscurity to eight-figure market caps within mere days.

Which Chinese Meme Coins are Trending in January 2026?Amidst numerous launches, four tokens distinguished themselves through market cap growth, trading volume, and viral narrative strength.

我踏马来了我踏马来了 became one of the fastest-rising assets of early 2026, surging into a $30–40 million market cap range with sharp volatility. Its growth was fueled by its aggressive, confident phrase which traders adopted as a hype slogan, combined with high on-chain visibility from large wallet movements that drew further attention.

Read More: What Is 我踏马来了? A New Horse Themed Meme Coin

人生K线Briefly approaching a $40+ million market cap, this 人生K线's power lay in its deeply relatable metaphor for traders, comparing life's ups and downs to a candlestick chart. Its chart-centric community fostered intense engagement through shared analysis and parabolic screenshot culture, creating a self-reinforcing momentum loop.

币安人生 (BIANRENSHENG)Reaching a peak market cap of approximately $150 million, 币安人生 was a dominant force in the sector. It benefited from implicit brand association with the leading exchange, which granted it perceived legitimacy and attracted larger traders viewing it as a more stable meme coin exposure compared to micro-cap alternatives.

Read More: What Is 币安人生 (BIANRENSHENG) and How Does It Work?

哈基米 (HAJIMI)Climbing to a $35–37 million market cap, 哈基米(HAJIMI) stood out due to its high meme adaptability. The playful, phonetically fun name was easily remixed into endless social media content, sustaining community engagement and driving consistent trading volume across multiple platforms.

Read More: What is Hajimi (哈基米)?

ConclusionThe January 2026 surge in Chinese meme coins signifies a maturation of meme-driven markets. These assets have evolved into culturally encoded financial instruments, capable of mobilizing significant liquidity through shared language and collective emotion.

The performance of 我踏马来了, 人生K线 , 币安人生, and 哈基米 cements top Chinese meme coins as a distinct and influential segment within the global crypto ecosystem. For participants, understanding the cultural context is now as essential as technical analysis. However, this exponential growth is a double-edged sword; the same velocity that creates immense opportunity also dictates the speed at which trends can reverse, demanding caution and respect for the market's rhythm.

Still wondering where to buy these trending meme coins? Look no further than WEEX. Register now to start trading instantly. Enjoy 0 trading fees and a smooth, seamless trading experience.

Further ReadingIs Dogecoin(DOGE) a Good Investment in 2026? Everything You Should KnowDogecoin(DOGE) Price Prediction: What's Next for Dogecoin(DOGE)?What Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Futures Trading in Crypto: A Beginner’s Guide in 2026

Crypto futures trading has evolved into one of the most dominant ways to engage with digital asset markets, enabling speculation without direct ownership of the underlying coins. By 2026, this domain is no longer exclusive to professionals, thanks to platforms that have democratized access through intuitive tools, deep liquidity, and diverse contract options.

This guide explains the mechanics of crypto futures trading, outlines essential knowledge for beginners, and explores why WEEX exchange has become the go-to choice for traders in the current landscape.

Key TakeawaysCrypto futures contracts allow traders to speculate on price movements in both directions (long and short) using leverage.This form of derivatives trading carries significantly higher risk than spot trading, making strict risk management non-negotiable.Leading platforms distinguish themselves with beginner-friendly interfaces, multiple contract types, and competitive liquidity to ensure efficient trade execution.What Is Crypto Futures Trading?Futures trading is a type of derivatives trading where participants agree to buy or sell an asset at a predetermined future price and date. In crypto, traders speculate on the future price of assets like Bitcoin or Ethereum without holding them.

Key advantages over spot trading include:

The ability to profit from both rising (long positions) and falling (short positions) markets.The use of financial leverage to control large positions with a smaller capital outlay.In 2026, perpetual futures contracts—which have no expiry date and use a funding rate mechanism to track spot prices—are the industry standard for retail traders.Read More: User Guide: What Are Perpetual Futures Contracts?

How Crypto Futures Trading Work?Trading futures requires an understanding of core mechanics. Traders open positions by depositing initial margin, which acts as collateral, not the full trade value.

Essential concepts include:

Leverage: A multiplier that increases both potential profits and losses (e.g., 10x leverage means a $100 margin controls a $1,000 position).Margin Requirements: Maintenance margin levels determine when a liquidation occurs if the trade moves against you.Funding Rates: Periodic payments exchanged between long and short traders to keep the perpetual contract price aligned with the spot market.Mastering these mechanics is fundamental before engaging in futures markets.

Why Crypto Futures Trading Is Popular in 2026?The growth of crypto futures is driven by market evolution and trader demand. Primary factors include:

Market Volatility: Creates frequent, high-potential trading opportunities.Hedging Capability: Allows spot portfolio holders to protect against downside risk.Capital Efficiency: Leverage enables greater market exposure with less capital.Short-Selling Access: Provides an easy way to profit from market declines without borrowing assets.In bearish or ranging markets, futures often present more viable strategies than spot trading alone.

WEEX Guide: Risk Management for BeginnersEffective risk management is the most critical skill in futures trading. Foundational principles include:

Using stop-loss orders on every position.Never risking a high percentage of total capital on a single trade.Avoiding over-leveraging.Maintaining emotional discipline during volatility.Modern platforms provide essential tools like stop-loss, take-profit orders, and real-time margin calculators to help implement these strategies.

WEEX Guide: Common Mistakes Beginners MakeNew traders often fall into predictable traps. Frequent errors include:

Overusing Leverage: The fastest path to significant losses.Trading Without a Plan: Entering markets based on emotion or hype.Ignoring Funding Rates: Can erode profits on held positions.Revenge Trading: Trying to immediately recoup losses, often leading to worse outcomes.Platform tools aid monitoring, but personal discipline is the ultimate safeguard.

Why Choose WEEX Futures?WEEX Futures stands out in the competitive cryptocurrency landscape by delivering a professional-grade trading experience tailored for both novice and experienced traders. Our platform combines industry-leading security measures with exceptional liquidity depth, ensuring reliable order execution even during volatile market conditions.

Read Also: User Guide: How to Choose a Reliable Platform for Crypto Futures Trading?

How to Start Futures Trading on WEEX?Now that you understand the basics, let's walk through the process of trading Bitcoin futures on WEEX. If you've already followed our guide on how to create an account on WEEX and set up 2FA for added security, you’re well-prepared to start futures trading.

Step 1: Log into Your WEEX AccountIf you don’t already have an account, follow our step-by-step guide on creating an account on WEEX. Once you’re logged in, navigate to the Futures Trading section from your dashboard.

Step 2: Familiarize Yourself with the Futures Market InterfaceWhen you enter the futures trading section, you'll notice a more advanced interface compared to spot trading. Key features of the interface include:

Order Book : Displays all open buy and sell orders for the selected futures contract.Position Information: Shows the details of your open futures positions, including leverage, margin, and unrealized profit/loss.Trading Pair: Select the crypto futures pair you want to trade (e.g., BTC/USDT).Charts & Data: Real-time price charts and indicators to help you analyze the market and make informed trading decisions.Step 3: Make Your First TradeSelect the BTC/USDT Futures to trade at the top left side of the page.

Use the [Price Chart] to identify potential trading setups based on patterns or any other technical indicator available on WEEX Futures.

Select the [Margin Mode], which will only apply to the selected Futures Contract, then choose between [Cross] and [Isolated] and click [Confirm].

Now, you need to [Adjust Leverage] and click [Confirm]. Please note that using high leverage carries high risks and shouldn’t be done without a robust risk management strategy.

Pro Tip: When trading with leverage, be aware of the liquidation risk. If the market moves against you too far, your position may be liquidated, meaning you lose your initial investment.

Select [Type of Order] - [Price] - [Size], toggle the [TP/SL] feature to set up your [Take Profit] and [Stop Loss] orders, and choose between a [Open/Long] or [Open/Short] position.

Is Futures Trading Suitable for Everyone?No, futures trading is not for all investors. It is a high-risk activity suited for:

Active, disciplined traders who can adhere to a plan.Those seeking to hedge existing spot portfolios.Individuals thoroughly comfortable with the mechanics of leverage and margin.It is generally not suitable for passive, long-term investors or those with a low risk tolerance.

ConclusionCrypto futures trading is an integral, powerful component of the digital asset ecosystem in 2026. It offers unparalleled flexibility but demands respect, education, and ironclad risk management.

By providing accessible tools within a secure and liquid environment, WEEX exchange has lowered the barrier to entry. For traders committed to continuous learning and disciplined strategy execution, futures markets offer a dynamic arena for engagement, provided one navigates them with caution and clarity.

Ready to start your futures trading journey? Register on WEEX now and begin trading instantly. Experience a powerful, secure, and user-friendly platform designed for your success.

What Is Brevis (BREV) and How Does It Work?

When building decentralized applications (DApps), developers face two primary constraints: smart contracts cannot natively access historical blockchain data or information from external blockchains without introducing trusted oracles. Furthermore, executing complex computational tasks directly on mainnets like Ethereum is prohibitively expensive.

Brevis directly addresses these limitations of scalability and interoperability by introducing a Zero-Knowledge (ZK) Coprocessor. Functioning like a GPU for a blockchain, Brevis operates as a co-processor, handling intensive data computation off-chain. This enables developers to create powerful, data-driven DApps that can securely utilize any on-chain data across multiple blockchains, all without adding new trust assumptions to their applications.

What Is Brevis (BREV)?Brevis (BREV) is the native utility and governance asset of the Brevis network, designed to align incentives among all ecosystem participants.

Token Utility:

Proof Fees: Developers pay fees in BREV to request and verify proofs within the ProverNet system.Staking and Security: Network provers are required to stake BREV tokens as collateral. Malicious behavior or service failure can result in slashing, securing network integrity.Governance: Brevis (BREV) holders can participate in protocol governance, influencing parameters and future development.Future Gas Token: Upon migration to its dedicated rollup, BREV is slated to become the native gas token for the Brevis network.Brevis (BREV) TokenomicsBrevis has a fixed total supply of 1,000,000,000 (1 billion) Brevis (BREV). The allocation strategy prioritizes long-term ecosystem growth and community engagement.

Token Allocation:

Ecosystem Growth: 37%Community Incentives: 32.20%Team: 20%Seed Investors: 10.80%How Does Brevis Work?Brevis fundamentally separates computation from verification. It offloads heavy data-processing workloads from the main blockchain to its specialized environment. After processing, it returns a succinct cryptographic proof that verifiably attests to the correctness of the result, which the main chain can efficiently validate.

The ZK Coprocessor ModelWithin this model, a smart contract on a main chain (such as Ethereum) submits a request for a specific computation or data query. Brevis's off-chain system processes this request and generates a Zero-Knowledge Proof (ZKP). This proof is then submitted back to the requesting contract. The contract can cryptographically verify the proof's validity in a fraction of the time and cost it would take to re-execute the computation, ensuring trustless correctness.

ProverNetThe operational core of Brevis is ProverNet, a decentralized network of participants who compete to generate proofs for computation requests. This marketplace ensures that proof generation remains decentralized, secure, and cost-efficient. Initially deployed on the Base blockchain, the architecture is designed for a future migration to a dedicated Brevis rollup, further optimizing performance and sovereignty.

Key Features of BrevisBrevis enhances Web3 development through several key architectural innovations:

Omnichain Data Access: DApps can seamlessly query and utilize verified on-chain data from any supported blockchain. This unlocks novel use cases like cross-chain reputation systems, historical financial analysis, and sophisticated multi-chain DeFi strategies.Trust-Free Verification: By relying on mathematically verifiable ZK proofs, Brevis removes the need to trust any intermediary. The destination blockchain cryptographically verifies the proof's integrity, not the prover's reputation.High-Performance zkVM: The platform utilizes the Pico zkVM, engineered for high-speed proof generation. This efficiency is critical for supporting real-time DApps that require low-latency data processing.ConclusionBrevis represents a pivotal advancement in modular blockchain infrastructure. By providing a ZK-powered coprocessor, it liberates smart contracts from their inherent data and computation limits. Developers gain the ability to build more intelligent, interconnected, and powerful DApps that can leverage the full breadth of blockchain data, all while maintaining the core tenets of security and decentralization.

Ready to trade Brevis (BREV) and other cryptocurrencies?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

Further ReadingWhat is Snowball (SNOWBALL)?Why POPCAT Crashes? A Complete ExplanationWhat Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What is Ethereum OTC and How to Buy ETH OTC With PKR on WEEX Exchange?

Ethereum is the foundational platform for decentralized applications and smart contracts, making ETH a core holding for many investors. For those executing substantial trades, over-the-counter trading offers a strategic advantage. This guide explains Ethereum OTC crypto, how an OTC desk functions, and provides a clear walkthrough for trading ETH with Pakistani Rupees (PKR) on the WEEX OTC platform.

What is the Ethereum OTC Crypto?Ethereum OTC (Over-The-Counter) trading refers to the direct, off-exchange purchase or sale of ETH tokens between two parties. These transactions are privately negotiated and facilitated by specialized brokers or OTC desks, bypassing the public order books of traditional cryptocurrency exchanges.

The main draw of OTC trading for Ethereum is its efficiency in handling large-volume orders. On a standard exchange, a significant ETH trade can move the market price, leading to slippage and a higher average cost. The OTC model solves this by allowing parties to agree on a fixed price in advance. This guarantees price certainty, minimizes market impact, and provides a higher level of privacy, making it the preferred channel for institutions, venture capital funds, and large-scale traders managing substantial Ethereum positions.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange is a specialized service, often called an OTC desk, that arranges private cryptocurrency transactions. Unlike public spot markets, it does not use an open order book. Instead, it provides clients with a firm, non-fluctuating quote for their specific trade, which is locked in until execution.

This approach delivers three critical benefits for sophisticated market participants. First, it acts as an ultra-fast fiat gateway, enabling the quick conversion of traditional capital into crypto to act on time-sensitive opportunities. Second, it ensures zero slippage; the final execution price matches the quoted price exactly, protecting large capital allocations. Third, leading OTC desks feature multi-currency infrastructure, seamlessly connecting local banking systems like Pakistan's to the global digital asset market for efficient cross-border settlement.

What is WEEX OTC Crypto Trading Exchange?WEEX is a global cryptocurrency exchange that provides a dedicated and secure OTC trading desk. The WEEX OTC platform is designed to offer a streamlined, confidential path for converting fiat currency into Ethereum and other leading digital assets.

Central to its user-friendly design is the WEEX OTC Quick Buy feature, which simplifies the entire purchasing workflow. The platform facilitates instant transactions, allowing users to buy crypto anytime, anywhere in just a few steps. It achieves reliable and efficient service by aggregating deep liquidity and integrating a wide range of mainstream global and regional payment methods, effectively bridging traditional finance with the Web3 ecosystem.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Ethereum with PKR on WEEX OTC Crypto Exchange?Buy Ethereum OTC with PKR on WEEX (Web)Step 1: Select [PKR] fiat currency and [ETH] crypto, then select the payment method.

Step 2: Input the PKR payment amount, then click [Buy ETH] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Ethereum OTC with VND on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [PKR] fiat currency and [ETH] crypto.

Step 3: Input the PKR payment amount, then click [Buy ETH] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is Ethereum OTC?Ethereum OTC is the process of buying or selling ETH directly between two parties through a private broker or trading desk, rather than on a public exchange. It is tailored for large transactions to ensure price stability, avoid market impact, and maintain a higher degree of privacy for the participants.

How does the OTC process in crypto work?In the OTC process, a client contacts a desk with their trade requirements. The desk provides a fixed price quote based on current market conditions. Upon agreement, the desk facilitates the direct settlement between the buyer and seller off the public order book, ensuring the trade is executed at the pre-agreed price without slippage.

What is an OTC crypto desk?An OTC crypto desk is a specialized unit within a financial institution or exchange that handles large-volume cryptocurrency trades directly between counterparties. It operates privately to provide liquidity, negotiate custom terms, and ensure discreet and efficient execution of trades that would be disruptive on public markets.

Is OTC crypto legal?Yes, OTC crypto trading is legal in most countries when conducted through compliant and regulated platforms. Reputable exchanges like WEEX operate within legal frameworks, implementing necessary KYC (Know Your Customer) and AML (Anti-Money Laundering) checks to ensure transparency and regulatory adherence.

Does WEEX charge fees for OTC trading?WEEX applies variable fees that depend on the specific trading pair and the chosen payment method. The platform's system is designed to automatically suggest the most advantageous payment channel for the user. Importantly, during special promotional campaigns, OTC trading can often be conducted with zero手续费 (no fees).

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What Is Solana OTC Crypto and How to Trade SOL OTC with Google Pay on WEEX Exchange?

Solana is a high-performance blockchain known for fast transactions and low fees, making SOL one of the most actively traded crypto assets in the market. As SOL liquidity grows, many traders prefer OTC crypto trading to execute larger or time-sensitive transactions with better price control. This article explains what Solana OTC crypto trading is, how a crypto OTC trading exchange works, and how WEEX Exchange supports efficient OTC trading. You will also learn how to trade SOL OTC using Google Pay on WEEX via web and app, followed by practical answers to common OTC crypto questions.

What Is the Solana OTC Crypto?Solana OTC crypto refers to over-the-counter trading of SOL, Solana’s native token. In this model, SOL is traded directly between counterparties rather than through public exchange order books. According to MoonPay’s overview of crypto OTC trading, OTC transactions are usually facilitated by brokers, OTC desks, or trusted peer-to-peer platforms that arrange pricing and settlement privately.

The main advantage of SOL OTC crypto trading is execution stability. Large SOL trades placed on public markets can trigger slippage or short-term volatility. OTC trading allows both parties to agree on a fixed price before execution, reducing market impact. This controlled approach is commonly used by institutional traders, high-net-worth individuals, and users who value predictable settlement and transaction privacy.

What Is Crypto OTC Trading Exchange?A crypto OTC trading exchange, sometimes called an OTC desk or platform, enables direct crypto transactions outside traditional spot markets. Instead of matching orders publicly, the platform provides quoted prices that are executed immediately once accepted. This structure eliminates slippage and protects traders from sudden price changes during large transactions.

OTC crypto exchanges also act as efficient fiat gateways. They allow users to convert fiat currencies into crypto or back into fiat quickly and securely. By connecting local banking systems with blockchain infrastructure, OTC platforms support multi-currency settlement and cross-border capital flow. For assets like SOL, OTC crypto trading offers speed, privacy, and price certainty that standard exchanges may not always deliver.

What Is WEEX OTC Crypto Trading Exchange?WEEX OTC Crypto Trading Exchange is designed to make fiat-to-crypto trading simple, fast, and accessible. WEEX has officially launched its WEEX OTC Quick Buy feature to streamline fiat deposits with a secure and seamless experience. The platform supports more than 200 trading pairs and multiple mainstream payment methods.

Through WEEX OTC, users can purchase cryptocurrencies anytime and anywhere using fiat currencies, completing transactions in just three steps. Pricing is transparent, settlement is fast, and the interface is suitable for both beginners and experienced traders. The integrated OTC entry allows users to move directly from fiat payment to crypto ownership without unnecessary complexity.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Solana with Google Pay on WEEX OTC Crypto Exchange?Trading SOL OTC with Google Pay on WEEX is designed for speed and clarity. Both the web platform and mobile app focus on transparent pricing, fast settlement, and secure payment flows.

Buy Solana OTC with Google Pay on WEEX (Web)Step 1: Select [Google Pay] and [SOL] crypto, then select the payment method.

Step 2: Input the payment amount, then click [Buy SOL] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Solana OTC with Google Pay on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [Google Pay] and [SOL] crypto.

Step 3: Input the payment amount, then click [Buy SOL] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ About Solana OTC Crypto TradingHow does buying SOL OTC crypto work?SOL OTC trading allows buyers to receive a fixed quote before execution. The transaction is completed privately through the platform, reducing slippage and ensuring stable pricing for larger trades.

What is an OTC crypto exchange?An OTC crypto exchange executes trades directly between counterparties outside public markets. It focuses on private, high-volume transactions with fixed pricing and flexible settlement methods.