WEEX Position Airdrop is Live Now!

For many newcomers to futures (or anyone without a mature trading routine), the real hurdle isn’t “reading the market” — it’s placing that very first order. Traditional “contract trial bonus” campaigns still require users to pick a pair, direction, and leverage themselves, creating both psychological and operational friction.

WEEX’s Position Airdrop is built to solve exactly that: it merges “reward credited” with “live position opened.” As soon as you claim it, you receive a pre-opened contract position. This lowers the learning barrier and lets users focus on what actually matters: managing the position, controlling risk, and planning exits.

This article will quickly walk you through what a Position Airdrop is, its advantages, and how to use it.

What is Position Airdrop ?

Position Airdrop is like the platform handing you a “ready‑to‑go live futures ticket.” You choose long or short, tap confirm, and a real futures position is instantly opened at market price. In other words: the moment you receive the airdrop, you’re already on the field, experiencing an actual contract trade.

After claiming, you can manage it just like any normal position:

- Set / adjust take-profit and stop-loss

- Close (partial or full)

- Add or remove margin (including adding your own funds)

- After closing, use any remaining trial funds to open new positions (within the validity period)

In one line: Position Airdrop turns “reward credited → user places an order” into “reward credited = position already live,” letting users skip the hesitation phase and practice the core skills immediately.

Difference between a Position Airdrop and a trial futures bonus?

Core difference: Position Airdrop streamlines the very first opening trade, letting users enter the core loop of managing and reviewing positions with minimal psychological burden.

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

Dimension | Position Airdrop | Trial Funds (Futures bonus) |

Distribution method | System automatically places an order to open a position.The user only needs to pick a direction. | Funds are distributed to the user's futures account |

How to Use | No manual setup: once claimed, you go straight to managing the position. | After claiming, the user must still choose pair, direction, leverage, etc., and then open a position. |

Entry threshold | Low, no need to understand leverage or order flow | Relatively high, the user needs to understand the order process and parameter settings |

User Experience | Faster entry into live position management and P&L feedback. | Fully goes through choosing every order parameter. |

Feature Highlights of Position Airdrop

1. Position instantly live upon claim—straight to core actions

Once claimed, the system auto-creates your first real futures position. Pair, leverage, position size, and margin mode are preconfigured; you only choose long or short and can immediately focus on stop placement, risk monitoring, and locking in profits—skipping the typical beginner friction of selecting instruments, leverage, and modes.

2. The remaining trial margin is reusable for iterative practice

Any unconsumed trial funds after closing can be redeployed, letting one allocation power multiple strategy drills: first timely stop-loss discipline, then staged take-profits, then trailing stops and margin adjustments—forming a progressive skill ladder instead of a one‑and‑done burn.

3. Real matching and real fee feedback accelerate leverage intuition

Once the position goes live, users feel real fills, P&L, fees, and funding—seeing how small capital scales into bigger exposure and that gains and risks grow in tandem

User Experience Flow

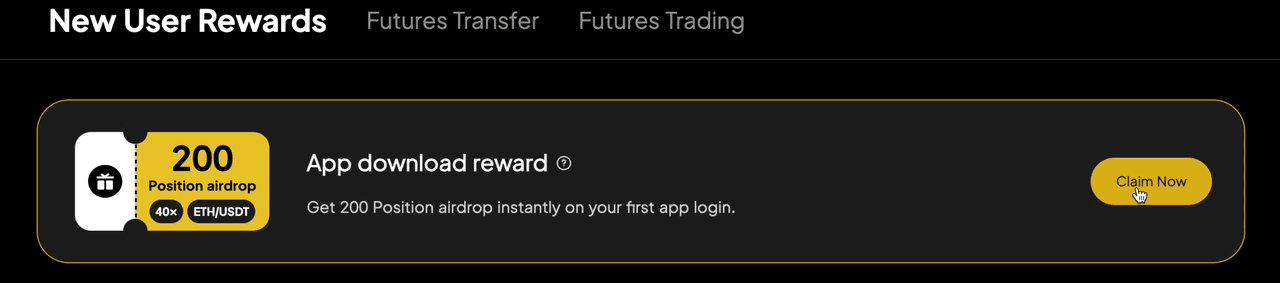

- In any campaign that offers a Position Airdrop , complete the required tasks and then claim the reward directly on the campaign page.

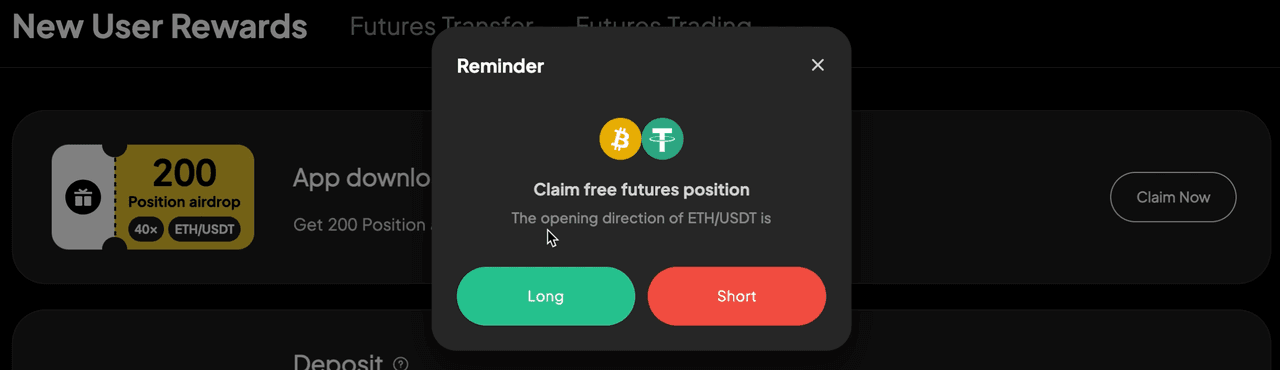

- Tap Claim and a Buy/Sell dialog appears. Simply choose Long or Short—your first position is created instantly.

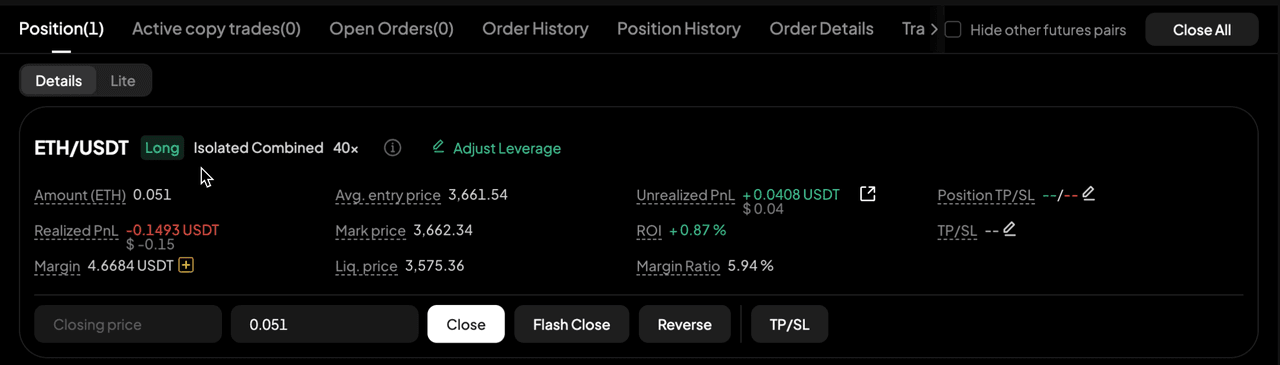

- Once created at market price, you can manage the position: set or edit take‑profit / stop‑loss, partially or fully close it, and add or remove margin from the Positions (Orders) screen.

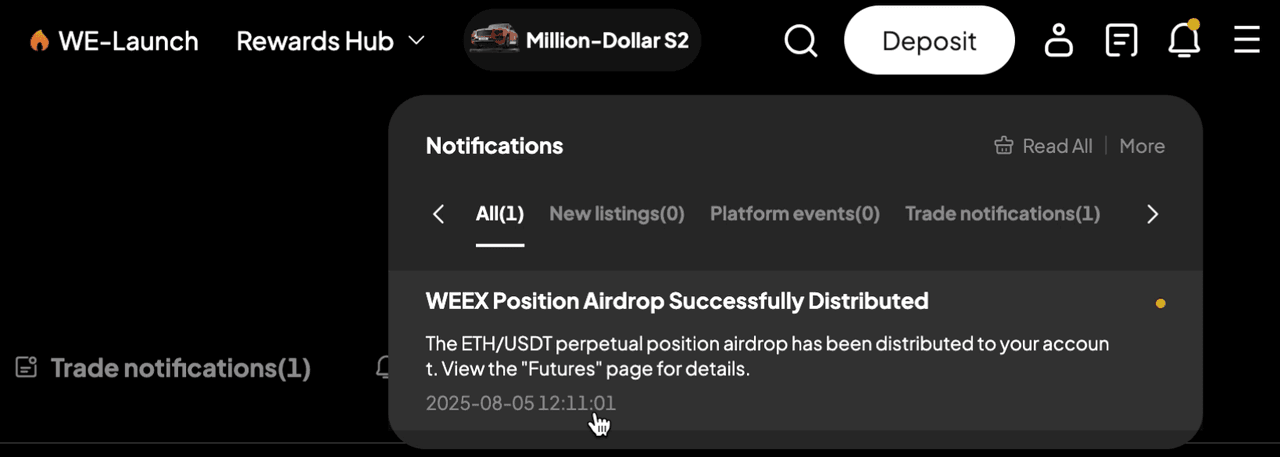

- After a successful claim, an in‑app message confirms the position is live. You can review and manage it from the Futures page.

FAQ

1. Position Airdrop Reclaim Rules

Futures bonus follows the same expiration mechanics as other trial funds

- The unused amount will be reclaimed upon expiration

- Futures bonus will also be reclaimed if the user transfers it out of the futures account

2. What if a user already holds the same position?

The system will add margin to the existing position.

If direction, pair, leverage, and margin mode all match, the system treats this as an add-margin operation and updates average open price and unrealized PnL accordingly.

3. Will the position created by a Position Airdrop be automatically closed if the user doesn’t close it after the 7-day validity period?

No, it will not be automatically closed. Similar to trial funds, the position will remain open even after the bonus expires. Users must manually close the position themselves.

You may also like

What Is zkPass (ZKP)? The Complete Guide to the Privacy-Powered Data Verification Protocol

If you're searching for "what is zkPass (ZKP)" or tracking the "zkPass token price", you've come to the right place. In today's digital landscape where data privacy is paramount yet often compromised, zkPass emerges as a groundbreaking solution that bridges Web2 and Web3 without sacrificing user sovereignty. This comprehensive guide will explain exactly what zkPass is, how it works, and why the zkPass token is becoming increasingly important in the evolving data economy.

What is zkPass (ZKP)?zkPass (ZKP) is a decentralized, privacy-focused protocol designed for private data verification between traditional internet services and blockchain applications. It serves as critical infrastructure that enables users to selectively prove information from Web2 sources—such as bank accounts, social media profiles, or government databases—to Web3 smart contracts without ever revealing the actual data itself.

Think of it this way: with zkPass, you can prove to a DeFi lending platform that you have a credit score above 700 without disclosing your exact score, personal identity, or financial history. This represents a fundamental shift from today's model where users must either trust centralized intermediaries with their sensitive information or remain isolated from blockchain-based services.

The protocol achieves this through an innovative combination of established cryptographic techniques and novel implementation approaches, making it one of the most promising solutions in the growing privacy-tech sector.

How Does zkPass Work?The Core Technology: MPC + ZKPzkPass operates on two pillars of modern cryptography:

Multi-Party Computation (MPC): Allows multiple parties to jointly compute a function while keeping their inputs privateZero-Knowledge Proofs (ZKP): Enables one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itselfThese technologies work together to ensure that data verification occurs without data disclosure—a critical distinction that sets zkPass apart from conventional verification methods.

The TransGate Innovation: Three-Party TLS (3P-TLS)One of zkPass's most significant breakthroughs is its TransGate technology, which enables users to generate proofs from any HTTPS website using a modified Three-Party TLS handshake.

Here's how it works in practice:

Standard TLS: Normally, when you access a secure website (like your bank), there's a 2-party handshake between you (Client) and the serverzkPass's 3P-TLS: Introduces a third party—the Verifier (zkPass Node)—into the handshake processThe Verifier witnesses the data transfer to ensure authenticityThe Verifier never sees the unencrypted dataOnly cryptographic proof of the transaction is generatedThis means zkPass can work with any existing HTTPS website without requiring special APIs or cooperation from Web2 companies—a massive advantage over traditional oracle solutions.

The Verification Process: From Data to ProofThe complete workflow looks like this:

User Access: A user accesses their Web2 data source through the TransGate interface3P-TLS Verification: The modified handshake verifies the data's authenticity without exposing its contentProof Generation: Selected data points are converted into zero-knowledge proofs locally on the user's deviceOn-Chain Verification: These proofs are submitted to smart contracts for verificationAccess Granted: Based on the proof's validity, the user gains access to Web3 servicesThroughout this entire process, the actual sensitive data never leaves the user's control in readable form.

Real-World Applications: Where zkPass Creates ValueFinancial Services & DeFiUnder-Collateralized Lending: Prove creditworthiness without revealing financial detailsCompliance Verification: Meet regulatory requirements without exposing personal identityWealth Verification: Access premium services by proving asset thresholdsIdentity & Access ManagementAge Verification: Prove you're over 18 without sharing your birthdateCitizenship Proof: Verify nationality for services without passport disclosureKYC Compliance: Meet know-your-customer requirements privatelyGaming & Social EcosystemsAchievement Verification: Prove gaming accomplishments without exposing account detailsSocial Proof: Verify social media influence for DAO access or rewardsAsset Ownership: Confirm ownership of digital assets across platformsEnterprise & Institutional UseEmployment Verification: Prove employment status or income without HR disclosureEducation Credentials: Verify degrees or certifications privatelyProfessional Licensing: Confirm professional qualifications without exposing detailszkPass (ZKP): Network Fuel and GovernanceToken OverviewThe zkPass token (ZKP) serves as the native utility and governance token of the zkPass ecosystem. Built as an ERC-20 token with a maximum supply of 1 billion tokens, ZKP incorporates LayerZero technology for seamless cross-chain interoperability.

zkPass (ZKP) Use CasesPayment Mechanism: Users and applications pay ZKP tokens to generate proofs and verify dataSecurity Staking: Validators must stake ZKP tokens as collateral to ensure honest participationAccess Credential: Developers and enterprises need ZKP to access premium features and toolsGovernance Rights: Token holders participate in protocol upgrades and parameter adjustmentsWhy zkPass Matters Now More Than EverSolving Critical Web2-Web3 Integration ChallengesData Sovereignty: Users maintain complete control over their personal informationPrivacy Preservation: Verification occurs without unnecessary data exposureUniversal Compatibility: Works with any HTTPS website without API requirementsFraud Prevention: Direct source verification eliminates data manipulation risksAddressing Growing Market NeedsRegulatory Evolution: Increasing privacy regulations demand better data handlingUser Awareness: Growing concern about data privacy and securityIndustry Demand: DeFi, gaming, and social platforms need reliable verification methodsTechnological Maturity: Advancements in ZKP technology enable practical implementationFinal Thoughts: The Future of Private Data VerificationzkPass (ZKP) offers a groundbreaking solution to one of Web3’s biggest challenges: leveraging Web2 data without compromising privacy. By integrating proven cryptography with innovative implementation, zkPass effectively bridges the two ecosystems.

For users, developers, or investors tracking the zkPass token price, this protocol delivers practical answers to growing demands for private, secure data verification.

As privacy concerns and blockchain adoption rise, zkPass is positioned to become a key enabler across industries—allowing verification without exposure while working seamlessly within existing internet infrastructure.

Ready to trade zkPass (ZKP) and other cryptocurrencies?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

Further ReadingWhat Is Brevis (BREV) and How Does It Work?Why POPCAT Crashes? A Complete ExplanationWhat Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: What makes zkPass different from other privacy solutions?A: Unlike solutions that require specific API integrations or only work with pre-approved data sources, zkPass works with any HTTPS website through its innovative TransGate technology, making it universally applicable.

Q2: Is zkPass secure?A: Yes. The protocol uses established cryptographic techniques (MPC and ZKP) and has been through extensive security audits. The 3P-TLS implementation ensures data authenticity without exposing sensitive information.

Q3: How can I start using zkPass?A: Users can access zkPass through supported applications and platforms. Developers can integrate the protocol using available SDKs and documentation to add private verification capabilities to their applications.

Q4: Where can I track the zkPass token price?A: The zkPass token price can be monitored on major cryptocurrency exchanges, including WEEX, as well as through market data platforms and portfolio tracking applications.

Q5: What's the future roadmap for zkPass?A: The protocol continues to expand its compatibility with additional data sources and blockchain networks while improving proof generation efficiency and user experience.

What is AAPL stock? AAPL/USDT Perpetual Futures Explained

If you're asking "what is AAPL stock" - you're not alone. As one of the most searched and traded securities globally, Apple Inc.'s stock represents far more than just a ticker symbol. AAPL stock (NASDAQ: AAPL) has become a cornerstone of modern portfolios, blending technological innovation with financial stability in a way few companies have achieved. Whether you're a beginner investor or an experienced trader, understanding AAPL stock is essential in today's market landscape.

Understanding the Basics: What is AAPL stock?AAPL stock refers to the publicly traded common shares of Apple Inc., the Cupertino-based technology giant that revolutionized personal computing, mobile communication, and digital services. With a market capitalization consistently hovering around $4 trillion, Apple isn't just a company - it's an economic force that influences global markets.

When people search for "what is AAPL stock", they're typically seeking to understand:

How Apple's business model translates to shareholder valueWhy institutional investors consider AAPL a "must-own" positionThe trading mechanics behind this highly liquid securityHow to access Apple's growth through various investment vehiclesWhat Makes Apple's Business Model So Powerful?Apple's success story is built on three pillars that directly impact AAPL stock performance:

Hardware DominanceThe iPhone, representing over 50% of Apple's revenue, continues to drive the company's financial engine. Each product cycle generates massive revenue spikes that analysts closely monitor when evaluating AAPL stock prospects.

Services TransformationApple's Services segment - including App Store, Apple Music, iCloud, and Apple Pay - has become the company's growth engine, boasting higher margins and recurring revenue streams that provide stability to AAPL stock valuation.

Financial EngineeringApple's aggressive share buyback program, returning over $650 billion to shareholders since 2012, has been a significant driver of AAPL stock appreciation by increasing earnings per share and demonstrating management's confidence.

AAPL Stock: From Traditional Markets to Crypto DerivativesTraditional Market AccessAAPL stock trades on NASDAQ during regular U.S. market hours (9:30 AM to 4:00 PM EST) with exceptional liquidity - typically tens of millions of shares changing hands daily. This makes AAPL stock accessible through virtually any brokerage account, with options for fractional shares allowing investors to participate regardless of budget size.

The Crypto Connection: AAPL/USDT Perpetual FuturesFor traders seeking innovative ways to engage with Apple's market performance, AAPL/USDT perpetual futures offer a groundbreaking opportunity. These derivative contracts allow you to speculate on Apple's price movements using cryptocurrency pairs, providing:

24/7 Trading Accessibility: Unlike traditional markets, AAPL/USDT perpetual futures trade around the clock, allowing you to react to global news and earnings reports instantlyLeverage Flexibility: Many platforms offer adjustable leverage options, enabling sophisticated position sizing strategiesCross-Asset Integration: Trade Apple exposure while maintaining a crypto-native portfolio structureGlobal Accessibility: Available to traders worldwide without traditional brokerage restrictionsWhy Institutional Investors Love AAPL Stock?The Swiss National Bank's approach to Apple mirrors broader institutional sentiment. As with their strategic MSTR stock positions for Bitcoin exposure, institutions view AAPL stock as:

A reliable store of value in volatile marketsA liquidity anchor for large portfoliosA growth-and-income hybrid (through dividends and appreciation)A benchmark-relative performer that rarely disappointsKey Metrics Every AAPL Stock Investor Should MonitorWhen evaluating AAPL stock, focus on these critical indicators:

Financial Health MetricsPrice-to-Earnings Ratio: Currently in the low-to-mid 30s range, reflecting growth expectationsFree Cash Flow: Consistently above $100 billion annually, funding buybacks and dividendsGross Margins: Services segment margins approaching 70%, enhancing overall profitabilityMarket Structure FactorsInstitutional Ownership: Over 60% held by institutions, providing price stabilityTrading Volume: Exceptional liquidity ensures efficient price discoveryOptions Activity: Heavy trading in AAPL options indicates sophisticated investor interestHow to Trade AAPL Stock?For traders seeking sophisticated exposure, WEEX Exchange offers comprehensive AAPL/USDT perpetual futures trading with:

Low trading fees: Lower costs than many traditional brokersHigh Security: Institutional-grade protection for your assetsIntuitive Interface: Designed for both beginners and professional tradersCross-Platform Support: Seamless experience across web and mobileRisk Considerations on AAPL StockWhile AAPL stock represents a blue-chip investment, consider:

Valuation Sensitivity: High expectations are priced into current levelsRegulatory Scrutiny: Ongoing antitrust investigations in multiple jurisdictionsMarket Concentration: Heavy reliance on iPhone sales remains a focal pointGlobal Economic Factors: Consumer spending patterns impact device refresh cyclesConclusion: Why AAPL Stock Belongs in Modern PortfoliosUnderstanding "what is AAPL stock" means recognizing how Apple combines innovation, financial strength, and market leadership into one investable asset. Whether through traditional shares or modern instruments like AAPL/USDT perpetual futures, Apple offers a direct path to the digital economy.

For traders seeking advanced exposure, WEEX Exchange provides a secure and accessible platform for trading AAPL-linked derivatives. With competitive fees, strong security, and 24/7 trading, WEEX supports both new and experienced traders in capturing Apple’s growth with flexibility.

Ready to trade AAPL/USDT perpetual futures? Sign up and start now on WEEX!

FAQQ1: What are Perpetual Futures?A: Perpetual futures are derivative contracts that allow traders to speculate on the price of assets such as Bitcoin, Ethereum, or other cryptocurrencies.

Q2: Where can i trade AAPl/USDT perpetual futures?A: You can trade AAPL/USDT perpetual futures on WEEX Exchange with low trading fees.

Q3: How long can you hold a perpetual futures contract?

A: Perpetual futures allow traders to speculate on an asset's price indefinitely, with no expiration date—unlike traditional futures contracts.

How to Invest in Crypto 2026? Everything You Need to Know

The cryptocurrency market offers far more than just Bitcoin and Ethereum. Today's investors have thousands of digital assets to choose from for portfolio diversification. Making sound investment decisions starts with a clear understanding of the main cryptocurrency categories, their distinct roles, and associated risk profiles.

Mainstream Coins: The Foundational “Core Assets”Mainstream coins are the established giants of the crypto market, typically ranking within the top 20 by market capitalization. They are characterized by massive user bases, deep liquidity, high trading volumes, and a proven track record of surviving multiple market cycles. Their broad community consensus, real-world utility, and resilience make them the essential cornerstone for any crypto portfolio.

Examples:

Bitcoin (BTC) is the original and preeminent decentralized digital currency.Ethereum (ETH) is the leading smart contract platform, foundational to DeFi, NFTs, and dApps.Solana (SOL) is a high-performance blockchain known for speed and a rapidly growing ecosystem.For beginners, allocating a significant portion of a portfolio to these blue-chip cryptocurrencies is a prudent strategy. They provide exposure to the crypto market's growth with relatively lower volatility and higher stability compared to newer, unproven projects.

Stablecoins: The Essential “Safety Pad”Stablecoins are cryptocurrencies pegged to the value of a stable asset, most commonly the US Dollar. They are designed to maintain a stable price, making them a crucial tool for preserving value, facilitating trades, and acting as a safe haven during market volatility. They serve as the primary bridge between traditional finance and the crypto economy.

Examples:

USDT (Tether) and USDC (USD Coin) are the most widely adopted fiat-backed stablecoins.In any investment strategy, stablecoins function as a parking spot for capital, a medium for transfers, and a key component for risk management, allowing investors to exit volatile positions without leaving the blockchain ecosystem.

High-Risk Altcoins: The “Potential High-Return” SegmentHigh-risk altcoins encompass all cryptocurrencies beyond Bitcoin and Ethereum. This category includes projects with smaller market capitalizations that often focus on niche innovations like privacy, oracle networks, or scalable smart contracts. While they can introduce groundbreaking technology, many lack widespread adoption and are subject to extreme price volatility and lower liquidity.

Examples:

Chainlink (LINK) is a decentralized oracle network.Cardano (ADA) is a research-focused smart contract platform.These assets can offer significant growth potential but come with substantially higher risk. Investing in them requires thorough fundamental analysis of the project's technology, team, and use case, and should only be done with capital one is prepared to lose.

Meme Coins: The Speculative “Emotional Assets”Meme coins are cryptocurrencies born from internet culture and social media trends, not technological fundamentals. Their value is almost entirely driven by community sentiment, viral hype, and speculative trading, leading to wild, unpredictable price swings. They represent the highest-risk, highest-volatility corner of the crypto market.

Examples:

Dogecoin (DOGE) is the original meme coin.Shiba Inu (SHIB) is a popular Ethereum-based successor.Investing in meme coins is akin to speculative gambling. Beginners should avoid them entirely or allocate only a tiny fraction of "entertainment money" they are fully prepared to lose, understanding that gains and losses can be equally dramatic.

Read More: Is Dogecoin(DOGE) a Good Investment in 2026? Everything You Should Know

How to Invest in Crypto?A prudent asset allocation strategy for new investors prioritizes capital preservation while allowing for measured growth. A balanced, risk-controlled framework is essential:

Foundation (80-90% of Portfolio): Allocate the majority to stablecoins and mainstream coins like BTC and ETH. This provides stability, liquidity, and core exposure to the market.Growth & Risk (Up to 10-15% of Portfolio): Dedicate a small portion to researched high-risk altcoins with strong fundamentals. This allows participation in innovative projects with higher return potential.Speculation (≤5% of Portfolio, Optional): If desired, use a minimal amount for meme coin speculation. Treat this as a learning experience with money you can afford to lose completely.This structured approach helps beginners manage downside risk systematically while progressively exploring different segments of the crypto ecosystem.

ConclusionNavigating the digital asset landscape requires recognizing that different cryptocurrency categories serve different purposes and carry vastly different risk-reward profiles. A successful investment strategy is not about chasing the highest returns but about constructing a balanced crypto portfolio aligned with your financial goals and risk tolerance.

By building a foundation with mainstream coins, using stablecoins for safety and flexibility, and cautiously exploring altcoins and meme coins, investors can participate in the dynamic crypto market with clarity and discipline.

Now that you understand how to invest in crypto, it's time to take action. If you're looking for a trusted platform to execute your strategy, choose WEEX. Register now to start seamless trading with 0 fees, a user-friendly interface, and a high-security environment.

Further ReadingWhere to Buy Bitcoin: Top Trusted Crypto Exchanges for BTC in 2026Futures Trading in Crypto: A Beginner’s Guide in 2026Is Cryptocurrency Safe in 2026?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Which 4 Chinese Meme Coins Are Tredning in January 2026?

Unlike previous cycles driven by Western internet culture, this surge is deeply rooted in Chinese slang, social satire, and high-context humor. Fueled by the low-fee BNB Chain ecosystem, viral narratives, and rapid speculative capital, several projects saw exponential growth in a remarkably short time.

What defined the top Chinese meme coin trend in January 2026 was not just price action, but the unprecedented speed at which these tokens achieved multi-million dollar market capitalizations without any traditional fundamentals. This article analyzes the four names that dominated the narrative: 我踏马来了, 人生K线 , 币安人生, and 哈基米.

Key TakeawaysThe Chinese meme coin market in January 2026 was dominated by tokens leveraging culturally familiar phrases and high-velocity trading on BNB Chain, rather than utility.Narrative strength and cultural resonance proved more critical for short-term momentum than technological innovation or roadmap promises.While generating exponential returns, these assets exhibited extreme volatility. Success required strict risk management due to their reliance on concentrated liquidity and shifting trader sentiment.Chinese Meme Coin Growth in Early 2026The explosive growth in January followed a distinct, observable pattern:

Narrative-First Adoption: Success was built on pre-existing, viral Chinese internet slang, which created instant community recognition and lowered adoption barriers.BNB Chain Efficiency: The low transaction fees and fast confirmations of BNB Chain made it the preferred launchpad, attracting a dense network of active meme coin traders.Speculative Capital Rotation: After periods of consolidation in major assets, speculative capital aggressively rotated into these high-beta, culturally-themed tokens trending on Chinese crypto social media.Sentiment-Driven Valuation: Prices were almost entirely dictated by social media momentum and chart patterns, with traditional fundamentals like whitepapers or utility playing a negligible role.This environment enabled multiple projects to rocket from obscurity to eight-figure market caps within mere days.

Which Chinese Meme Coins are Trending in January 2026?Amidst numerous launches, four tokens distinguished themselves through market cap growth, trading volume, and viral narrative strength.

我踏马来了我踏马来了 became one of the fastest-rising assets of early 2026, surging into a $30–40 million market cap range with sharp volatility. Its growth was fueled by its aggressive, confident phrase which traders adopted as a hype slogan, combined with high on-chain visibility from large wallet movements that drew further attention.

Read More: What Is 我踏马来了? A New Horse Themed Meme Coin

人生K线Briefly approaching a $40+ million market cap, this 人生K线's power lay in its deeply relatable metaphor for traders, comparing life's ups and downs to a candlestick chart. Its chart-centric community fostered intense engagement through shared analysis and parabolic screenshot culture, creating a self-reinforcing momentum loop.

币安人生 (BIANRENSHENG)Reaching a peak market cap of approximately $150 million, 币安人生 was a dominant force in the sector. It benefited from implicit brand association with the leading exchange, which granted it perceived legitimacy and attracted larger traders viewing it as a more stable meme coin exposure compared to micro-cap alternatives.

Read More: What Is 币安人生 (BIANRENSHENG) and How Does It Work?

哈基米 (HAJIMI)Climbing to a $35–37 million market cap, 哈基米(HAJIMI) stood out due to its high meme adaptability. The playful, phonetically fun name was easily remixed into endless social media content, sustaining community engagement and driving consistent trading volume across multiple platforms.

Read More: What is Hajimi (哈基米)?

ConclusionThe January 2026 surge in Chinese meme coins signifies a maturation of meme-driven markets. These assets have evolved into culturally encoded financial instruments, capable of mobilizing significant liquidity through shared language and collective emotion.

The performance of 我踏马来了, 人生K线 , 币安人生, and 哈基米 cements top Chinese meme coins as a distinct and influential segment within the global crypto ecosystem. For participants, understanding the cultural context is now as essential as technical analysis. However, this exponential growth is a double-edged sword; the same velocity that creates immense opportunity also dictates the speed at which trends can reverse, demanding caution and respect for the market's rhythm.

Still wondering where to buy these trending meme coins? Look no further than WEEX. Register now to start trading instantly. Enjoy 0 trading fees and a smooth, seamless trading experience.

Further ReadingIs Dogecoin(DOGE) a Good Investment in 2026? Everything You Should KnowDogecoin(DOGE) Price Prediction: What's Next for Dogecoin(DOGE)?What Is MANYU? ManyuShiba Meme Coin ExplainedDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

What is Dogecoin OTC and How to Buy DOGE OTC With VND on WEEX Exchange?

For investors and traders in Vietnam, getting direct access to popular cryptocurrencies like Dogecoin (DOGE) with local currency can be challenging. Dogecoin OTC (Over-the-Counter) trading offers a solution, providing a direct and efficient way to execute significant transactions away from the public market's noise. This guide explains what Dogecoin OTC trading is, why a professional OTC desk is valuable, and gives you a clear, step-by-step walkthrough on how to buy DOGE with Vietnamese Dong (VND) using the streamlined WEEX OTC platform.

What is the Dogecoin OTC Crypto?Dogecoin OTC trading is the direct purchase and sale of DOGE between two parties, negotiated privately rather than through a public exchange's order book. These transactions are facilitated by OTC desks, which act as trusted intermediaries connecting buyers and sellers who wish to trade larger amounts.

This method is particularly suited for a high-profile asset like Dogecoin, which is known for its strong community and occasional sharp price movements. The primary value lies in executing large orders with minimal market impact. Placing a substantial DOGE order on a spot exchange can cause noticeable price slippage due to its volatility. OTC trading eliminates this by providing a fixed, pre-agreed price for the entire transaction. Additionally, it offers greater privacy and flexibility, as terms can be customized to the needs of the parties involved, which is appealing for businesses, influencers, or investors making strategic moves.

What is a Crypto OTC Trading Exchange?A Crypto OTC trading exchange, or OTC desk, is a specialized service for executing large, negotiated digital asset trades. It operates parallel to public markets, providing a private venue for deals that are impractical on standard exchanges due to their size or the need for discretion.

Using an OTC desk provides strategic advantages: zero slippage on large orders, enhanced privacy, and flexible settlement options. For assets like Dogecoin, avoiding slippage is key to maintaining cost efficiency. OTC desks bridge traditional finance and crypto by supporting various payment methods, including local currencies like VND. This allows Vietnamese traders to convert funds seamlessly and execute trades without the constraints of exchange trading hours or order book depth.

What is WEEX OTC Crypto Trading Exchange?WEEX Exchange provides a dedicated OTC trading solution designed for secure and efficient fiat-to-crypto conversions. The WEEX OTC platform supports a wide range of trading pairs and integrates multiple payment channels, enabling the direct purchase of Dogecoin with Vietnamese Dong. The process is user-friendly, with features like WEEX OTC Quick Buy allowing for fast transactions.

Why Choose WEEX Exchange for OTC Crypto Trading?Access over 200 major trading pairsMainstream payment methods accepted: Visa/Mastercard, Apple Pay, Google Pay, Bank Transfer, SEPA, PIXQuick Buy – completes your purchase in just three stepsCNY deposits supported via Alipay, WeChat Pay, and DingTalkNo KYC required for non-CNY depositsMultiple payment channels – automatically recommends the optimal option based on the currency pairWhether you're an institution, fund, miner, or high‑volume trader, WEEX OTC provides a professional, secure, and tailored gateway to execute large cryptocurrency trades efficiently and discreetly.

How to Trade Dogecoin with VND on WEEX OTC Crypto Exchange?Buy Dogecoin OTC with VND on WEEX (Web)Step 1: Select [VND] fiat currency and [DOGE] crypto, then select the payment method.

Step 2: Input the VND payment amount, then click [Buy DOGE] to submit info.

Step 3: Confirm the order info, we will redirect to the payment channel to complete the transaction.

Buy Dogecoin OTC with VND on WEEX (App)Step 1: Click the [Deposit] and select the [Buy crypto], enter the OTC platform.

Step 2: Select [VND] fiat currency and [DOGE] crypto.

Step 3: Input the VND payment amount, then click [Buy DOGE] to submit info.

Step 4: Confirm the order info, we will redirect to the payment channel to complete the transaction.

FAQ about Crypto OTC TradingWhat is OTC trading in cryptocurrency?OTC trading is the direct buying and selling of digital assets between two parties, negotiated privately through a broker or desk, rather than on a public exchange's order book.

Who typically uses Dogecoin OTC trading?Dogecoin OTC is used by individuals and entities making large transactions, such as businesses, community leaders, or investors who want to avoid moving the market price, ensure price certainty, or require a more private settlement process.

Is OTC trading safe?OTC trading is safe when conducted through reputable, established platforms like WEEX that provide secure settlement processes and vet their counterparties. The main risk, counterparty default, is mitigated by using trusted services.

Does WEEX support VND payments for OTC trading?Yes, WEEX explicitly supports Vietnamese Dong (VND) for OTC transactions, allowing users to purchase Dogecoin and other cryptocurrencies directly with their local currency.

What are the fees for OTC trading on WEEX?Fees on WEEX vary by trading pair and payment method. The platform automatically suggests the most cost-effective channel. Promotional periods with reduced or zero fees are also common.

Are there legal considerations for OTC trading in Vietnam?The regulatory environment for crypto is evolving. Users should stay informed about local regulations. Trading through internationally compliant platforms like WEEX, which implement security and compliance measures, is advisable.

Follow WEEX on social media:

Instagram: @WEEX_ExchangeX: @WEEX_OfficialTiktok: @weex_globalYoutube: @WEEX_GlobalTelegram: WeexGlobal Group

Auto Earn vs. Staking: Which is Better for You?

WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

Read More: What's WEEX Auto Earn and How to Use It?

What is Crypto Staking?Crypto Staking is the process of locking digital assets to support a Proof-of-Stake (PoS) blockchain network. By participating, users help validate transactions and maintain network security while earning rewards—without the energy-intensive mining required in Proof-of-Work systems like Bitcoin.

There are two main roles:

Validators run nodes and verify transactions, often requiring a significant stake (e.g., 32 ETH on Ethereum).Delegators contribute smaller amounts to validators and share in the rewards proportionally.Staking strengthens network security—the more assets are staked, the higher the cost to attack the chain. It offers a sustainable way for holders to grow their crypto while supporting the ecosystem's health and decentralization.

Core Advantages of WEEX Auto EarnFlexibility: Your Funds, Your Control. Unlike platforms like Binance Earn or Coinbase Rewards that often require locking funds for fixed terms, WEEX Auto Earn imposes no lock-up periods. You retain full control—deposit or withdraw anytime without penalties, making it ideal for traders and cautious savers alike.Accessibility: Start Small, Earn Now. While many competitors enforce minimum deposits ranging from $10 to $100 or more, WEEX Auto Earn lets you begin earning with as little as 0.01 USDT. This truly low barrier welcomes beginners and allows seasoned users to test the waters before committing larger sums.Ease of Use: One Click, Instant Activation. Forget complex onboarding steps, multiple confirmations, or navigating nested menus. With WEEX, enabling Auto Earn takes one click in the Assets section—no lengthy enrollment, no confusing settings. Interest starts accruing immediately, with rewards distributed automatically the following day.Auto Earn vs. Staking: Which is Better for You?If you prioritize flexibility, simplicity, and immediate liquidity, WEEX Auto Earn stands out as the more user-friendly and accessible choice—especially if you are new to earning passive income in crypto or prefer to keep your funds readily available.

Unlike traditional staking, which often involves locking assets for fixed periods, navigating validator selection, or meeting minimum deposit thresholds, WEEX Auto Earn allows you to start earning with just 0.01 USDT, withdraw at any time without penalties, and activate the feature instantly with one click. This makes it ideal for traders, cautious savers, or anyone who values control and convenience over potentially higher but less flexible staking returns.

Don't hesitate any longer. Sign up now and experience Auto Earn instantly, exclusively on WEEX.

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: What is the difference between Auto Earn and Staking?A: With Auto Earn, your funds are always available for trading or withdrawal. When using Flexible Staking, there is no bonding or unbonding period. Your funds will be immediately staked and unstaked.

Q2: Should I enable Auto Earn on WEEX?A: By turning on Auto Earn, you can generate earnings with no lock-up periods, and your funds are always accessible. It's the easy way to get more out of your crypto.

Q3: How does Auto Earn work?A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account.

Q4: How profitable is WEEX Auto Earn?A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Is This AI Token Worth It? Acet (ACT) Price Analysis

Acet (ACT) is a community-driven fan token launched on the Binance Smart Chain, distinguished by its innovative "Zero Initial Supply" mechanism. Unlike conventional token models, ACT tokens are not pre-mined; instead, they are generated exclusively through user participation in liquidity provision. This approach is designed to mitigate issues of token oversupply and promote fair, demand-driven distribution.

Positioned at the intersection of fan engagement and decentralized finance (often referred to as DeFansFi), Acet integrates features such as staking and liquidity incentives to foster community participation. The project also seeks to expand utility beyond the crypto ecosystem by exploring real-world applications and partnerships. It is notably backed by Thai entrepreneur Acme Worawat and supported by the Traderist platform, adding further visibility and credibility to its development roadmap.

What Is ACT Labs Building?ACT is a utility token developed within the ecosystem of ACT Labs, a venture studio focused on creating decentralized, AI-driven infrastructure. Unlike single-application tokens, ACT Labs operates as an incubator and builder, working on multiple products that integrate on-chain execution with autonomous AI agent systems.

The core objective of ACT Labs is to facilitate interactions between AI agents, as well as between humans and AI agents, enabling secure, low-interaction execution of tasks on the blockchain. Examples of its projects include decentralized commerce protocols, autonomous trading frameworks, and AI-verified task coordination systems.

Within this ecosystem, the ACT token functions as a coordination and incentive mechanism across various products, aligning token utility with tangible development progress. This approach differentiates ACT from purely speculative or meme-driven AI tokens and ties its value proposition to real-world utility and ongoing product releases.

ACT Labs emphasizes open collaboration and transparency, maintaining publicly accessible repositories and encouraging external developer contributions. This commitment to building in the open positions the project within the longer-term narrative of decentralized infrastructure, rather than short-lived hype cycles.

Acet (ACT) Price AnalysisACT has recently experienced significant price appreciation, drawing attention to its position within the growing AI and blockchain infrastructure space. Such movements naturally raise questions about whether they are driven by fundamental progress or speculative momentum.

A combination of factors appears to be contributing to the rally:

Increased Trading Activity – Higher transaction volumes and a growing holder base suggest broader market participation rather than isolated speculative trading. Improved liquidity and visibility across social and trading platforms have further amplified price momentum.Rising Interest in AI Crypto Infrastructure – ACT benefits from renewed market focus on tokens associated with autonomous agents, on-chain automation, and decentralized AI execution. Its positioning as a utility-driven infrastructure project resonates with investors looking beyond short-term narratives.Relative Valuation – ACT’s market capitalization remains modest compared to more established infrastructure tokens, which can attract speculative capital while also reflecting its early-stage status. At this phase, price action often reflects expectations around future development milestones rather than current adoption levels.From a neutral standpoint, the rally indicates growing market recognition and engagement. However, sustained value will depend on ACT Labs’ ability to consistently deliver functional products, onboard developers, and deepen token integration across its ecosystem. While price movement signals attention, long-term viability will be determined by execution, not sentiment alone.

ConclusionACT’s recent price movement highlights increasing interest in decentralized AI infrastructure and the tangible development work being conducted by ACT Labs. By anchoring its value to a multi-product venture studio model—rather than a single application—the token is positioned to grow alongside a portfolio of agent-driven systems.

While short-term volatility reflects market sentiment and speculative interest, the long-term trajectory will be shaped by continued delivery, adoption, and real-world usage. For participants interested in the intersection of AI and blockchain, ACT represents a project whose progress can be measured not only by price action but also by development output and ecosystem integration.

Ready to trade Acet (ACT)?Join WEEX now—enjoy zero trading fees, smooth execution, and instant access. Sign up today and start trading in minutes.

FAQQ1: What is ACT used for?A: ACT serves as a utility and governance token within the ACT Labs ecosystem, enabling coordination, incentives, and participation across its AI-driven decentralized applications.

Q2: What is ACT Labs?**A: ACT Labs is a venture studio building decentralized infrastructure for AI agents, focusing on autonomous on-chain execution and human-agent interaction.

Q3: Why has ACT’s price increased recently?A: The price rise reflects growing interest in AI-related crypto projects, higher trading activity, and market recognition of ACT Labs' development progress.

Q4: Where can ACT be traded easily?A: Acet (ACT) is available on WEEX, which offers accessible trading with user-friendly interfaces.

WEEX Auto Earn: How to Enable Auto Earn?

WEEX Auto Earn is a digital asset growth tool launched by WEEX, supporting USDT. It allows users to deposit or withdraw funds flexibly with no lock-up period, while the system calculates and distributes daily interest automatically, enabling idle funds to generate continuous returns. With just one click to enable the feature, users can start earning from as little as 0.01 USDT.

Read More: What's WEEX Auto Earn and How to Use It?

How to Enable Auto Earn on WEEX Exchange?New to WEEX Auto Earn? Follow these simple steps to get started :

Log into WEEX App, go to "Assets" pageTap "Auto Earn" and enable the featureWatch your daily earnings grow automaticallyFor more information, check this video below to learn more:

Note:

New users: Activate within 7 days of verification for bonus APRComplete verification before activation for the best ratesDon't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Top 3 Best Crypto Earning Apps in 2025: Why WEEX Auto Earn Stands Out?

Imagine daily habits—like having coffee, walking, or gaming—now earning you crypto. A growing range of apps turns routines into effortless rewards, making portfolio growth accessible without trading knowledge.

Today, you can earn crypto by learning, staying active, shopping, or even sharing device resources, often starting for free. These approaches lower entry barriers and weave crypto naturally into everyday life.

Leading platforms such as WEEX, Bybit, and KuCoin now integrate staking, learn-and-earn programs, and liquidity incentives. These features let users grow assets through both market activity and structured rewards, creating a more holistic crypto journey. To help you start, here’s a curated list of the best crypto-earning apps for 2025.

WEEX - Best of AllWEEX Auto Earn excels in 2025 with its flexible and transparent approach, allowing users to earn rewards instantly with no lock-up periods or minimum deposits. It calculates interest hourly across Spot, Funding, and Futures accounts, with daily USDT payouts based on your lowest daily balance for predictable returns.

New users benefit from bonus APR by verifying within seven days, while smart features like auto-pausing when balances fall too low enhance user experience. With zero platform fees, WEEX Auto Earn offers a secure and seamless path to passive crypto earnings.

Core Features of WEEX Auto EarnFlexible Earnings: Once enabled, interest starts accruing automatically without additional operations.Stable Returns: The system takes a daily snapshot of your balance and calculates earnings based on tiered interest rates.Automatic Settlement: Interest is calculated daily and distributed to your funds account the following day.New User Rewards: Newly registered users who complete KYC verification can enjoy an exclusive APR for new users (within specified limits,see details below).Don't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

BybitWhile widely recognized as a leading crypto trading platform since 2018, Bybit serves a global community of over 50 million users with far more than just advanced trading tools. The exchange offers a diverse suite of earning features designed to help both passive investors and active traders grow their crypto portfolios effectively and conveniently.

Core Features:Bybit Savings: Provides flexible and fixed-term options with competitive, guaranteed APRs for low-risk yield.Crypto Liquidity Mining: Users can supply liquidity to AMM-based pools and earn yields, with optional leverage to increase potential returns.Dual Asset: A short-term trading tool that allows users to choose “Buy Low” or “Sell High” strategies to earn enhanced interest based on market outlook.Wealth Management: Access professionally managed crypto investment funds, allowing hands-off participation in curated trading strategies.Beyond its reputation as a high-performance exchange, Bybit stands out through these integrated earning solutions—making it a comprehensive platform for users seeking growth through savings, staking, liquidity provision, or managed investments.

KuCoinFounded in the Seychelles and operating globally, KuCoin serves over 37 million users across 200+ countries. Beyond its core exchange services, KuCoin offers a wide range of integrated features that enable users to earn, learn, and engage with crypto through accessible, education-driven, and reward-based experiences.

Core Features:

KuCoin Earn: Provides both flexible and fixed-term staking options, recognized by Investopedia and Forbes as a leading staking platform.Learn and Earn: Users earn Token Tickets by completing educational courses and quizzes, which can be redeemed for cryptocurrency.Mystery Box: Offers limited-edition NFT releases through brand collaborations on KuCoin's NFT marketplace.It’s important to note that many of these features require KYC verification, and access may be restricted in certain regions, including the United States and Canada. Users are encouraged to confirm eligibility before participating in any program.

Why WEEX Auto Earn Stands Out?In the crowded landscape of cryptocurrency platforms, users are often faced with a dizzying array of products promising yield and convenience. WEEX has carved out a distinct position by focusing on user-centric design, transparency, and seamless integration, particularly with its flagship “Auto Earn” feature.

What's Next for WEEX Auto Earn?WEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.Don't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

Grow Your Crypto Daily: Earn Up to 100% APR with WEEX Auto Earn

In the dynamic crypto market, your idle assets can work for you around the clock. WEEX Auto Earn is a flexible savings product designed to let your USDT earn daily compound interest—with no lock-up periods, no minimum deposit, and complete liquidity control.

New User Bonus: High-Yield Welcome OfferAs a new user, you receive a special tiered interest rate to maximize your initial earnings:

Example Earnings (Deposit: 10,000 USDT)

Tiered Rate Structure:

First 100 USDT → 100% APRRemaining 9,900 USDT → 3.5% APR30-Day Earnings Breakdown (Daily Compounding):

High-Yield Portion (100 USDT)Daily rate: 100% ÷ 365 ≈ 0.27397%30-day earnings: 8.55 USDTStandard Portion (9,900 USDT)Daily rate: 3.5% ÷ 365 ≈ 0.009589%30-day earnings: 28.77 USDTTotal 30-Day Earnings for New Users: ≈ 37.32 USDT

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DateToday's EarningsTotal EarningsAccount BalanceDay 11.2451.24510,001.25Day 21.2472.49210,002.49Day 31.2493.74110,003.74Day 41.2514.99210,004.99Day 51.2536.24510,006.25Day 61.2557.510,007.50Day 71.2578.75710,008.76Day 81.25910.01610,010.02Day 91.26111.27710,011.28Day 101.26312.5410,012.54Day 151.27118.8910,018.89Day 201.27925.2810,025.28Day 251.28731.7110,031.71Day 301.29537.3210,037.32Existing User Benefits: Sustained Growth PlanFor our loyal users, WEEX offers a stable enhanced earnings program:

Example Earnings (Deposit: 10,000 USDT)

Tiered Rate Structure:

First 200 USDT → 13% APRRemaining 9,800 USDT → 3.5% APR30-Day Earnings Breakdown (Daily Compounding):

Enhanced Portion (200 USDT)Daily rate: 13% ÷ 365 ≈ 0.03562%30-day earnings: 2.15 USDTStandard Portion (9,800 USDT)Daily rate: 3.5% ÷ 365 ≈ 0.009589%30-day earnings: 28.48 USDTTotal 30-Day Earnings for Existing Users: ≈ 30.63 USDT

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DateToday's EarningsTotal EarningsAccount BalanceDay 11.0211.02110,001.02Day 21.0222.04310,002.04Day 31.0233.06610,003.07Day 41.0244.0910,004.09Day 51.0255.11510,005.12Day 61.0266.14110,006.14Day 71.0277.16810,007.17Day 81.0288.19610,008.20Day 91.0299.22510,009.23Day 101.0310.25510,010.26Day 151.03315.4210,015.42Day 201.03620.610,020.60Day 251.03925.810,025.80Day 301.04230.6310,030.63Core Benefits of WEEX Auto EarnFlexibility & ControlNo lock-up periods: Withdraw or trade anytimeZero management fees: Keep 100% of your earningsLow entry point: Start with as little as 0.01 USDTSmart & EfficientDaily compounding: Automatic reinvestment for exponential growthReal-time calculation: Hourly interest based on eligible balancesTimely payouts: Earnings distributed daily at 12:00 UTCSecure & TransparentMulti-account coverage: Includes spot, funding, and futures balancesFair calculation: Based on daily lowest balance snapshotAuto-management: Pauses and settles when balance drops below 0.01 USDTWEEX Auto Earn Earnings TimelineDay 1 → Activate Auto Earn, start earning immediatelyEvery day → Automatic compounding and reinvestmentDay 30 → New users earn ≈ 37.32 USDTDay 365 → Continuous growth through compoundingTake Action: Put Your USDT to Work TodayWhether you're new to crypto or an experienced trader, WEEX Auto Earn offers the simplest way to grow your idle assets.

Three Simple Steps to Start Earning:

Log into WEEX App, go to "Assets" pageTap "Auto Earn" and enable the featureWatch your daily earnings grow automaticallyFor more information, check this video below to learn more:

Quick Tip:

New users: Activate within 7 days of verification for bonus APRComplete verification before activation for the best ratesDon't let your USDT sit idle any longer! Activate WEEX Auto Earn today and experience the power of daily compound growth—where every dollar works for you. Sign up and try WEEX Auto Earn now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Why Choose WEEX Auto Earn?Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How does auto earn work?

A: Auto Earn is an additional feature that enables you to earn crypto on every eligible asset in your account. Your assets will generate rewards through our Staking, Opt-In and USDG rewards programs, which compound over time

Q2: Is it good to invest in WEEX Auto Earn?

A: While WEEX implements robust security measures, users should understand that keeping assets on any centralized platform carries inherent risks. WEEX Auto Earn is provided through the centralized exchange, meaning users trust WEEX to manage and secure their funds.

Q3: What are the risks of using WEEX Auto Earn?

A: The interest rates displayed on WEEX Auto Earn are not guaranteed and can fluctuate according to several factors: Demand on EARN products (the more investors there are, the more the APR tends to drop). Variations in the crypto market and overall interest rates.

Q4: How profitable is WEEX Auto Earn?

A: In early 2025, WEEX's flexible stablecoin products averaged 3.5% APR.

What is WEEX Auto Earn and Why It Stands Out?

WEEX Auto Earn is a digital asset growth tool launched by Weex, supporting USDT. Users do not need to lock their assets; funds can be deposited or withdrawn flexibly. The system calculates interest daily and automatically distributes earnings, allowing idle funds to continuously generate returns.

WEEX vs Market Products: Why WEEX Stands Out?In the crowded landscape of cryptocurrency platforms, users are often faced with a dizzying array of products promising yield and convenience. WEEX has carved out a distinct position by focusing on user-centric design, transparency, and seamless integration, particularly with its flagship “Auto Earn” feature. In this article, we'll show the core dimensions where WEEX differentiates itself from typical market offerings and directly compares it against major competitors.

Core Advantages of WEEXWEEX's design philosophy prioritizes capital efficiency, ease of use, and clear value for both novice and experienced traders. Check below its key advantages!

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

DimensionWEEX AdvantageFor UsersCompared to Typical Market ProductsYieldNew users enjoy 100% APR, existing users up to 13% APRBeginners get amplified returns; loyal users benefit from stable, competitive wealth management.Offers a highly competitive annualized yield, especially for onboarding and rewarding existing customers.Capital FlexibilityNo lock-up, instant accrual, withdraw anytimeMaximizes capital efficiency. Funds remain available for trading or withdrawal without interruption.Most competing platforms require fund transfers to a separate “earn” wallet or enforce lock-up periods.Ease of UseOne-click participation, automatic settlement and payoutOperational barriers are minimized. Users enable the feature once and earnings are handled automatically.Many platforms require manual, repeated subscriptions and redemptions for each earning cycle.Yield TransparencyDaily distribution with a clear interest calculation formulaReturns are credited predictably every day, fostering trust and allowing for easy tracking.Ensures greater transparency compared to opaque or complex yield aggregation methods.Low Entry ThresholdNo mandatory KYC for basic use, extremely low minimum investment (0.01 USDT)Removes access barriers, making sophisticated yield generation accessible to all retail investors.Some products require VIP status, large minimum deposits, or extensive identity verification.What's Special with WEEX Auto Earn?To contextualize WEEX's position, here is a direct comparison of its “Auto Earn” feature against similar flexible savings products from other leading exchanges:

td {white-space:nowrap;border:0.5pt solid #dee0e3;font-size:10pt;font-style:normal;font-weight:normal;vertical-align:middle;word-break:normal;word-wrap:normal;}

ProductWEEX Auto EarnBinance Simple EarnOKX EarningBitget Wealth ManagementProduct TypePassive Income / Auto-CompoundFlexible SavingsSimple EarnFlexible InvestmentAPR / Yield RulesBase Rate: ~3.5%New Users (0-100U): 100% APR

Existing Users (0-200U): 13% APRDaily APR: ~2.21%

Tiered Annualized Yield<1000U: ~10% APR (for 180 days)

>1000U: ~1% APR0-300U: 13% APR

>300U: ~3% APRMinimum Investment0.01 USDT0.1 USDT0.1 USDT0.1 USDTInterest PayoutPaid next day. Automatic after enabling; no separate action needed.Starts accruing next day (T+1) after manual subscription.Starts accruing next day after manual subscription.Hourly accrual, withdraw anytime.Yield SourceOn-chain activitiesLending & DeFi incomeLending & Market MakingNot specifiedAccounts UsedUnified Account: Funding, Contract, & Spot Available BalanceSpot WalletFunding & Spot Trading AccountsFunding & OTC Accounts

Key Takeaways from the Comparison:

Aggressive User Acquisition: WEEX offers the most attractive promotional APRs (100% for new users, 13% for existing) to directly acquire and reward its user base.Unmatched Convenience: The one-click, auto-compounding model with no manual redemption required is a significant usability advantage over competitors who often require recurring manual operations.True Capital Integration: By using a unified account balance for earning, WEEX eliminates the need to manually move funds between “trading” and “savings” wallets, a friction point on other platforms.What's Next for WEEX Auto Earn?WEEX is not static; its product roadmap demonstrates a clear commitment to growth and user satisfaction:

Multi-Currency Support (Phase II): Will expand beyond USDT to include mainstream assets like BTC, ETH, USDC, and WXT, providing diversified earning options.Enhanced Risk Control Logic: Optimization to reduce misidentification rates, making the product accessible to a wider range of users without compromising security.Web Version Launch: Expanding access from mobile-only to a web platform to improve user engagement, retention, and conversion.Global Expansion: Plans to open services to more countries and regions, allowing a global audience to access its yield products.ConclusionWEEX Auto Earn offers a differentiated approach to crypto yields by prioritizing user convenience and capital efficiency. Its key advantages include seamless integration with trading accounts for automatic earnings on idle balances, highly competitive promotional APRs for new and existing users, and complete liquidity preservation through zero lock-up periods. The platform eliminates traditional friction points through one-click activation and daily automated distribution.

Discover how WEEX transforms passive crypto holdings into productive assets while maintaining full trading flexibility. Experience WEEX Auto Earn to grow your wealth now!

Further ReadingWhat is WEEX Auto Earn and How to Participate? A Complete GuideWhat's WEEX Auto Earn and How to Use It?Introduction to WEEX Auto Earn and How It WorksDisclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

FAQQ1: How are the interests calculated and distributed?

A: Once you activate WEEX Auto Earn, the system automatically calculates earnings every hour. The total daily earnings are distributed at 12:00 PM (UTC+0) on the following day and credited to your funding account.

Q2: Can I withdraw my funds at any time?

A: Yes. It allows users to deposit and withdraw at any time, and the funds are credited instantly.

Q3: What happens to my interes t if I turn off Auto Earn?

A: The product can be canceled at any time. The minimum subscription amount is 0.01 USDT. If your balance falls below this threshold, no interest will be generated.

Q4: Will my contract position balances generate interest after participating Auto Earn?

A: Only the available balance in your contract account will accrue interest. Order margins, position margins, and contract trial funds are not included in the interest calculation.

Q5: How long does the 100% APR new user bonus last?

A: The 100% APR new user exclusive offer lasts for 7 days.

What Is Quant (QNT)?

Quant represents a pioneering financial technology solution dedicated to bridging conventional financial infrastructure with distributed ledger technologies. The platform's core interoperability solution, Overledger, employs a standardized API architecture to seamlessly integrate diverse blockchain networks, payment platforms, and digital asset ecosystems. This approach empowers financial institutions to facilitate data exchange and cross-system transactions without requiring substantial modifications to their current technological stack.

Developed through collaborations with central banking authorities including the Bank of England and the European Central Bank, Quant's technology has been adopted by international financial institutions to enhance operational efficiency and ensure regulatory compliance in digital finance implementations. Commercial enterprises can leverage Quant's software suite to enable smart payment solutions, tokenized asset exchanges, and cross-chain operational capabilities within their existing applications.

What is Quant Capable for?OverledgerOverledger functions as an API-driven integration layer that enables businesses to connect their established systems with multiple blockchain environments through a unified interface. APIs serve as communication channels between software applications, facilitating seamless data transmission and reception.

By maintaining standardized request and response protocols, Overledger allows development teams to interact with various blockchain networks without requiring deep technical expertise in each specific protocol. The platform additionally enables the creation of multi-chain decentralized applications capable of simultaneous operation across numerous blockchain environments.

Quant FlowQuant Flow operates as an API-centric platform that empowers banking institutions, financial technology companies, and payment processors to integrate programmable digital currency functionality into their current infrastructure. Leveraging Overledger's underlying technology, the platform facilitates the automation of accounting procedures and supports transaction execution triggered by predefined conditions. Quant Flow incorporates regulatory compliance features, fraudulent activity monitoring, and capital control mechanisms to assist organizations in risk mitigation and financial oversight.

QuantNetQuantNet provides a comprehensive solution for financial institutions to transfer tokenized currency and digital assets across disparate networks without depending on isolated ledger systems or manual intervention. Rather than maintaining separate institutional silos, QuantNet delivers a unified gateway connecting both public and private blockchains, payment networks, and digital asset platforms.

The system's native ISO 20022 compatibility ensures adherence to the universal messaging standard prevalent throughout the financial sector. This standardization enables efficient cross-system communication while minimizing the requirement for additional reconciliation tools or intermediary software. QuantNet further automates post-trade settlement processes and coordinates asset transfers across multiple systems.

Quant FusionQuant Fusion establishes a connectivity framework that interfaces public blockchain networks with permissioned institutional systems. This enables organizations to transfer data and assets across different platforms without utilizing conventional bridging solutions or token wrapping mechanisms. The Fusion architecture comprises two primary components: the Multi-Ledger Rollup (MLR) and the Network of Networks infrastructure.

Quant's MLR technology processes and settles transactions across multiple blockchain networks simultaneously, distinguishing it from traditional rollup solutions limited to single-chain operations. The Network of Networks functionality allows participants to integrate their proprietary nodes or blockchain instances into an interconnected ecosystem.

The Fusion rollup maintains adaptability to support various blockchain types, including public networks, corporate systems, and regulated environments requiring controlled interoperability. To preserve privacy, Quant Fusion does not provide conventional public blockchain exploration tools. Instead, users access activity-specific information including balance details, transaction records, and smart contract data through dedicated API endpoints and user interfaces.

PayScriptQuant PayScript operates as a financial programming instrument that enables banking institutions and corporations to define monetary movement and behavior parameters. The platform supports both traditional banking accounts and stablecoin implementations, facilitating automated payment processing, optimized workflow management, and enhanced administration of complex financial transactions. By utilizing PayScript's rules configuration engine, organizations can establish precise instructions for capital flows without requiring advanced programming expertise.

How Does Quant Work?Central Bank Digital Currencies: Governmental entities can develop and implement CBDC frameworks using Quant's interoperability solutions that connect payment systems, private ledgers, and regulated networks.

Corporate Supply Chains: Business enterprises can optimize settlement processes, monitor asset movement, and automate regulatory compliance by integrating supply-chain management platforms with blockchain networks through Quant's API infrastructure.

Cross-Network Operations: Organizations can execute transactions and deploy smart contracts across multiple public and private blockchain environments using Quant Fusion's multi-ledger ecosystem.

Programmable Payment Solutions: Financial institutions can automate payroll distribution, tax processing, treasury management, and event-driven transactions through Quant Flow's payment orchestration tools.

Tokenized Settlement Systems: Banking organizations and financial platforms can facilitate real-time settlement of tokenized deposits, investment funds, and digital assets via QuantNet's unified regulatory-compliant infrastructure.

What is Quant (QNT)?QNT serves as the native digital asset within the Quant ecosystem, fulfilling multiple functional roles:

Transaction Fees: QNT functions as the primary currency for Multi-Ledger Rollup transaction costs, operating as the rollup's native settlement token when deposited.

Cross-Chain Transfers: QNT enables the deposit and withdrawal processes for ERC-20 tokens within the Multi-Ledger Rollup environment, supporting cross-chain asset mobility.

Network Participation: QNT can be staked by node operators performing sequencer or validator functions. Participants receive QNT rewards for contributing to network operations and security maintenance.

ConclusionQuant is architected to assist financial institutions in transitioning toward interconnected, programmable digital infrastructure. Its interoperability layer enables cross-ledger communication, while complementary products including Quant Flow, QuantNet, Quant Fusion, and PayScript facilitate tokenized settlement and cross-network execution. Collectively, these solutions aim to streamline financial organizations' adoption of blockchain technology while supporting compliant digital currency implementation.

Further ReadingWhat Is Edel (EDEL)?

What Is Decred (DCR)?

What Is Momentum (MMT)?

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

Cardano (ADA) Price Prediction: It's the Right Time to Buy Cardano (ADA)?

Cardano (ADA) has reclaimed market attention, though not through the sustained bullish performance many early investors had anticipated. While the token opened 2025 with notable strength—achieving year-to-date gains exceeding 60%—this upward momentum has significantly moderated. Currently trading near $0.47, ADA has retreated approximately 45% from its mid-year peak, reflecting the broader cryptocurrency market's struggle with macroeconomic pressures, profit realization activities, and ongoing regulatory ambiguity.