What is Canton Network: Pioneering Institutional Crypto with Canton Coin (CC) and Privacy-Preserving Blockchain Innovation

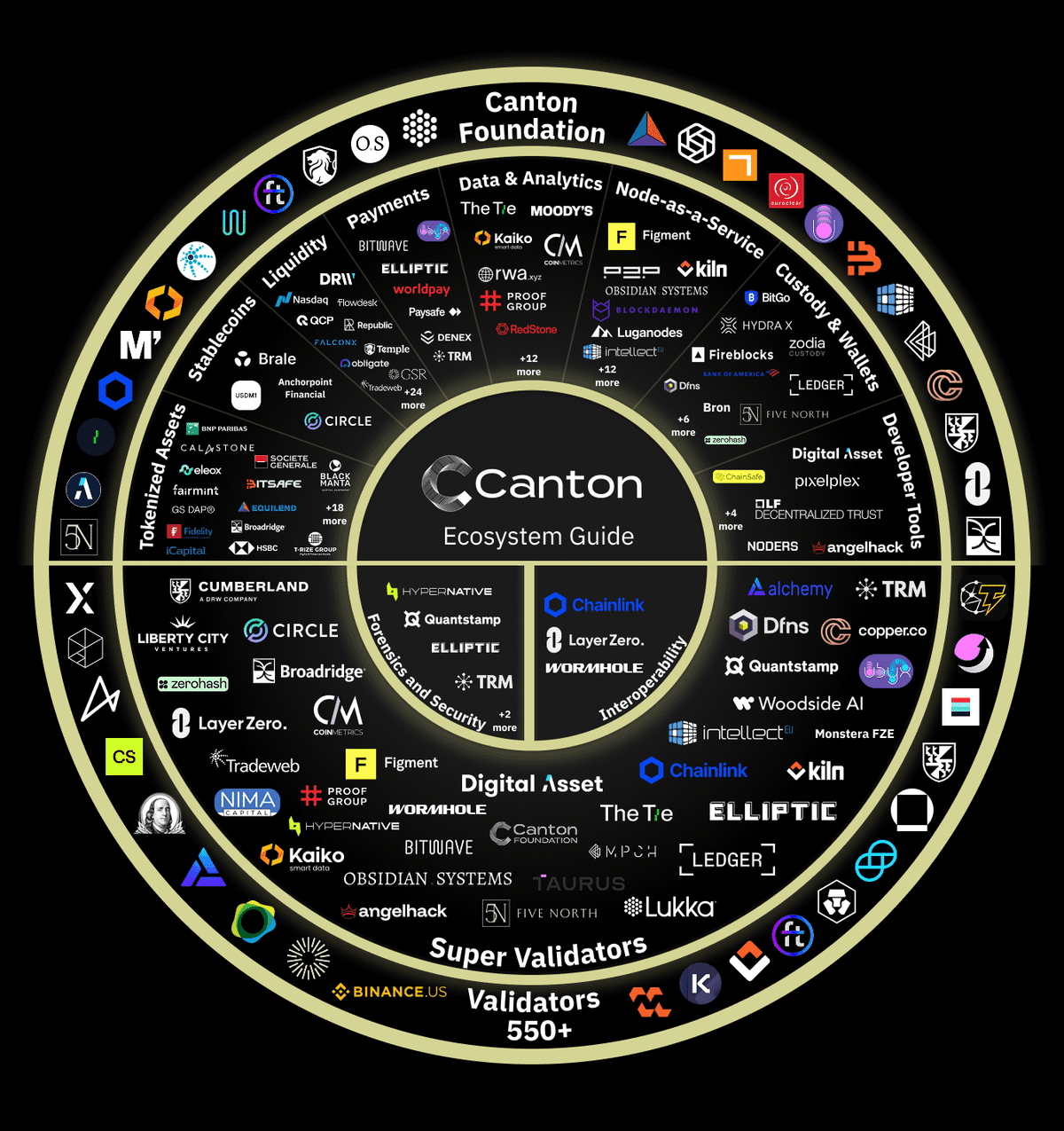

Picture a world where the ironclad vaults of traditional finance open to blockchain’s relentless 24/7 pulse—without the usual chaos of exposed data or regulatory nightmares. That’s the reality Canton Network is building. Launched in May 2023 by a powerhouse consortium including Goldman Sachs, Microsoft, and Deutsche Bank, this public-yet-permissioned Layer 1 isn’t another speculative side project. It’s the settlement layer where real-world assets (RWAs) and stablecoins finally live and breathe on-chain. As of late 2025, with Canton Coin (CC) trading near $0.13 and daily transactions topping 600,000, Canton Network is quietly closing the gap between Wall Street caution and crypto speed.

What Makes Canton Network the Institutional Crypto Standard?

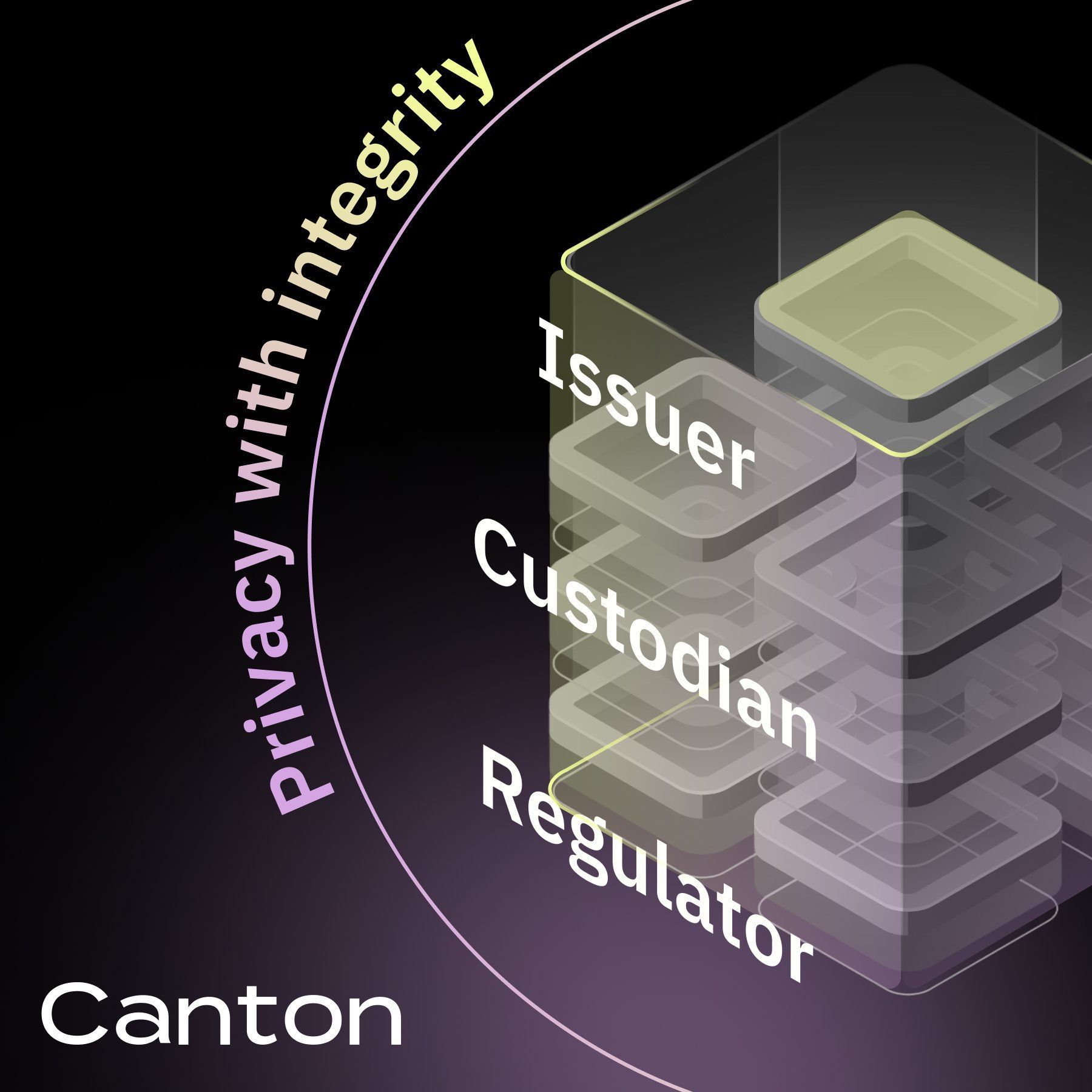

Canton Network runs on a “network of networks” architecture: each institution keeps its own private sub-ledger, syncing seamlessly via a shared global synchronizer. Unlike typical public chains that broadcast every transaction to every node—inviting compliance disasters—data here flows encrypted and only to parties specified in the smart contract. Sensitive operations, like the $280 billion daily U.S. Treasury repo market, remain confidential yet fully auditable.

Think of it as a secure diplomatic summit: participants share only what’s required for the deal, but the entire agreement locks in atomically across borders. Governed by the independent Global Synchronizer Foundation under the Linux Foundation, the network now boasts over 600 validators and 31 super validators. Monthly transaction volume exceeds 15 million, with more than $6 trillion in assets tokenized. Major U.S. exchanges—Binance U.S., Crypto.com, Gemini, and Kraken—are fully integrated, turning institutional adoption into an unstoppable trend.

The Privacy Advantage: Why Canton Network Crypto Stands Apart

While most blockchains scream transparency, Canton whispers. Its synchronizers distribute encrypted messages only to relevant parties, enabling real-time settlement across bonds, treasuries, and even tokenized real estate—without the silos that trap capital in legacy systems. Just this week, Franklin Templeton’s Benji Token went live on the network, proving how Canton unlocks collateral mobility while staying MiCA-compliant.

This rare balance of decentralization and control makes Canton Network coin the backbone of RWAs. Assets aren’t just “on-chain”—they’re programmable, reusable, and regulator-friendly, delivering a capital efficiency revolution already powering institutional DeFi pilots.

Inside Canton Coin: The CC Token Powering a Fair, Utility-First Economy

Canton Coin (CC) isn’t built for hype—it’s engineered for real work. Outlined in the Canton Network whitepaper, CC is the native payment and incentive layer that rewards actual network contribution, not speculation. No pre-sales. No team allocations. No VC lockups. Tokens are minted only through verifiable utility: running validators, deploying applications, or driving traffic.

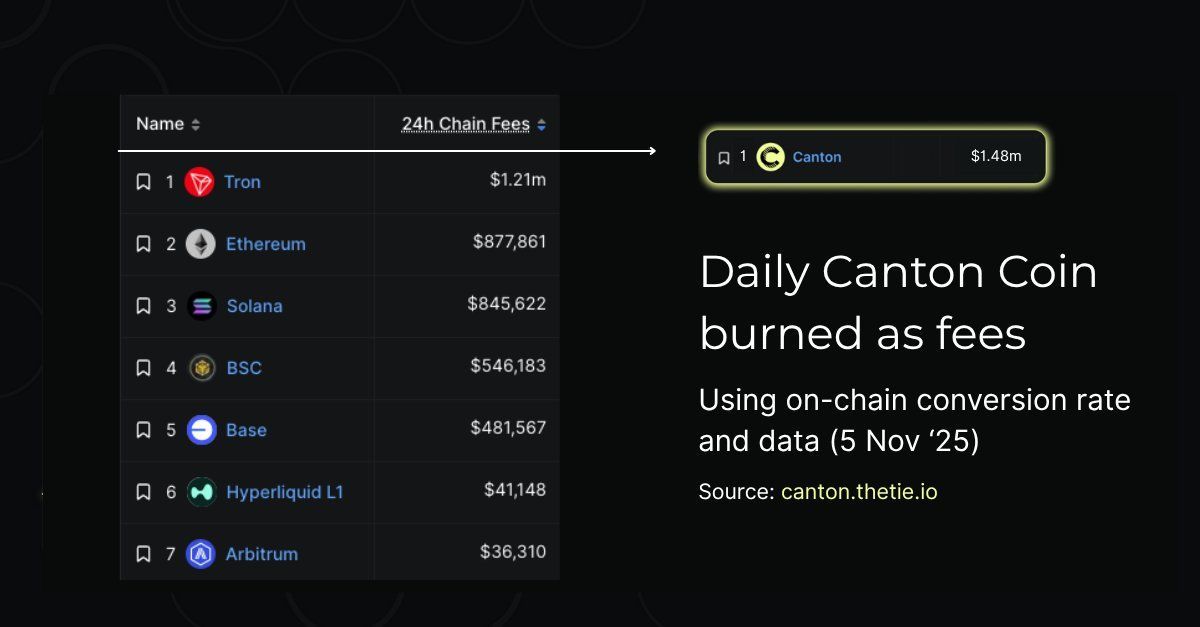

Every 10 minutes, in structured mining rounds, stakeholders earn redeemable coupons based on liveness, validation, and app activity. Pay gas in CC? It’s automatically burned. The more the network is used, the tighter supply becomes—creating a self-regulating deflationary loop tied directly to real economic activity. With 22 billion CC in circulation and a 100 billion cap over the first decade (followed by 2.5 billion annually), this model echoes Zcash’s privacy legacy but supercharges it with institutional-grade infrastructure.

CC Coin Tokenomics Breakdown: Minting, Burning, and Long-Term Alignment

The minting curve is deliberately bootstrapped: early years favor super validators to fund backbone infrastructure, but by year five, regular validators dominate rewards. The split starts 50/50 between infrastructure and applications, then shifts to 75% for app providers—ensuring builders, not just operators, thrive. External parties can delegate minting via AmuletRules_Transfer, but unredeemed rewards expire, keeping the system merit-driven and lean.

This design kills speculation at the root. Despite a post-listing dip to $0.126, CC sees $80 million in daily volume across top exchanges. Recent $540 million treasury commitments—including Tharimmune’s strategic pivot—signal growing conviction in CC’s long-term value, backed by $1.48 million in daily fees and real RWA throughput.

Canton Network’s 2025 Breakout: Listings, Integrations, and Real-World Traction

This year has been explosive for Canton Network crypto. CC launched October 31 at $0.11, rapidly listing on Gate.io, Bybit (via Launchpool with 355% APR staking), MEXC (zero-fee trading through November 24), and now WEEX—offering deep liquidity, tight spreads, and a seamless mobile experience for traders worldwide. Whether you’re spot trading CC/USDT or staking for yield, WEEX delivers institutional-grade execution with retail-friendly simplicity, making it a go-to platform for accessing Canton Network coin alongside KuCoin, Phemex, and others.

Network momentum is undeniable: Talos joined as a super validator this month, Chainlink’s SCALE integration unlocked oracle and cross-chain functionality across 22+ networks, and Broadridge now processes $4 trillion in monthly ledger repos on-chain. Copper Research reports over 500,000 daily transactions—proof that Canton isn’t promising the future; it’s running it.

On X, the conversation is electric. Threads dissect the $500 million treasury round from DRW and Liberty City Ventures. AMAs spotlight privacy’s role in institutional DeFi. One viral post sums it up: “Canton now has 598 validators and growing—this is what real on-chain adoption looks like.”

Why is Canton Network the Settlement Layer for RealFi?

Compare Canton to meme-driven chains chasing viral pumps, and its strength is clear: while others tokenize hype, Canton tokenizes reality—national debts, repurchase agreements, precious metals—making them liquid, auditable, and programmable. Its BFT consensus with privacy scales without gas wars. Partnerships like Nasdaq’s listings and HSBC’s pilots underscore a shift from DeFi speculation to RealFi—real finance, on-chain.

With a $4.5 billion market cap and year-end price targets between $0.08 and $0.17, CC’s upside isn’t driven by unlocks—it’s fueled by burn mechanics that reward usage. As stablecoins become settlement engines and RWAs go programmable, Canton Network coin isn’t just bridging TradFi and crypto—it’s fusing them.

This is the infrastructure where the future of global capital markets is being built, one private, atomic sync at a time.

Frequently Asked Questions (FAQ)

- What is Canton Coin (CC), and how is it different from other crypto tokens?

Canton Coin is the native utility token of Canton Network, designed to reward real network activity—validation, app deployment, traffic—rather than speculation. With no pre-mine or VC allocation, CC is minted only through contribution, and fees paid in CC are burned, creating a supply model tied directly to usage and long-term ecosystem health.

- Where can I buy and trade Canton Network coin (CC) right now?

CC is live on WEEX, KuCoin, Phemex, Gate.io, Bybit, and MEXC with USDT and USDC pairs. WEEX stands out for fast deposits, low-latency trading, and strong mobile support—ideal for active traders. Always use secure wallets and enable 2FA. DYOR before investing.

- What’s the outlook for Canton Network crypto in 2026 and beyond?

With 600+ validators, $6T in tokenized assets, and growing integrations (Chainlink, Talos, Franklin Templeton), analysts expect CC to rise as RWAs go mainstream. If repo volumes sustain $280B daily, valuation could double or more by 2027—positioning Canton as the default settlement layer for institutional blockchain.

You may also like

What is USDCoin OTC and How to Buy USDC OTC With INR on WEEX Exchange?

For businesses, traders, and investors in India, obtaining significant amounts of USD Coin (USDC) efficiently and compliantly is key to participating in global markets, DeFi, and stable treasury management. USDC OTC (Over-the-Counter) trading provides a direct path for converting Indian Rupees (INR) into this trusted dollar-pegged asset. This guide explains the specific use case for USDC OTC trading, outlines the advantages of using a professional desk, and provides a clear, step-by-step tutorial on how to securely buy USDC with INR on the WEEX exchange.

What is the USDCoin OTC Crypto?USDCoin OTC trading is the direct, negotiated purchase and sale of USDC tokens between two parties, conducted privately outside of public exchange order books. While USDC itself is a stablecoin, its OTC market focuses on efficient, large-scale settlement of stable value rather than avoiding volatility. These transactions are facilitated by OTC desks that connect parties needing to move between local currency and a global digital dollar.

For participants in India's market, the value of USDC OTC is multifaceted. It provides a compliant and efficient on-ramp to dollar-denominated digital assets. A company paying international vendors, an investor allocating to DeFi yield protocols, or a trader seeking a stable base during market uncertainty needs a reliable method to convert INR to USDC. The OTC channel offers execution certainty for large amounts, a fixed, known cost, and transactional privacy. Importantly, when conducted through a platform like WEEX, it ensures the necessary KYC/AML procedures are followed, aligning with India's regulatory expectations for crypto transactions.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, functions as a specialized brokerage service for large, negotiated digital asset trades. It operates as a private marketplace, separate from the public order-driven exchanges, designed to handle transactions that are impractical for the spot market due to their size, need for price certainty, or specific settlement requirements.

The strategic benefits of an OTC desk are price certainty, minimized market impact, and regulatory-compliant infrastructure. For a stablecoin like USDC, the emphasis is on the latter two. OTC desks provide a firm quote and handle the entire settlement, bridging local financial systems—like India's INR banking network—with the global crypto economy. Platforms operating in this space must navigate local regulations, such as India's requirement for exchanges to register with the Financial Intelligence Unit (FIU-IND) and enforce KYC, providing users with a structured and compliant path for capital movement.

What is WEEX OTC Crypto Trading Exchange?WEEX Exchange offers an integrated OTC trading solution designed for secure and seamless fiat-to-crypto conversions. The WEEX platform supports a wide range of trading pairs and connects users to multiple payment channels. For Indian users, WEEX facilitates the purchase of cryptocurrencies like USDC through its C2C trading platform, which supports transactions in Indian Rupee (INR). This peer-to-peer model, overseen by the exchange, provides a direct and accessible on-ramp.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade USDCoin with INR on WEEX OTC Crypto Exchange?Buy USDCoin OTC with INR on WEEX (Web)Step 1: Select [INR] fiat currency and [USDC] crypto, then select the payment method.

Step 2: Input the INR payment amount, then click [Buy USDC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy USDCoin OTC with INR on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [INR] fiat currency and [USDC] crypto.

Step 3: Input the INR payment amount, then click [Buy USDC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is the purpose of OTC trading for a stablecoin like USDC?OTC trading for USDC focuses on efficient, large-scale conversion of local currency (like INR) into a stable digital dollar. It's used by businesses for international settlements, investors entering DeFi, or anyone needing to move significant, stable value into the crypto ecosystem quickly and with a known cost.

How is USDC OTC different from trading it on a spot exchange?Trading USDC on a spot exchange involves buying from an open order book, which is suitable for smaller, retail-sized orders. USDC OTC is designed for larger transactions, offering a single, negotiated price for the entire block, greater privacy, and often access to deeper liquidity pools through direct counterparty matching.

Is OTC crypto trading legal and taxed in India?OTC crypto trading is legal in India when conducted through platforms compliant with local regulations, such as those registered with the FIU-IND. All crypto profits in India are subject to a 30% tax, and a 1% Tax Deducted at Source (TDS) may apply to certain transactions. It is the investor's responsibility to report and pay applicable taxes.

Does WEEX support INR payments for buying USDC?Yes, WEEX supports Indian Rupee (INR) transactions for purchasing cryptocurrencies like USDC through its C2C (peer-to-peer) trading platform, which connects buyers with verified sellers offering INR payment options.

What are the main risks of OTC trading?Key risks include counterparty risk (mitigated by the platform's escrow service), potential for less price transparency than public markets, and the user's responsibility to ensure all transactions comply with local tax laws and reporting requirements.

Why would an Indian user choose OTC for USDC instead of a bank's forex service?OTC for USDC can be faster, operate outside traditional banking hours, and provide direct access to the cryptocurrency for use in Web3 applications, DeFi, or as a digital dollar holding. It serves a different need than traditional forex for converting INR to physical USD held in a bank account.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

WEEX Labs: Key Highlights of This Market Rebound

As of the writing date, after nearly three months of choppy pullbacks, the crypto market has finally ushered in a long-overdue broad rally.

What stands out is the clear “stair-step narrative” in this rebound: the Meme sector, acting as the emotional vanguard, kicked off early this month, with its overall market cap surging around 30%. While talk of a full-blown bull market rally is still premature, the recent price action is unmistakably signaling a rapid thaw in market risk appetite — or “risk-on” sentiment, as traders like to say.

Breaking down this rally in detail, we can identify three distinct features:

First, high-liquidity legacy Meme coins seized the high ground early, establishing a clear profit effect. This rebound didn’t start with chaotic pumps across random on-chain memes; instead, it was spearheaded by established heavyweights like Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE). PEPE, in particular, led the pack with a staggering 65% gain this month.

These projects, backed by deep community roots and the amplifying power of social media, quickly filled the gap after the market stabilized, in turn sparking a catch-up rally in blue-chip memes like WIF, BONK, BROCCOLI, and PENGU.

Second, on-chain activity is reigniting, with PVP hype flaring up again. The explosive gains in blue-chip memes have opened the market’s imagination, drawing profit-seeking capital to hunt for higher-upside “new concepts” on-chain.

From WHITEWHALE (paying homage to OG traders), to “雪球” memes riding viral social posts, to 114514 carrying the stamp of internet subculture — these emerging tokens have been hyped to new highs in short order.

Though these plays lack traditional fundamentals, their underlying “cultural consensus” and “viral fission” perfectly align with the Meme sector’s core DNA: poking fun at seriousness and crowning consensus as king. At the end of the day, the true allure of meme coins lies in their entertainment value and viral spread, not rigorous logic — and that’s precisely what explains their lightning-fast rise when sentiment turns.

Finally, capital spillover is playing out clearly, with value-oriented sectors showing signs of taking the baton. While the Meme sector still has lingering heat, today’s price action reveals that practical-narrative sectors like PayFi, AI, and DePIN are already stepping up to lead gains. Standout performers such as Ripple (XRP), Stellar (XLM), and Render (RENDER) are mostly battle-tested projects that have weathered multiple cycles.

This flow from “pure emotion plays” toward “value logic” is highly instructive: it shows that liquidity isn’t fully locked in the Meme sector. Instead, the buzz generated by memes is now replenishing oversold, high-quality assets with sustainable growth stories.

In summary, even though chatter about an Altcoin Season or Memecoin Season has quieted compared to past peaks, recent performance proves that structural opportunities remain plentiful. On one hand, meme coins have evolved into the market’s “risk thermometer,” likely continuing to serve as the leading indicator for sentiment repair and liquidity return. On the other hand, funds are returning from pure speculation to “supported narratives” – even for Meme coins, which are considered speculative, it is the older tokens with stronger consensus that are being hyped first. This suggests that the next market phase will most likely be a structural bull driven primarily by value resurgence, catalyzed by emotion — a view that aligns closely with our earlier outlook in “2026 Outlook – Which Big Opportunities Stand Out?”

So, will capital rotate next into RWA or DeFi to pump those blue-chip value plays? Time will tell — we’ll be watching closely.

Note: All tokens mentioned above are available as spot trading pairs on WEEX. The discussion of these tokens reflects only current market conditions and does not represent any investment opinion or recommendation from our side.

About Us

WEEX Labs is the research department established by WEEX exchange, dedicated to tracking and analyzing cryptocurrency, blockchain technology, and emerging market trends, and providing professional assessments.

We adhere to the principles of objectivity, independence, and comprehensiveness in our analysis. Our aim is to explore cutting-edge trends and investment opportunities through rigorous research methods and cutting-edge data analysis, providing the industry with comprehensive, rigorous, and clear insights, and offering all-round guidance for Web3 startups and investors in their development and investment.

Disclaimer

The views expressed herein are for informational purposes only and do not constitute endorsements of any discussed products or services, nor investment, financial, or trading advice. Readers should consult qualified professionals before making any financial decisions. Please note that WEEX Labs may restrict or prohibit all or part of its services in restricted jurisdictions.

The Future of Passive Income in Crypto: Why Auto Earn is Leading the Way in 2026

As we move into 2026, the landscape of cryptocurrency passive income has undergone a significant transformation. Gone are the days when investors had to choose between complex staking procedures, unpredictable yield farming risks, or minimal returns from traditional savings. The future of passive income in crypto has crystallized around one revolutionary concept: Auto Earn. This automated yield-generation mechanism represents the pinnacle of financial innovation, combining security, simplicity, and superior returns in ways previously unimaginable.

At the forefront of this revolution stands WEEX Auto Earn, a platform that has redefined what investors can expect from their digital assets. By analyzing current trends and technological advancements, we can clearly see why Auto Earn platforms like WEEX's are positioned to dominate the passive income space in 2026 and beyond.

What is Auto Earn and How Has It Evolved?WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

How Auto Earn Works?Auto Earn represents the next generation of cryptocurrency yield generation—a fully automated system that eliminates the complexities and manual interventions traditionally associated with crypto investing. Unlike conventional staking or liquidity provision methods, Auto Earn platforms automatically allocate user funds to optimal yield-generating strategies while maintaining flexibility and accessibility.

The WEEX Auto Earn AdvantageWEEX Auto Earn has distinguished itself through several key innovations:

Automated Optimization: The platform continuously scans multiple yield opportunities across various blockchain networks and DeFi protocols, automatically redirecting funds to maximize returns without requiring user intervention.

Flexible Redemption: Unlike locked staking periods, WEEX Auto Earn offers unparalleled flexibility, allowing users to redeem their assets at any time while still earning competitive yields.

Risk-Managed Strategies: By employing sophisticated risk assessment algorithms and diversification across multiple protocols, WEEX minimizes exposure while maximizing potential returns.

Why Auto Earn is Dominating the 2026 Crypto Landscape?The Simplicity RevolutionIn 2026, crypto adoption has reached mainstream levels, bringing millions of new investors who prioritize simplicity and user experience. Auto Earn platforms like WEEX have successfully addressed this demand by eliminating technical barriers. Users no longer need to understand complex concepts like validator selection, slashing risks, or impermanent loss. The entire process has been streamlined into a single click: deposit assets and watch them grow.

Superior Risk-Adjusted ReturnsTraditional yield-generating methods often forced investors to choose between security and returns. WEEX Auto Earn has revolutionized this paradigm through:

Intelligent Diversification: Assets are automatically distributed across multiple yield sources, reducing dependency on any single protocol or platform.

Dynamic Rebalancing: The system continuously adjusts allocations based on real-time market conditions, risk assessments, and opportunity costs.

Institutional-Grade Security: With advanced security protocols and insurance mechanisms, WEEX Auto Earn provides peace of mind that was previously available only to institutional investors.

Unprecedented Flexibility and AccessibilityThe 2026 investor demands flexibility that traditional staking cannot provide. WEEX Auto Earn offers:

Zero Lock-up Periods: Unlike traditional staking that requires fixed commitment periods, Auto Earn allows instant access to funds without sacrificing yield potential.

Multi-Asset Support: From major cryptocurrencies to emerging altcoins, the platform supports a diverse range of assets, each earning optimized yields.

Cross-Chain Integration: Seamless operation across multiple blockchain networks ensures maximum opportunity capture without technical complexity.

Read More: Why Choose WEEX Auto Earn?

Comparative Analysis: Auto Earn vs. Traditional StakingVersus Traditional StakingWEEX Auto Earn overcomes traditional staking limitations through:

Higher Effective Yields: By optimizing across multiple networks and protocolsReduced Technical Risk: Eliminating validator selection and slashing concernsEnhanced Liquidity: No lock-up periods, instant redemption capabilitiesSimplified Management: Automated reward compounding and reinvestmentThe 2026 Investor Profile and Auto Earn AdoptionMainstream User AdoptionBy 2026, Auto Earn has become the default choice for:

First-Time Crypto Investors: Seeking simple, secure entry pointsTraditional Finance Migrants: Expecting professional-grade tools and securityRetirement Planners: Incorporating crypto yields into long-term strategiesInstitutional Entities: Requiring scalable, compliant yield solutionsGlobal Regulatory AlignmentWEEX Auto Earn has pioneered regulatory-compliant features including:

KYC/AML integrationTransparent reporting systemsJurisdiction-specific compliance frameworksInstitutional audit trails2026 and Beyond: What's Next for Auto EarnWEEX is continuously evolving the Auto Earn platform with planned enhancements:

Advanced Personalization: AI-driven strategy customization based on individual risk profiles and financial goals

Cross-Platform Integration: Seamless connectivity with traditional banking and investment platforms

Enhanced Security Protocols: Next-generation encryption and decentralized custody solutions

Sustainable Yield Strategies: Environmentally conscious protocol selection and carbon-neutral operations

Conclusion: Why Auto Earn is the Unquestioned LeaderAs we look toward 2026, the evidence is overwhelming: Auto Earn represents the future of cryptocurrency passive income. Platforms like WEEX Auto Earn have successfully addressed every major limitation of previous yield-generation methods while introducing unprecedented levels of security, simplicity, and sophistication.

The combination of automated optimization, institutional-grade security, flexible accessibility, and superior risk-adjusted returns has created a perfect storm of advantages that traditional methods cannot match. As cryptocurrency continues its march toward mainstream adoption, Auto Earn stands ready to serve as the bridge that brings safe, reliable passive income to millions of new investors worldwide.

For those seeking to maximize their crypto holdings' potential while minimizing complexity and risk, WEEX Auto Earn offers not just a product, but a complete reimagining of what passive income can achieve in the digital age. The future is automated, intelligent, and accessible—and that future is already here.

Don't hesitate any longer. Sign up now and experience Auto Earn instantly, exclusively on WEEX.

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What is USDCoin OTC and How to Buy USDC OTC With TWD on WEEX Exchange?

For investors navigating the crypto markets, moving large sums of stable capital efficiently is as crucial as executing speculative trades. USDCoin (USDC) OTC trading offers a direct path to secure significant amounts of this trusted stablecoin away from public order books. This guide explains what USDC OTC trading entails, outlines the advantages of using a dedicated OTC desk, and provides clear, step-by-step instructions on how to buy USDC with TWD using the WEEX OTC platform.

What is the USDCoin OTC Crypto?USDCoin OTC trading refers to the direct purchase and sale of USDC between two parties, facilitated outside of public cryptocurrency exchanges. Instead of being matched on an open order book, these transactions are negotiated privately, often through a broker or an OTC desk. This method is fundamentally about achieving price certainty and minimizing market impact for substantial transactions.

The core value is in executing large, stable transfers. While a massive buy order for a volatile asset like Bitcoin on a public exchange can cause price slippage, USDC is designed to be price-stable. However, the OTC process for USDC focuses on other critical advantages: enhanced privacy, as trades are not recorded on public ledgers, and the ability to settle large volumes swiftly through customized terms. This makes it ideal for institutions, traders, and businesses that need to move large sums of dollar-pegged value into or out of the crypto ecosystem quickly and discreetly, without revealing their operational footprint.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, functions as a private brokerage service for digital assets. It operates parallel to the public spot market, providing a negotiated, over-the-counter venue for trades. These desks are built to serve participants who require three key elements that public exchanges often cannot provide for large orders.

First is enhanced privacy and discretion. OTC transactions are conducted directly between counterparties and are not displayed on public order books, keeping trading strategies and large capital movements confidential. Second is zero slippage on large orders. Traders receive a fixed, quoted price for the entire transaction, eliminating the risk of price deterioration while a large order is being filled on an exchange. Third is flexibility in settlement. OTC desks can accommodate various payment methods and settlement timelines tailored to the needs of the parties involved, bridging traditional finance with digital asset liquidity seamlessly.

What is WEEX OTC Crypto Trading Exchange?WEEX Exchange offers a integrated OTC trading solution designed to simplify the process of converting fiat currency to cryptocurrency. The WEEX OTC platform supports a wide array of trading pairs and connects users to multiple mainstream payment channels, allowing for the purchase of assets like USDC with TWD at any time. The process is streamlined for user convenience through features like WEEX OTC Quick Buy, enabling fast and secure transactions.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade USDCoin with TWD on WEEX OTC Crypto Exchange?Buy USDCoin OTC with TWD on WEEX (Web)Step 1: Select [TWD] fiat currency and [USDC] crypto, then select the payment method.

Step 2: Input the TWD payment amount, then click [Buy USDC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy USDCoin OTC with TWD on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [TWD] fiat currency and [USDC] crypto.

Step 3: Input the TWD payment amount, then click [Buy USDC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC in crypto?OTC in crypto stands for "Over-the-Counter." It refers to the direct trading of cryptocurrencies between two parties, negotiated privately through a broker or a dedicated desk instead of being executed on a public exchange's order book.

How does buying USDC OTC work?Buying USDC OTC involves contacting an OTC desk or using a platform's OTC service, receiving a fixed quote for the desired amount, and agreeing to the terms. The settlement is then completed directly, often via bank transfer, with the stablecoin delivered to your wallet.

Is OTC crypto legal?Yes, OTC crypto trading is legal in most jurisdictions when conducted through regulated and compliant platforms. Reputable exchanges implement KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures to ensure operations are transparent and lawful.

What are the main risks of OTC trading?The primary risks include counterparty risk (the other party defaulting), less price transparency compared to public exchanges, and the need for thorough due diligence on the trading partner or platform to avoid fraud.

Does WEEX Exchange charge fees for OTC Trading?WEEX Exchange applies fees that vary depending on the specific trading pair and the payment method used. The platform is designed to automatically suggest the most cost-effective payment channel available. Users can also look for promotional periods where trading fees may be reduced or waived.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is USDCoin OTC and How to Buy USDC OTC With VND on WEEX Exchange?

For businesses, traders, and investors in Vietnam seeking a stable gateway to the global crypto market, accessing significant amounts of USD Coin (USDC) efficiently is crucial. USDC OTC (Over-the-Counter) trading provides a direct, stable path for acquiring this trusted dollar-pegged asset away from public order books. This guide explains the unique role of USDC in OTC trading, details the advantages of using a professional OTC desk, and delivers a clear, step-by-step tutorial on how to buy USDC with Vietnamese Dong (VND) using the streamlined WEEX OTC platform.

What is the USDCoin OTC Crypto?USDCoin OTC trading is the direct, negotiated purchase and sale of USDC tokens between two parties, conducted outside of public cryptocurrency exchanges. Unlike volatile assets, these transactions focus on transferring substantial, stable value. They are privately facilitated by OTC desks, which act as intermediaries matching entities needing to convert local currency into a global digital dollar equivalent.

For participants in Vietnam's market, the core value of USDC OTC lies in efficient, stable cross-border capital movement. While USDC itself is designed for price stability, the primary advantages of the OTC channel are large-scale execution, enhanced privacy, and access to deep liquidity. An import/export business settling international invoices, a remittance service managing pools of liquidity, or an investor looking to park capital in a stable digital asset cannot risk the inefficiencies of public markets for large sums. The OTC process provides a fixed quote and discreet settlement, ensuring the transaction is completed smoothly, at a known cost, and without operational details being publicly broadcast.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, functions as a private brokerage service specializing in large, negotiated digital asset transactions. It operates separately from the public spot markets, providing a venue for trades that require customization, discretion, and access to substantial liquidity that might not be visible on standard exchanges.

The strategic use of an OTC desk is defined by three key pillars: minimized market impact, price certainty, and flexible, localized settlement. For stablecoins like USDC, the concern shifts from price slippage to execution efficiency and privacy for large transfers. An OTC desk provides a firm quote and handles the entire settlement process seamlessly. Crucially, it bridges local financial systems—like Vietnam's VND banking network—with the global blockchain ecosystem. This allows businesses and individuals to convert local currency into a globally accepted digital dollar (USDC) efficiently, facilitating trade, investment, and treasury management without the hurdles of traditional foreign exchange.

What is WEEX OTC Crypto Trading Exchange?WEEX Exchange offers a fully integrated OTC trading solution designed to simplify the process of converting local fiat currency to cryptocurrency. The WEEX OTC platform supports an extensive selection of trading pairs and connects users to a wide array of global and regional payment channels. This infrastructure allows for the convenient purchase of USD Coin and other digital assets directly with Vietnamese Dong (VND). The user experience is prioritized through intuitive features like WEEX OTC Quick Buy, enabling swift and secure transactions.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade USDCoin with VND on WEEX OTC Crypto Exchange?Buy USDCoin OTC with VND on WEEX (Web)Step 1: Select [VND] fiat currency and [USDC] crypto, then select the payment method.

Step 2: Input the VND payment amount, then click [Buy USDC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy USDCoin OTC with VND on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [VND] fiat currency and [USDC] crypto.

Step 3: Input the VND payment amount, then click [Buy USDC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is the purpose of OTC trading for a stablecoin like USDC?OTC trading for USDC focuses on efficiency and privacy for large-scale stable value transfers, rather than avoiding price . It enables businesses and high-net-worth individuals to convert significant amounts of local currency (like VND) into a digital dollar equivalent quickly and discreetly for use in global trade, DeFi, or as a stable store of value.

How is USDC OTC different from Bitcoin OTC?While both involve private, large-scale transactions, Bitcoin OTC primarily aims to avoid market slippage on a volatile asset. USDC OTC, given the token's price stability, emphasizes fast, private settlement of dollar-denominated value and seamless bridging between local currency systems and the global crypto dollar market.

Is OTC trading the best way to buy large amounts of USDC in Vietnam?For acquiring substantial amounts, yes. OTC trading through a reputable platform like WEEX offers better price discovery for large orders, ensures transaction privacy, and provides access to deeper liquidity pools than typically available on public retail order books, making it the preferred method for institutional and significant retail volumes.

Does WEEX support VND payments for buying USDC OTC?Yes, WEEX OTC facilitates the direct purchase of USD Coin (USDC) with Vietnamese Dong (VND). The platform integrates various local payment channels suitable for users in Vietnam, allowing for a smooth conversion from VND to the USDC stablecoin.

Does WEEX Exchange charge fees for OTC Trading with VND?WEEX Exchange applies fees that vary depending on the specific trading pair and the payment method selected. The platform's algorithm is designed to automatically suggest the most cost-effective payment channel for the user. Promotional periods with reduced or zero fees are also frequently offered.

What are the typical use cases for buying USDC OTC in Vietnam?Common use cases include businesses engaging in international trade seeking efficient dollar settlement, individuals or services involved in cross-border remittances, investors looking to allocate capital to a stable digital asset during market uncertainty, and participants in decentralized finance (DeFi) requiring a stable base currency for lending, borrowing, or providing liquidity.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

Top 3 Meme Coins to Watch in 2026

The resilience and cyclical resurgence of meme coins underscore a fundamental market truth: in periods of high liquidity and speculative fervor, narrative and community can temporarily eclipse traditional notions of utility. As sentiment turns bullish, capital increasingly flows toward assets driven by collective psychology and viral momentum.

Entering 2026, established tokens like Dogecoin (DOGE), Pepe (PEPE), and Bonk (BONK) are positioned to lead this charge, having cultivated robust communities and deep liquidity. Alongside them, a constant influx of new, low-market-capitalization projects seeks to capture the imagination of risk-tolerant traders, making the meme coin segment a focal point, rather than a sideshow, during market upswings.

Why Meme Coins Thrive During Bull Markets?Meme coins are uniquely suited to bullish environments where optimism and risk appetite are high. Their value proposition is not tied to cash flows or complex metrics, but to social traction, cultural relevance, and the self-reinforcing cycle of attention and price action. Simplified narratives enable rapid dissemination across social platforms, while abundant market liquidity reduces the friction for speculative entry and exit, creating ideal conditions for their growth.

Established Meme Coins With Breakout Potential in 2026Dogecoin (DOGE)Dogecoin(DOGE) maintains its status as the original and most recognized meme coin. Its primary strengths are its unparalleled brand recognition, massive global holder base, and high liquidity across virtually all major exchanges. Historically, DOGE has acted as a sentiment amplifier during late-stage bull runs, often moving in correlation with broader Bitcoin-led rallies. Its longevity and stability provide a relative "safe haven" within the inherently risky meme sector.

Read More: Is Dogecoin(DOGE) a Good Investment in 2026? Everything You Should Know

Pepe (PEPE)Pepe(PEPE) has cemented itself as a leading second-generation meme coin within the Ethereum ecosystem. It appeals to a trader demographic attuned to high volatility and rapid hype cycles. PEPE's strength lies in its strong, recognizable meme identity and its deep integration into Ethereum's DeFi and trading infrastructure, allowing it to quickly capture speculative capital flowing into the ecosystem.

Bonk (BONK)Bonk(BONK) has emerged as the de facto flagship meme coin of the Solana blockchain. Its growth has been intertwined with Solana's own resurgence, benefiting from the network's low fees and high transaction speeds that facilitate frenetic trading activity. BONK often serves as a high-beta proxy for Solana ecosystem sentiment, making it a key asset to watch during altcoin seasons.

The High-Risk Frontier: Low-Cap Meme CoinsBeyond the established leaders lies the volatile world of low-capitalization meme coins. These projects often launch with humorous narratives or minimal utility (like trading bots or community tools), aiming to become the next viral sensation. While they carry exponentially higher risks—including extreme volatility, illiquidity, and potential for abandonment—they represent the purest form of asymmetric bet in the crypto space, capable of delivering outsized returns during peak hype cycles. They should be approached strictly as high-risk speculative instruments, not long-term investments.

How to Identify Meme Coin Breakout Signals?Key metrics can offer clues about building momentum within the meme coin sector:

Whale Accumulation: Sustained buying by large wallets can signal informed positioning ahead of anticipated rallies.Network Activity Spikes: Surges in daily active addresses and transaction counts often precede retail-driven price breakouts.Holder Growth & Derivatives Interest: A rising number of unique holders, coupled with increasing futures open interest, can indicate broadening conviction and speculative interest.ConclusionThe meme coin segment remains a powerful reflection of market psychology, where cultural resonance and community dynamics can drive valuation independently of technical fundamentals. As we look toward 2026, Dogecoin, Pepe, and Bonk are poised to leverage their established communities and liquidity to capitalize on bullish sentiment. Concurrently, the endless cycle of new low-cap projects will continue to offer high-stakes opportunities for speculative traders. Success in this arena demands not belief in any single narrative, but a disciplined understanding of the volatility, timing, and crowd psychology that define it.

Are you ready to join the memecoin revolution in 2026? Sign up now and begin your crypto journey seamlessly on WEEX, featuring smooth trading with 0 fees.

Further ReadingHow to Trade Dogecoin(DOGE) Futures on WEEX?Dogecoin(DOGE) Price Prediction: What's Next for Dogecoin(DOGE)?What Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: Which meme coin will boom in the future?A: The top memecoins by market capitalization in 2026 include Dogecoin (DOGE), Shiba Inu (SHIB), PEPE, OFFICIAL TRUMP (TRUMP), and Bonk (BONK). These tokens have shown high liquidity, strong community support, and rising utility, making them stand out in the meme token sector.

Q2: What are the best meme coins to buy in 2026?A: Dogecoin, Pepe, and Bonk are widely viewed as top candidates due to strong liquidity, active communities, and positive on-chain momentum.

Q: Are low-cap meme coins safe investments?A: Low-cap meme coins carry significantly higher risks, including illiquidity and project failure. They are suitable only for high-risk strategies.

What is USDCoin OTC and How to Buy USDC OTC With CAD on WEEX Exchange?

For Canadian institutions, treasury managers, and professional traders, acquiring substantial amounts of stablecoins like USDCoin (USDC) efficiently is crucial for treasury operations and crypto market access. Over-the-counter (OTC) crypto trading is the professional channel for these large-scale, stablecoin transactions. This guide explains the specifics of USDCoin OTC trading and provides a clear, step-by-step walkthrough for trading USDC with Canadian Dollars (CAD) on the WEEX Exchange platform.

What is the USDCoin OTC Crypto?USDCoin OTC Crypto refers to the direct, private trading of USDC tokens between parties, conducted away from public exchange order books. This method is not for retail-sized trades but for negotiated, block-sized transactions typically facilitated by a dedicated OTC desk. For Canadian market participants, it is the optimal route for converting large sums of CAD into a stable digital dollar equivalent without causing market impact.

The core advantage is price certainty and execution efficiency. While USDC is designed to maintain a 1:1 peg with the US dollar, executing a multi-million dollar order on a public exchange could still face minor slippage or liquidity fragmentation. OTC trading provides a single, guaranteed price for the entire order, ensuring precise capital deployment. This is why institutions use OTC desks for treasury management, hedging, and as a gateway to the broader DeFi and crypto ecosystem.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, is a specialized service that facilitates private, high-volume digital asset transactions. It acts as a professional intermediary or principal market-maker, connecting large buyers and sellers directly. For stablecoins like USDC, the desk provides deep, immediate liquidity from its reserves to execute trades at the quoted price.

These platforms deliver key institutional benefits. They eliminate slippage risk for block trades, providing a firm quote. They offer direct access to consolidated liquidity pools to fill large orders instantly. Furthermore, they support flexible settlement using various fiat rails, which for Canadian clients may include local Interac e-Transfers or bank wires, enabling seamless cross-border capital movement.

What is WEEX OTC Crypto Trading Exchange?The WEEX OTC Crypto Trading Exchange is the integrated, professional service within the WEEX ecosystem designed for secure and efficient fiat-to-crypto transactions. It simplifies converting local currencies like Canadian Dollars (CAD) into stablecoins such as USDCoin (USDC) through a user-friendly, quote-based interface.

WEEX has officially launched its WEEX OTC Quick Buy feature to streamline this process. Following platform upgrades, WEEX now supports an extensive range of trading pairs, potentially including direct CAD-to-USDC options, allowing Canadian users to access stablecoins quickly. The process is designed for completion in just a few simple steps, whether on web or mobile.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade USDCoin with CAD on WEEX OTC Crypto Exchange?Trading USDCoin with Canadian Dollars on WEEX's OTC desk is a straightforward process designed for clarity and speed. The following outlines the general steps based on typical platform procedures for converting fiat to crypto.

Buy USDCoin OTC with CAD on WEEX (Web)Step 1: Select [CAD] fiat currency and [USDC] crypto, then select the payment method.

Step 2: Input the CAD payment amount, then click [Buy USDC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy USDCoin OTC with CAD on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [CAD] fiat currency and [USDC] crypto.

Step 3: Input the CAD payment amount, then click [Buy USDC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC in crypto?OTC stands for Over-the-Counter. It describes a method of trading cryptocurrencies directly between two parties, negotiated privately rather than through a public exchange's order book. This is the standard practice for large transactions that require price stability, privacy, and minimal market disruption.

Why use OTC to trade a stablecoin like USDC?Even stablecoins can experience minor price deviations or liquidity gaps on public exchanges for very large orders. OTC trading guarantees execution at a single, agreed-upon price for the entire order size. This is critical for precise treasury management, institutional arbitrage, and efficiently moving large capital sums into the crypto market as a stable base currency.

Is OTC crypto trading legal in Canada?Yes, trading cryptocurrencies, including via OTC desks, is legal in Canada. The industry operates within a regulatory framework where platforms may need to register as Money Services Businesses (MSBs) with FINTRAC and comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. It is important for users to verify the compliance status of any platform they use.

What are the main benefits of using an OTC desk?The primary benefits are executing large orders without causing price slippage, achieving guaranteed price certainty, and maintaining transaction privacy. OTC desks provide these advantages by matching large buy and sell orders off the public books and offering negotiated, fixed prices, which is invaluable for professional and institutional trading strategies.

Does WEEX charge fees for OTC Trading?WEEX states that it offers competitive fees across its services. For specific OTC transactions, fees can depend on factors such as the trading pair, selected payment method, and the size of the order. Reputable platforms provide transparent cost breakdowns before the user confirms the transaction.

Is KYC required for trading on WEEX?Yes, identity verification (KYC) is a standard requirement for using licensed cryptocurrency exchanges, including for OTC services. This process is mandated by international anti-money laundering regulations and is essential for platform security, fraud prevention, and regulatory compliance. The requirements and process may vary based on the user's region and the fiat currency involved.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is Dogecoin OTC and How to Buy DOGE OTC With CAD on WEEX Exchange?

For Canadian traders, investors, or content creators looking to move large amounts of the popular meme cryptocurrency Dogecoin (DOGE), executing trades on public exchanges can be costly and inefficient. Over-the-counter (OTC) trading provides a private and strategic alternative, designed specifically for substantial transactions. This guide explains what Dogecoin OTC trading is and how you can securely trade DOGE with Canadian Dollars (CAD) on the WEEX Exchange platform.

What is the Dogecoin OTC Crypto?Dogecoin OTC Crypto refers to the direct, private buying and selling of DOGE tokens between two parties, negotiated outside the public order books of a centralized exchange. This method is not a standard retail spot trade but a facilitated transaction, often handled by a dedicated OTC desk. It is particularly useful for Canadian users, including influencers, businesses, or high-net-worth individuals, who need to acquire or liquidate significant amounts of DOGE without moving the public market price.

The core advantage is price certainty and minimized slippage. A large DOGE order on a public exchange could dramatically impact its price before the order is fully filled, resulting in a worse average price. OTC trading locks in a single, negotiated price for the entire block, protecting your capital from this volatility. This is crucial for a cryptocurrency like Dogecoin, whose value can be influenced by social sentiment and major announcements.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, is a specialized service that facilitates private, large-scale digital asset transactions. It acts as a professional intermediary, connecting significant buyers and sellers directly. You can think of it as the institutional "wholesale" layer of the crypto market, built for discretion and handling substantial volume.

These platforms offer strategic benefits tailored for large trades. First, they can eliminate the risk of price by providing a firm quote for the entire order. Second, they offer access to deep liquidity pools to fill large orders promptly. Finally, they support flexible settlement using various payment rails, which for Canadian clients often includes secure Interac e-Transfers or bank wires.

What is WEEX OTC Crypto Trading Exchange?The WEEX OTC Crypto Trading Exchange is the integrated, professional service within the WEEX ecosystem designed for efficient over-the-counter transactions. It simplifies converting local currencies like Canadian Dollars (CAD) into cryptocurrencies such as Dogecoin through a user-friendly interface.

WEEX has officially launched its WEEX OTC Quick Buy feature to make this service accessible. The platform supports a wide range of trading pairs, and following recent upgrades, it likely offers direct pathways for Canadian users to purchase DOGE with CAD. The process is engineered for completion in just a few simple steps, directly from your web browser or mobile device.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Dogecoin with CAD on WEEX OTC Crypto Exchange?Buy Dogecoin OTC with CAD on WEEX (Web)Step 1: Select [CAD] fiat currency and [USDC] crypto, then select the payment method.

Step 2: Input the CAD payment amount, then click [Buy USDC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Dogecoin OTC with CAD on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [CAD] fiat currency and [USDC] crypto.

Step 3: Input the CAD payment amount, then click [Buy USDC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC in crypto?OTC stands for Over-the-Counter. It describes a method of trading cryptocurrencies directly between two parties, negotiated privately rather than through a public exchange's order book. This is common for large transactions to ensure price stability and privacy.

Is OTC trading legal in Canada?Yes, cryptocurrency trading, including via OTC desks, is legal in Canada. The industry operates within a regulatory framework where platforms must comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Reputable exchanges like WEEX adhere to these standards to ensure lawful and transparent operations for users.

Why trade DOGE OTC instead of on a public exchange?Trading DOGE OTC is ideal for larger volumes because it eliminates the price slippage that can occur on public exchanges. It also offers more privacy and can provide more flexible settlement terms. This makes it the preferred method for transactions that are substantial enough to impact DOGE's often-volatile market price.

What are the risks of OTC trading?The primary risks involve counterparty risk (the chance the other party defaults) and the potential for fraud if using an unverified service provider. These risks highlight the importance of only using OTC desks operated by established, reputable, and compliant exchanges with strong security measures and transparent operations.

Does WEEX charge fees for OTC Trading?WEEX offers competitive and transparent pricing for its OTC service. Fees may vary depending on the specific trading pair, payment method, and order size. The platform provides full cost disclosure before you confirm any transaction, and promotional offers with favorable terms may be available periodically.

Is KYC required for OTC Trading with CAD on WEEX?To comply with Canadian and international financial regulations, identity verification (KYC) is typically a standard requirement for trading cryptocurrencies with fiat currencies like CAD on licensed platforms. This process helps ensure platform security and regulatory compliance for all users.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is USDCoin OTC and How to Buy USDC OTC With AED on WEEX Exchange?

For large-scale investors, moving significant capital into the crypto market demands a solution that prioritizes stability, efficiency, and minimal market impact. Trading USD Coin (USDC) over-the-counter (OTC) provides exactly that. This guide explains what USDC OTC trading is, why a specialized OTC desk is essential, and how the WEEX exchange streamlines the process of converting AED into this premier stablecoin with security and speed.

What is the USD Coin OTC Crypto?USD Coin OTC Crypto refers to the private, over-the-counter trading of the USDC stablecoin. Unlike public exchange trading where orders are matched on an open ledger, OTC transactions are negotiated directly between parties, often facilitated by a dedicated desk. This method is crucial for institutional investors, businesses, or high-net-worth individuals executing substantial transactions.

The core advantage is price certainty and reduced market impact. A large USDC purchase on a public exchange can cause slippage, resulting in a worse average price. OTC trading provides a fixed quote for the agreed amount, protecting your capital from volatility. Furthermore, it offers flexible settlement, accommodating various payment methods like bank transfers to suit the specific needs for efficiency and discretion.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, is a specialized platform designed for executing large, private digital asset transactions. It acts as a direct conduit between buyers and sellers, operating outside public order books. Think of it as a professional wholesale marketplace for cryptocurrencies, built for significant volume without moving public markets.

These platforms offer distinct strategic benefits. First, they serve as a high-speed fiat gateway, enabling rapid conversion between traditional bank accounts and crypto assets. Second, they guarantee zero slippage; the price you see is the price you get, which is vital for precise capital deployment. Finally, robust OTC desks provide multi-currency infrastructure, seamlessly connecting global banking systems with the crypto economy through local payment rails.

What is WEEX OTC Crypto Trading Exchange?The WEEX OTC Crypto Trading Exchange is an integrated, user-focused platform within the global WEEX ecosystem. It is designed for secure and efficient over-the-counter transactions, simplifying the conversion between fiat currencies like AED and cryptocurrencies such as USDC. WEEX has officially launched our WEEX OTC Quick Buy feature to make this process more convenient and accessible than ever.

The platform supports a wide array of trading pairs and integrates numerous mainstream global and local payment methods. This means you can purchase stablecoins anytime, anywhere, through a process engineered for completion in just a few quick steps. It caters to both newcomers seeking simplicity and seasoned traders requiring reliable, large-scale execution.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade USD Coin with AED on WEEX OTC Crypto Exchange?Buy USD Coin OTC with AED on WEEX (Web)Step 1: Select [AED] fiat currency and [USDC] crypto, then select the payment method.

Step 2: Input the AED payment amount, then click [Buy USDC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy USD Coin OTC with AED on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [AED] fiat currency and [USDC] crypto.

Step 3: Input the AED payment amount, then click [Buy USDC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC in crypto?OTC stands for Over-the-Counter. It describes the process of trading cryptocurrencies directly between two parties, negotiated privately rather than through a public exchange's order book. This method is typically used for large transactions to obtain better price stability and privacy.

Why trade USDC OTC instead of on the spot market?Trading USDC OTC is ideal for large volumes because it eliminates price slippage and avoids impacting the public market price. It also offers more flexible settlement terms and payment methods compared to standard spot trading, which is better suited for smaller, retail-sized orders.

Is OTC crypto trading legal?Yes, OTC crypto trading is legal in most jurisdictions when conducted through compliant platforms. Reputable exchanges like WEEX adhere to applicable financial regulations and implement robust security and operational standards to ensure lawful and transparent operations.

What is an OTC crypto desk?An OTC crypto desk is a specialized service, often part of a larger exchange, that facilitates private, large-volume cryptocurrency trades. It acts as a facilitator or counterparty, providing liquidity and firm price quotes for transactions that are executed off the public order books.

Does WEEX Exchange charge fees for OTC Trading?WEEX Exchange applies different fees depending on the specific trading pair and the payment method selected. The platform is designed to automatically recommend the most optimal payment channel available to the user. Users can also watch for promotional periods where favorable terms, such as zero fees, may be offered.

Is KYC required for Crypto OTC Trading on WEEX?For deposits and trades using most fiat currencies (non-CNY), KYC verification is generally not required on WEEX, allowing for quicker access. As a globally licensed platform, WEEX maintains strong security protocols to protect all users and their transactions regardless of verification level.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is Ethereum OTC and How to Buy ETH OTC With GBP on WEEX Exchange?

For UK-based investors, funds, and businesses building significant positions in the Ethereum ecosystem, executing large trades on public exchanges is often inefficient and costly. Over-the-counter (OTC) crypto trading provides a professional, private solution for substantial transactions. This guide explains Ethereum OTC trading within the UK's regulatory context and how to securely trade ETH with British Pounds (GBP) on the WEEX Exchange platform.

What is the Ethereum OTC Crypto?Ethereum OTC Crypto refers to the direct, private buying and selling of ETH tokens between two parties, negotiated outside the public order books of a centralized exchange. In the UK, this method is used by institutions, venture capital firms, and sophisticated traders making strategic allocations to Ethereum and its vast Web3 ecosystem. The transaction is facilitated by a dedicated OTC desk, offering a bespoke service.

The primary advantage is price certainty for block trades. A large ETH order on a public exchange could significantly move the market, leading to costly slippage. OTC trading locks in a single, negotiated price for the entire order, protecting capital. This execution stability is crucial for strategic investments in DeFi protocols, NFT projects, or infrastructure built on Ethereum. It also offers greater privacy and flexible settlement terms, aligning with professional requirements.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, is a specialized service that facilitates private, high-volume digital asset transactions. It acts as a professional intermediary or principal market-maker. In the UK, firms offering cryptoasset services, including OTC desks, must be registered with the Financial Conduct Authority (FCA) for Anti-Money Laundering (AML) purposes or operate under an exemption.

These platforms provide key institutional benefits. They eliminate slippage risk by offering firm quotes for the entire order. They provide deep, on-demand liquidity to fill large orders immediately. Furthermore, they support flexible settlement using local payment rails like Faster Payments or SEPA transfers, enabling efficient capital movement for UK and European clients investing in the Ethereum network.

What is WEEX OTC Crypto Trading Exchange?The WEEX OTC Crypto Trading Exchange is the integrated, professional service within the WEEX ecosystem designed for secure fiat-to-crypto transactions. It simplifies converting local currencies like British Pounds (GBP) into Ethereum through a user-friendly, quote-based interface.

WEEX has officially launched its WEEX OTC Quick Buy feature to enhance accessibility. The platform supports a wide range of trading pairs, providing UK users a potential direct pathway to purchase ETH with GBP. The process is engineered for simplicity, allowing trades to be completed in just a few steps from either web or mobile, connecting UK capital to the global Ethereum market.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Ethereum with GBP on WEEX OTC Crypto Exchange?Buy Ethereum OTC with GBP on WEEX (Web)Step 1: Select [GBP] fiat currency and [ETH] crypto, then select the payment method.

Step 2: Input the GBP payment amount, then click [Buy ETH] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Ethereum OTC with GBP on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [GBP] fiat currency and [ETH] crypto.

Step 3: Input the GBP payment amount, then click [Buy ETH] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC in crypto?OTC stands for Over-the-Counter. It describes a method of trading cryptocurrencies directly between two parties, negotiated privately rather than through a public exchange's order book. This is the standard channel for large transactions that require price stability, privacy, and minimal market disruption.

Is OTC crypto trading legal in the UK?Yes, cryptocurrency trading is legal in the UK. The industry operates within a well-defined regulatory framework overseen by the Financial Conduct Authority (FCA). Firms offering cryptoasset services must be registered with the FCA for AML purposes. It is essential for UK users to verify the regulatory status of any platform they use.

Why would a UK investor trade ETH OTC?A UK investor would use OTC to trade ETH to execute a large order without causing price slippage on public markets, to secure a guaranteed price for a strategic investment in the Ethereum ecosystem, or to maintain transaction privacy. It is the professional method for significant capital deployment into Web3 projects, DeFi, or NFT ventures.

What are the main risks of OTC trading?The primary risks involve counterparty risk (the possibility the other party defaults) and the risk of fraud if using an unverified or disreputable service provider. These risks are mitigated by using OTC desks operated by established, transparent, and compliant platforms with robust security measures and a strong regulatory standing.

Does WEEX charge fees for OTC Trading?WEEX offers competitive and transparent pricing for its services. For OTC transactions, fees may vary based on the specific trading pair, payment method, and order size. The platform provides clear cost disclosure before you confirm any transaction, ensuring full visibility of all charges.

Is KYC required for OTC Trading with GBP on WEEX?To comply with UK and international financial regulations, including strict Anti-Money Laundering (AML) laws enforced by the FCA, identity verification (KYC) is a standard and mandatory requirement for trading cryptocurrencies with fiat currencies like GBP on licensed platforms. This process is essential for platform security and regulatory compliance.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

What is USDCoin OTC and How to Buy USDC OTC With GBP on WEEX Exchange?

For UK-based institutions, treasury managers, and professional traders, acquiring substantial amounts of stablecoins like USDCoin (USDC) efficiently is a cornerstone of modern crypto strategy. Over-the-counter (OTC) crypto trading provides the private, high-volume channel necessary for these critical transactions. This guide explains USDCoin OTC trading within the UK's regulatory framework and how to trade USDC with British Pounds (GBP) on the WEEX Exchange platform.

What is the USDCoin OTC Crypto?USDCoin OTC Crypto refers to the direct, private buying and selling of USDC tokens between parties, negotiated outside public exchange order books. This method is essential for UK funds, fintech companies, and businesses needing to convert large sums of GBP into a digital dollar equivalent for treasury operations, DeFi participation, or as a stable base currency. The transaction is facilitated by a dedicated OTC desk, offering bespoke service.

The primary advantage is execution efficiency and price certainty. While USDC maintains a 1:1 peg to the US dollar, executing a multi-million pound order on a public exchange could still encounter minor slippage or fragmented liquidity across order books. OTC trading provides a single, guaranteed price for the entire block, ensuring precise capital allocation. This is vital for efficient treasury management and aligns with the Financial Conduct Authority's (FCA) principles of market integrity and consumer protection.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, is a specialized service that facilitates private, high-volume digital asset transactions. It acts as a professional intermediary or principal market-maker. In the UK, firms providing cryptoasset services, including OTC trading, must be registered with the FCA for Anti-Money Laundering (AML) purposes or operate under a specific exemption, ensuring a regulated environment for professional participants.

These platforms deliver key institutional benefits. They eliminate slippage risk by providing firm quotes for block trades. They offer direct access to deep liquidity pools to fill large orders instantly. Furthermore, they support flexible settlement using local payment rails like Faster Payments, enabling UK clients to move capital efficiently between traditional banking and the stablecoin ecosystem.

What is WEEX OTC Crypto Trading Exchange?The WEEX OTC Crypto Trading Exchange is the integrated, professional service within the WEEX ecosystem designed for secure fiat-to-crypto transactions. It streamlines converting local currencies like British Pounds (GBP) into stablecoins such as USDCoin through a user-friendly, quote-based interface.

WEEX has officially launched its WEEX OTC Quick Buy feature to enhance accessibility. The platform supports an extensive selection of trading pairs, providing UK users a potential direct pathway to purchase USDC with GBP. The process is engineered for simplicity, allowing trades to be completed in just a few steps from either web or mobile, connecting UK capital to the global digital dollar market.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade USDCoin with GBP on WEEX OTC Crypto Exchange?Buy USDCoin OTC with GBP on WEEX (Web)Step 1: Select [GBP] fiat currency and [USDC] crypto, then select the payment method.

Step 2: Input the GBP payment amount, then click [Buy USDC] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy USDCoin OTC with GBP on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [GBP] fiat currency and [USDC] crypto.

Step 3: Input the GBP payment amount, then click [Buy USDC] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.